Dear Investor,

You may not realize it, but AstraZeneca enters a historically powerful seasonal window in early February – just as new clinical trial results and analyst forecasts signal renewed investor interest.

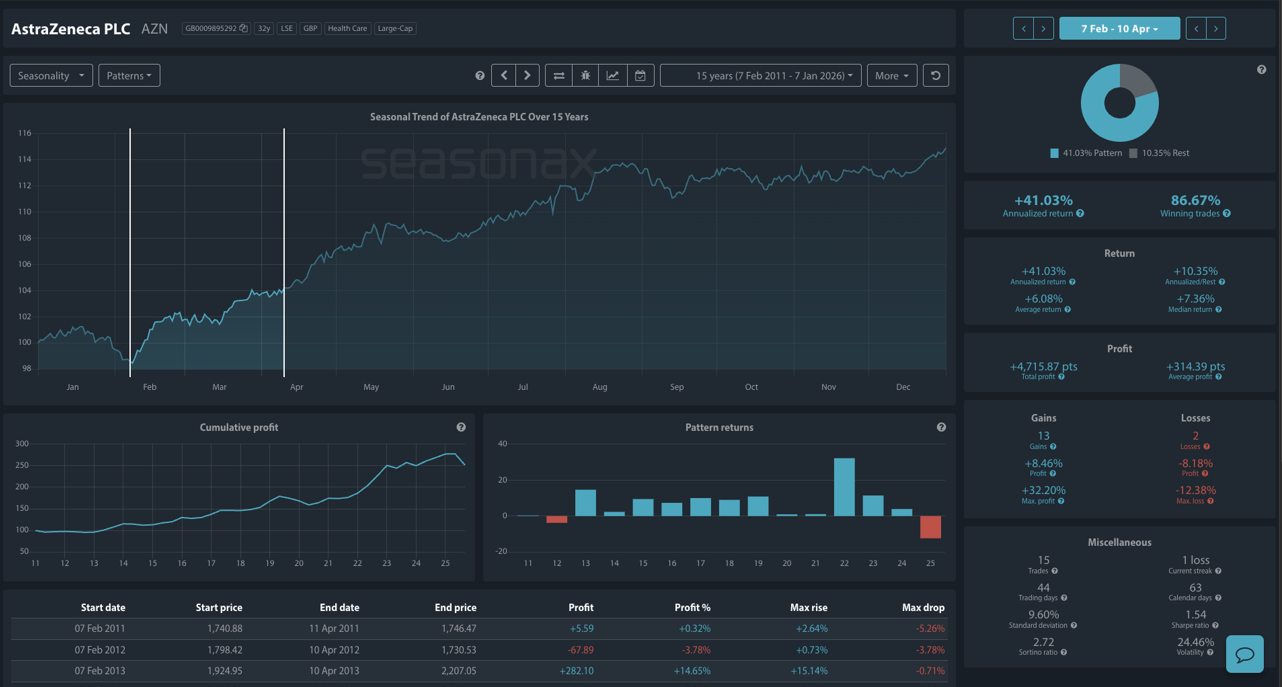

The chart below shows that over the last 15 years, AstraZeneca has produced an average return of +6.08% from 7 February to 10 April, with a win rate of nearly 87%.

Even more impressively, the pattern distribution is heavily skewed to the upside. One third of the gains are above 10% and there are a total of 13 gains with only 2 losses. When this is combined with the maximum return of +32.20% during this window it is not hard to see how strong this seasonal pattern is.

These strong seasonals could now be setting the stage for another potential move higher, especially as clinical catalysts and institutional positioning gain momentum.

Why It Matters Now: Drug Pipeline + Clinical Momentum

AstraZeneca has kicked off 2026 with encouraging developments in its immunology and biologics pipeline:

Saphnelo’s Phase III trial hits statistical significance:

On January 6, Reuters reported that Saphnelo (an Systemic Lupus Erythematosus treatment) achieved a statistically and clinically meaningful improvement in disease activity compared to placebo in the TULIP‑SC trial.

In the full analysis, 56.2% of patients saw improvement, compared to 37.1% on placebo. According to Reuters, these results reinforce AstraZeneca’s leadership in lupus treatments, and analysts expect the drug to play a growing role in biologics revenue over the next two years.

Technical Structure + Analyst Sentiment

AstraZeneca has been steadily trending higher on the back of a robust pharmaceutical pipeline and strong cash flow metrics. Earnings are demonstrating moderate growth over the last 12 quarters (9.91%) and the earnings are stable with low volatility.

According to TipRanks and Yahoo Finance, the stock has a consensus “Moderate Buy” rating from 15 analysts. The average 12-month price target is 13,862p, although that is close to current levels there is a high target of 18,400p, implying potential upside of +33% from current prices.

The stock is showing near term momentum. It is up over 12% in the past 3 months as investors rotate back into healthcare defensives and recent volume has been increasing, confirming the latest move higher.

As the healthcare sector often outperforms in the first quarter and defensive healthcare stocks attract demand, seasonality and investor sentiment appear to be aligning.

On the charts, there is the potential for a three inside bar up pattern to form on the anchoring monthly chart. If the monthly close is above the 14200 level, marked in red on the chart below, there is a strong technical case for buyers to defend that level and keep pushing the stock higher.

Distribution Matters: Why This Pattern Deserves Attention

Unlike noisy seasonal setups, AstraZeneca’s February-April window is statistically clean:

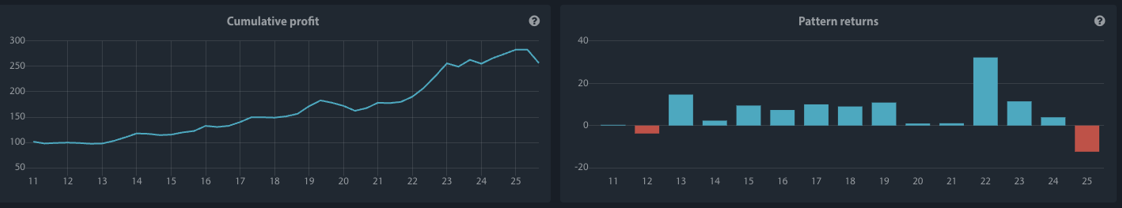

The cumulative profit curve shows a steady rise, with very little drawdown.

The pattern return bars reveal consistently positive years, punctuated by significant outliers to the upside.

Furthermore, volatility is modest/tilted to the upside, with only 2 losing trades in 15 years – and even those were shallow losses, capped at -3.78% and -12.38%.

Trade Risks and Opportunities: Healthcare Hedge or Momentum Play?

This seasonal window aligns well with:

- Positive drug pipeline headlines

- Macro preference for defensives in Q1

- Strong historical February-April performance

That said, there are always risks to consider:

- Broader equity market weakness or rotation out of defensives could mute upside.

- Regulatory delays or commercial rollout issues for Saphnelo or other pipeline drugs.

- Investor concerns over revenue concentration in a few key therapeutic areas.

Nonetheless, the strength of this seasonal pattern, supported by a robust clinical narrative, suggests AstraZeneca deserves a place on your watchlist as we head into February.

Use Seasonax for your professional handling of market-moving events!

Don’t just trade it – Seasonax it.

Yours sincerely,

Giles Coghlan, CMT

Macro Strategist Seasonax