At the last Bank of England meeting two of the more hawkish members of the Monetary Policy Committee, Mann and Haskell, pulled back from the hiking interest rate camp and moved into the holding interest rate camp. This led to the GBP sell off after the last March BoE meeting. However, since then the GBP has pulled back on an index level largely helped by the Chief Economist Huw Pill who was happy to look at the latest UK data and say that he saw no change from March’s rate meeting. This was perceived to be a ‘bullish’ reaction and was in contrast to Bailey, Greene, and Ramsden. Pill was indicating that he was happy for the BoE to hold rates thereby giving the GBP a lift.

However, will the GBP find sellers on any weaker UK data? Will the next CPI print send the GBP lower? Will a more hawkish Fed send the GBPUSD lower?

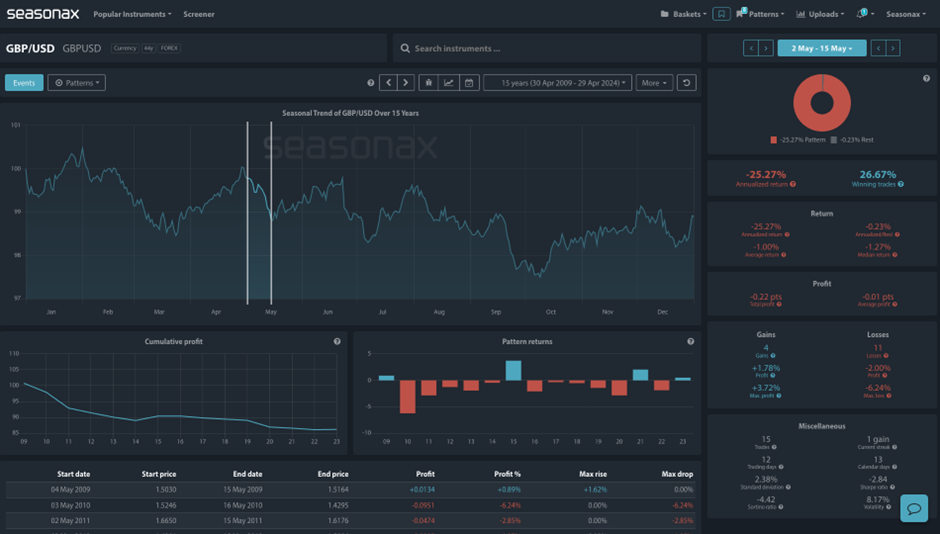

The GBPUSD seasonals are certainly interesting. Over the last 15 years, from May 02 through to May 15 the GBPUSD has lost value 75% of the time with an average fall of 1%. Will that pattern repeat itself again this year?

Technically, there are some attractive levels to note for the GBPUSD pair with 1.2600 a key area that seller’s will look at.

Giles Coghlan, CMT is a seasoned financial writer specialising in macro outlooks and key technical trading strategies

Sign up here for thousands of more seasonal insights just waiting to be revealed!

The major trade risk here is the USD finds weakness again and/or UK inflation ticks higher and the BoE signal that they need to keep rates higher/raise rates.

Remember, don’t just trade it Seasonax It!