Kering’s profitability is firmly tied to the performance of it’s Gucci brand with Bloomberg reporting that Kering derives nearly 70% of its profitability from Gucci.

Gucci is reported to be facing a problem of desirability and mass production even as it reports on slowing sales from China. Gucci is currently striving to reclaim its coveted status of “desirability,” a pinnacle pursued by all luxury brands. Its placement on the Lyst index, which monitors brands and products based on searches and mentions on social media, plummeted to as low as No. 12 in the third quarter of 2023, falling behind even smaller competitors like Prada and Miu Miu.

So, will the CEO, Francois-Henri Pinault. With nearly two decades in the job there is a wealth of experience to draw on, but will his approach for reform and renewal be enough?

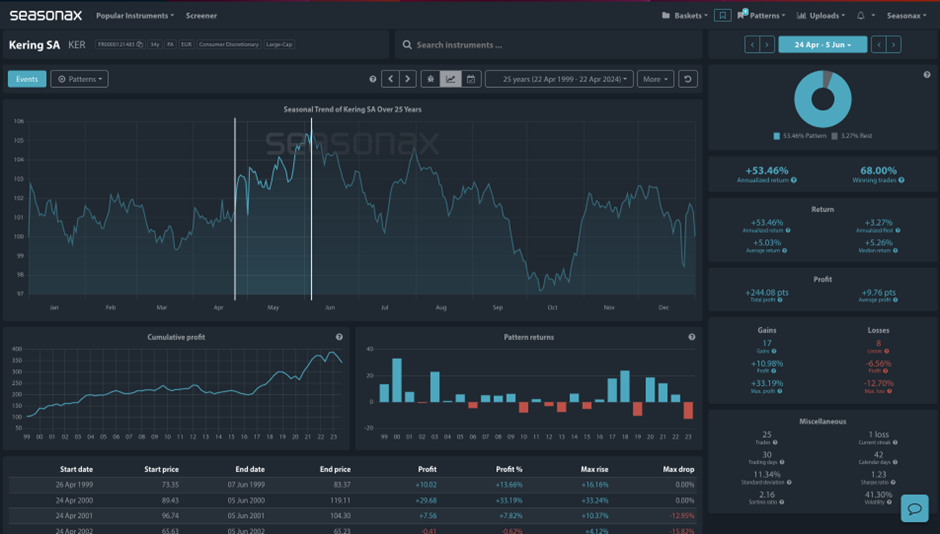

Kering SA seasonals are certainly strong. Over the last 25 years, between April 24 and June 05, Kering SA’s share price has risen over 5% with a number of years of double digit gains. Will this string seasonal pattern repeat itself again this year?

Technically, Kering SA has ben in a strong, downtrend and has just broken key support around the 360 region.

Sign up here for thousands of more seasonal insights just waiting to be revealed!

The major trade risk here is that previous seasonal patterns don’t necessarily repeat themselves each year.

Remember, don’t just trade it Seasonax It!