Around 4am UK time on Friday this week the Bank of Japan meet and will decide on their monetary policy for the coming month.

Speculation has been constantly surrounding the BoJ this year regarding whether they will exit their ultra loose monetary policy. On December 20 last year the bank unexpectedly tweaked the Yield Curve Control band by increasing it to +/- 0.50% .

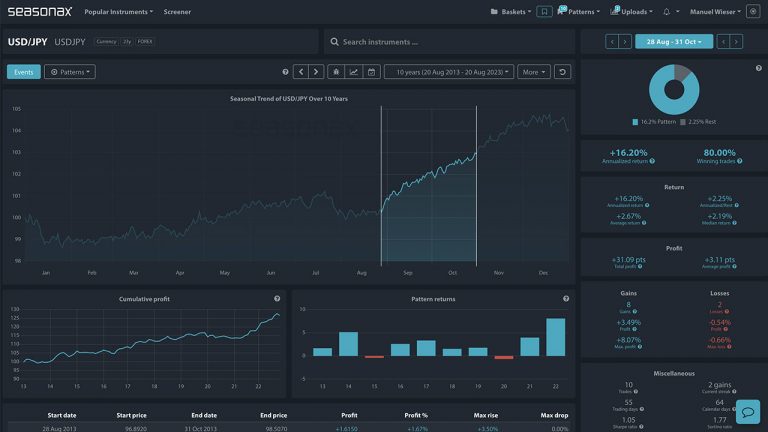

If the BoJ surprisingly announced a end to their yield curve control policy then the JPY would strengthen rapidly. This is why the seasonal weakness in the USDJPY pair is well worth being aware of.

Over the last 15 years between July 02 and August 24 the USDJPY pair fell over 70% of the time. The average fall was 1.09% and the maximum loss was a steep decline of over 5% on 2011.

So, if the BoJ exit their yield curve control policy on Friday would that offer a strong opportunity to enter a USDJPY short in expectation of JPY appreciation?

Major Trade Risks:

The major risk here would concern the drivers of the USD and, of course, whether or not the BoJ do exit their ultra loose monetary policy.

Remember, don’t just trade it, Seasonax it!