Dear Investor,

Are you also looking forward to some mulled wine, roasted chestnuts and holiday carols? The Christmas markets are gradually opening, and it is precisely within this context that many people find some peace and quiet and escape the hustle and bustle of everyday life.

However, if you’re involved with the stock market, you shouldn’t disconnect completely. After all, the most interesting time of the year has already begun.

Using the two major indices DAX and S&P 500 as examples, we will show you exactly how you can benefit from this.

While most media outlets only begin to focus on the year-end rally in December, seasonality shows us that it actually begins as early as October.

It’s still worthwhile to get involved

Even though the statistical rally has already begun, the DAX hasn’t yet generated much performance in the current cycle. Perhaps therein lies the opportunity. As is well known, the year-end rally occurs because many fund managers try to boost performance a bit more before the end of the year.

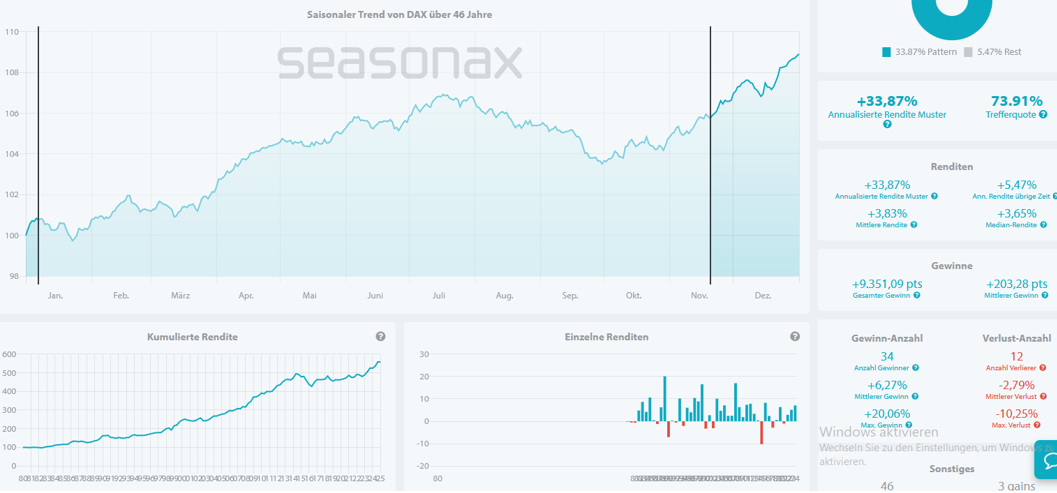

It becomes clear that this annual “price maintenance” significantly influences the seasonal situation. The DAX has been moving within a pronounced sideways range since May of this year. Therefore, with the major market participants now performing their annual ritual, a breakout of the DAX from this sideways range is likely only a matter of time. According to statistics, a very favorable ratio of 34 to 12, positive to negative years, with an average return of over 6% in the positive years, can be expected from mid-November to early January.

From a technical perspective, the chances of a breakout above the resistance zone are currently quite good. The DAX recently tested the lower boundary of its sideways range successfully and turned upwards again. This show of strength was also supported by the indicators, which is why a breakout is becoming increasingly likely from this analysis as well.

Can the S&P 500 also generate a year-end rally?

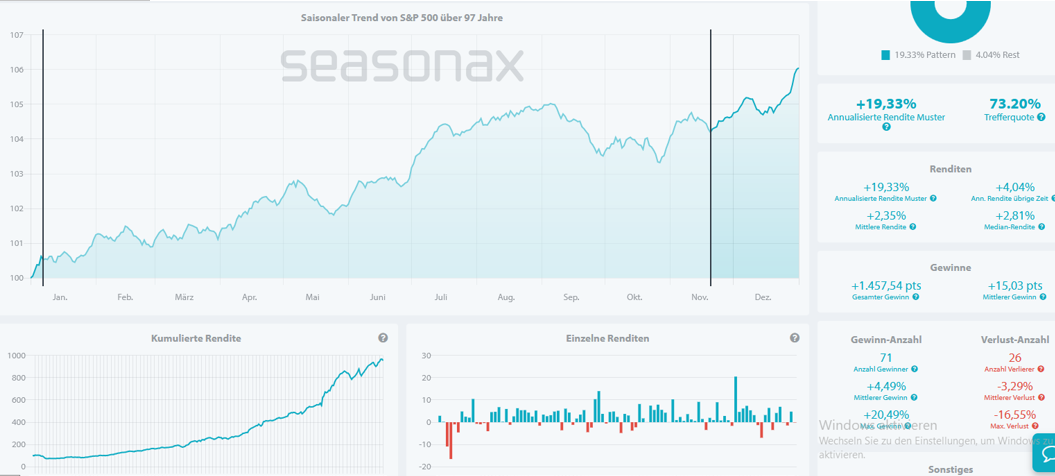

Statistics from the major US stock index S&P 500 show that the second part of the year-end rally is now beginning. This rally, like that of the DAX, could last until early January. Unlike the DAX, the S&P 500 has been in an upward trend since April of this year. Data spanning over 90 years shows that the S&P 500 boasts an outstanding track record. A gain was achieved 71 times between mid-November and early January. With an average return of around 4.5%, the performance is quite impressive. A loss was recorded only 26 times during this period.

This outstanding statistic is also reflected in the cumulative return. Significant setbacks have been virtually nonexistent over the years.

Does the US pull the DAX upwards with it?

“If the markets in the US do well, then so does Germany.” This adage has lost some of its relevance in recent years. Not least due to the “America First” policy, a certain degree of differentiation between the two major markets must be accepted. Nevertheless, it can still be observed that a favorable US market is not detrimental to developments in the German market.

For the upcoming pre-Christmas period, you should closely monitor the developing situation as the statistics predict. According to the figures described, the probability of this is quite high. Hence, a position that capitalizes on this effect is worthwhile both overseas and in Germany.

Conclusion:

As you enjoy the first mulled wines, or savor Christmas cookies and marzipan in the coming weeks, remember to take advantage of the markets and buy some of the corresponding items. Perhaps it will turn into more than just a pleasant evening at the Christmas market. Seasonax can help you make this happen. Despite all the positive prospects, don’t forget to set an appropriate spending limit. After all, some politician might get the unpleasant idea of trying to spoil the Christmas spirit in Europe.

Win with Seasonax and treat your friends to a mulled wine at the Christmas market.

Earn money at the year-end rally in Germany and the USA and finance a round of mulled wine for your friends and acquaintances at your nearest Christmas market.

And above all, remember to stay healthy so that you can continue to enjoy the stock market and Seasonax’s charts for a long time to come.

Take advantage of the benefits and use Seasonax for your professional handling of seasonal trends!

Best regards,

Christoph Geyer, CFTe

Winner of the Stock Analyst Award for Technical Analysis