After 34 years, Japan’s stock market has reached a new all-time high.

Dear Investor,

Tracing its origins back to 1949, the Nikkei 225 has weathered various economic storms, including Japan’s post-war boom, the 1980s bubble, and the challenging “Lost Decade” of the 1990s.

The “Lost Decade” kicked off with a bang—or rather, a pop—when soaring interest rates caused a massive financial bubble to explode. Picture this: banks were handing out cash like candy, and investors, caught up in the excitement, were gobbling it up. Sound a bit too familiar?

This mess shook people’s faith in the economy worldwide, sending stock markets into a nosedive. It was a long, tough road to recovery.

But here’s the twist: a series of smart economic moves in the early 2010s started turning things around. Fast forward to early 2024 – the market is not just back, it has soared by an impressive 20% since the start of the year.

The legendary trader, Warren Buffet, revealed in 2020 that his firm, Berkshire Hathaway, had bought around 5% of Japan’s top five trading companies sensing the shift in Japan’s economy. This was a move that Buffet’s long term supporter and vice chair, Charlie Munger, said was like, ‘having God just opening a chest and just pouring money into it’.

Can April’s cherry blossom inspire more growth?

Let’s take a closer look at Nikkei 225, a stock market index of the Tokyo Stock Exchange, that comprises 225 top-rated companies and serves as a barometer for the broader Japanese economy.

As of March 2024, it hit an epic milestone, soaring to the 40,000-point mark—a high we haven’t seen in 34 years. This comeback has caught the eye of investors around the globe, spotlighting Japan’s top stock indices as a crystal ball into the country’s economic wellbeing.

Japanese stocks show seasonal strength until early June

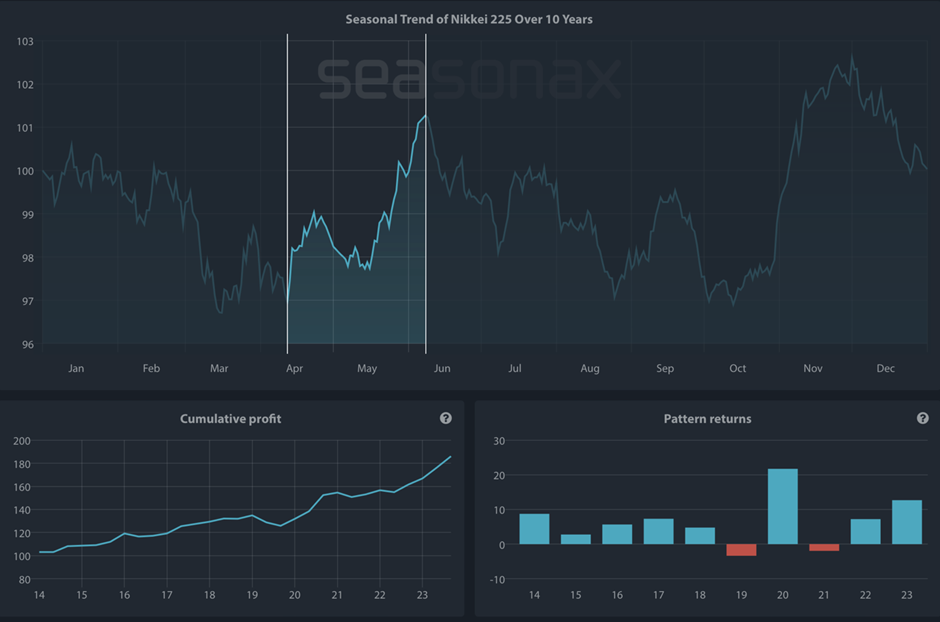

Most importantly, Japanese stocks are subject to excellent seasonality from now until early June. The seasonal chart below shows the typical pattern of the Nikkei 225 in the course of a calendar year. It has been calculated by averaging the market’s moves of the past 10 years. The horizontal axis shows the time of the year, the vertical axis shows the % change in price (indexed to 100).

Seasonal Chart of Nikkei 225 over the past 10 years

Source: Seasonax, sign up here https://app.seasonax.com/signup to access further analysis, 30 days for free

As the chart shows, the most interesting phase from a seasonal perspective starts on April 12 and ends on June 8.

Over the past 10 years, the average return of the Nikkei 225 in this time period amounted to 6.34%. This corresponds to an annualized gain of 48.60%.

In this seasonally strong phase, the Japanese stock market generated gains for investors in 8 out of 10 cases (red bars indicate years with negative returns, blue bars years with positive returns).

But there’s something to keep in mind: Nikkei 225 Index mostly covers big sectors like technology and consumer goods. By the start of 2024, these sectors took up nearly 73% of the index.

What’s Lifting Japan’s Stocks?

Two main things are giving Japan’s stock market a big boost: really low interest rates, and a yen that’s not as strong. These low rates are making it easier for Japan to grow and help its companies sell goods abroad more competitively, thanks to the cheaper yen. Plus, prices have been going up just a little (but not too much), which makes people feel good about the economy.

Even though prices are rising, Japan’s been careful not to hike interest rates too quickly. Since 2016, Japan’s even had negative interest rates to encourage people to spend and invest more.

Moreover, Japan’s spot in Asia makes it a go-to for investors, especially with some worries about China. Its stable market looks inviting, offering a safe place to invest in the region.

In contrast to the US stock market, it has not become overheated in recent years; and unlike in Europe, corona-related risks are comparatively moderate in Japan, at least so far.

Investing Ideas

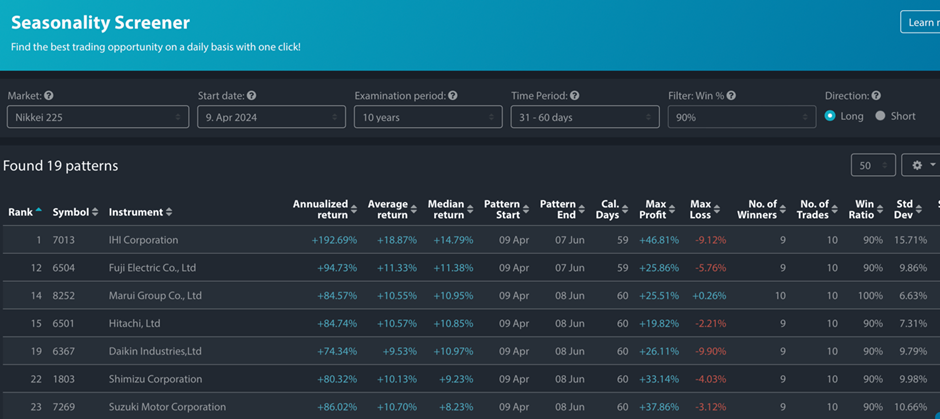

Bear in mind that some stocks and sectors are more suited to big changes happening in Japan and globally – like healthcare, financial services, and tech companies. For those looking to refine their investment strategies, Seasonax offers a screener to find these investment opportunities, and to identify optimal entry and exit points based on historical trends.

Register for free at www.seasonax.com, and explore patterns across various markets, including indices, (crypto)currencies, stocks, and commodities.

Remember, don’t just trade it, Seasonax it!

Yours sincerely,

Tea Muratovic

Co-Founder and Managing Partner of Seasonax