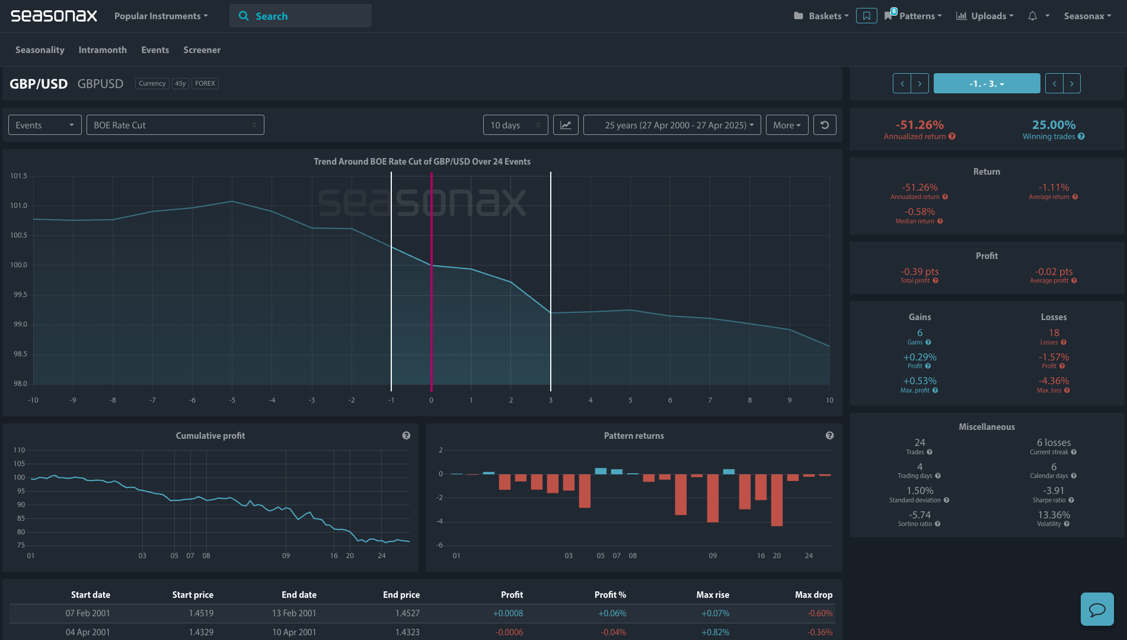

- Instrument: GBP/USD

- Average Pattern Move Post-Rate Cut: -1.11% over 4 days

- Winning Percentage: 25%

- Seasonality Source: Seasonax

Dear Investor,

You may not realize it, but GBP/USD is entering a crucial period. With the Bank of England (BOE) set to potentially shift toward interest rate cuts, the seasonal trends suggest notable downside risks when the BoE cut rates. We want to analyze the data in more detail.

Seasonality Overview:

The chart shows the typical development of GBP/USD around BOE rate cut events over the past 25 years. Historically, the pound weakens following a rate cut announcement, with an average decline of around -1.11% over the subsequent 4 trading days. The pattern has produced losses 75% of the time following these events, which points to the inherent bearish pressure linked to policy easing.

Technical Outlook:

Technically, GBP/USD is sitting in a tight spot. As highlighted on the monthly chart:

- Major Resistance is forming around the 1.3000 region — a descending potential trend line dating back to 2014.

- Key Support lies at 1.2000 — a zone that has held since the 2022 lows.

Currently, the pair is trading near 1.3300, but any failure to convincingly clear the 1.3000 resistance could open the door for a deeper pullback. If BOE rate cuts do materialize over the summer, it could accelerate a move back toward the 1.2000 handle.

Macro Drivers:

- IMF Global Outlook: The IMF recently downgraded global growth for 2025 to 2.8% (from 3.3%), warning of growing recession risks.

- UK-Specific Risks: Domestic inflation is easing, leaving the BOE more flexibility to cut, while sluggish growth and political uncertainty could weigh on sterling sentiment.

- Yield Spread Pressure: A dovish BOE while the Fed stays on hold or cuts more slowly could drive GBP underperformance versus USD.

Trade Risks:

The moves in GBP/USD will heavily depend on the timing and magnitude of any BOE cuts relative to Fed policy shifts. If the BOE cuts more cautiously or the Fed moves more aggressively to ease, the pound could remain resilient despite seasonal tendencies.

Use Seasonax for your professional handling of market-moving events!

Sign up here for thousands more seasonal insights waiting to be revealed!