On Wednesday we have UK services inflation data out. The key data to focus on for the UK remains labour market data, wage growth data, and data from services inflation. BoE Governor Bailey recognised ‘things are moving in the right direction’ at the latest meeting and on Friday March 21 Bailey said that rate cuts were ‘in play’ at future BoE meetings. CPI is expected to fall below 2% in Q2 aided by the full duty freeze. BoE’s Greene wrote in the FT this week that markets must stop comparing the UK to the US, as inflationary pressures in the UK are driven by services inflation. Greene said that UK rate cuts are ‘a way off’. So, that means the UK inflation data will be a laser focus for markets.

So, if we see the print come in much higher than markets are expecting that will mean that rates markets will start to look for a higher for longer rate narrative and that should lift the GBP against the USD as yield differentials narrow.

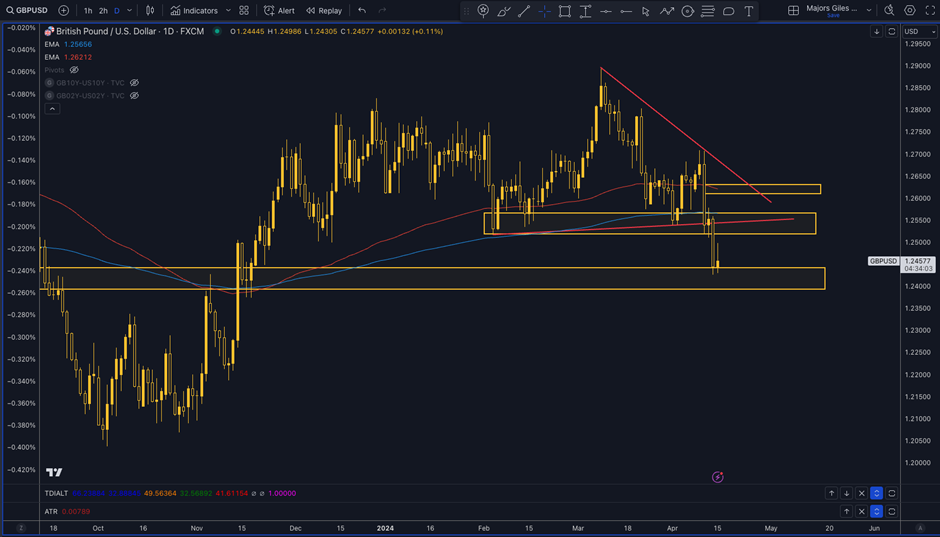

So, the seasonal strength in the GBPUSD pair could be a good opportunity for a GBPUSD retracement. Over the last 15 years the GBPUSD pair has risen over 70% of the time between April 19 and April 30th. The average gain has been 0.50%, but the largest move has been over 2.5% Will the GBPUSD find support from the 1.2400 region on Wednesday?

Sign up here for thousands of more seasonal insights just waiting to be revealed!

- The major trade risk here is if UK CPI surprises the downside as that should accelerate further GBPUSD weakness.

Remember, don’t just trade it Seasonax It!