Dear Investor,

You probably haven’t missed how the new U.S. President Donald Trump created quite a stir even before his recent election. Many announcements were promptly acted upon right after his inauguration. Numerous executive orders quickly created uncertainty amongst market participants on his very first working day.

One of his famous remarks, “Drill, Baby, Drill,” not only sparked amusement but also considerable anxiety. With this statement, he intended to emphasize his support for boosting the domestic oil industry. The renewable energy industry was largely set aside, underscored by his remarks about wind turbines.

Solar and Wind Power Continue to Advance

Even Donald Trump cannot reverse technological progress. Numerous successful companies in the renewable energy sector already exist. You’re likely interested in understanding how to benefit from this ongoing development. Let us introduce you to one promising example.

One company in renewable energy has been around since 1925 and is headquartered in Florida. NextEra Energy ranks among the world’s largest energy companies. Technically, it’s a diversified company since it continues operating conventional power plants alongside renewable energy projects.

However, its clear focus is now on wind and solar farms, hydrogen, and battery storage. This makes NextEra a compelling candidate for the future, even though its stock has recently shown some short-term weakness.

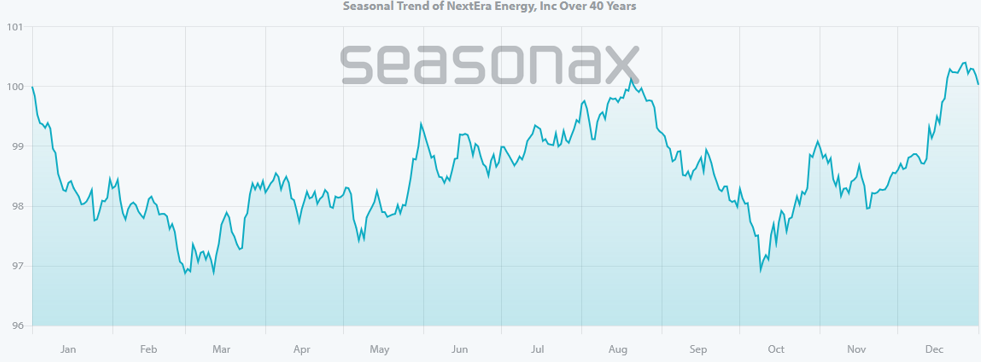

Current Developments Align with Seasonal Patterns

If you use seasonal charts, NextEra’s current trends probably won’t surprise you. The company typically shows average performance in the early months of the year. The U.S. election has only partially influenced recent price developments. Importantly, there hasn’t been a significant downturn resulting directly from the election.

Can NextEra Decouple from General Market Movements in the U.S.?

It seems likely that the statistical upward trend beginning on May 9 could occur independently from any statements or uncertainties from overseas.

The period from May 09 to August 21 historically represents the strongest seasonal phase for this company. This could be related to high electricity usage in the U.S. during summer months when air conditioning runs intensively.

With a historical hit ratio of 30 positive to just 10 negative trades during this period, the chances of profitability appear promising. The average return during positive years exceeds 9%, while negative years average a modest loss of roughly 5.5%.

Such probabilities make investment appealing even in uncertain times.

Warm days continue into autumn

Another notable period is from October 9 to the end of December. Although this also coincides with the typical year-end rally, NextEra stands out with a hit ratio of 31 winning trades to 09 losing trades. Performance averages are even stronger than during summer, with positive years bringing nearly 10%, and negative years only averaging losses around 6.5%.

These two timeframes offer attractive opportunities for short-term speculation with NextEra.

Win in the Electricity Market with Seasonax and Capitalize on High-Probability Trends!

The example of NextEra clearly shows you can always find notable market patterns, even when fundamentals or the current environment seem to argue against an investment. Using our data, you can set precise targets and stop-loss levels. For NextEra, a stop-loss around 6% is advisable, while profit targets can comfortably exceed 10% for both periods.

If the U.S. summer heats up sufficiently (politically, it almost certainly will), NextEra could benefit.

We wish you a pleasant start to spring and continued success in the markets.

Sometimes you need to go against the current to generate real power.

Use Seasonax for your professional approach to seasonal market patterns!

Best regards,

Christoph Geyer, CFTe

Winner of the AktienAnalystenAward for Technical Analysis