Walmart Inc. is a major American multinational retail corporation headquartered in Bentonville, Arkansas. Established in 1962 by brothers Sam and James “Bud” Walton, the company operates a variety of retail formats including hypermarkets, discount department stores, and grocery stores. Additionally, it owns and manages Sam’s Club retail warehouses. With a presence in 24 countries, Walmart operates over 10,500 stores and clubs worldwide under various names such as Walmart, Walmart de México y Centroamérica, and Flipkart Wholesale.

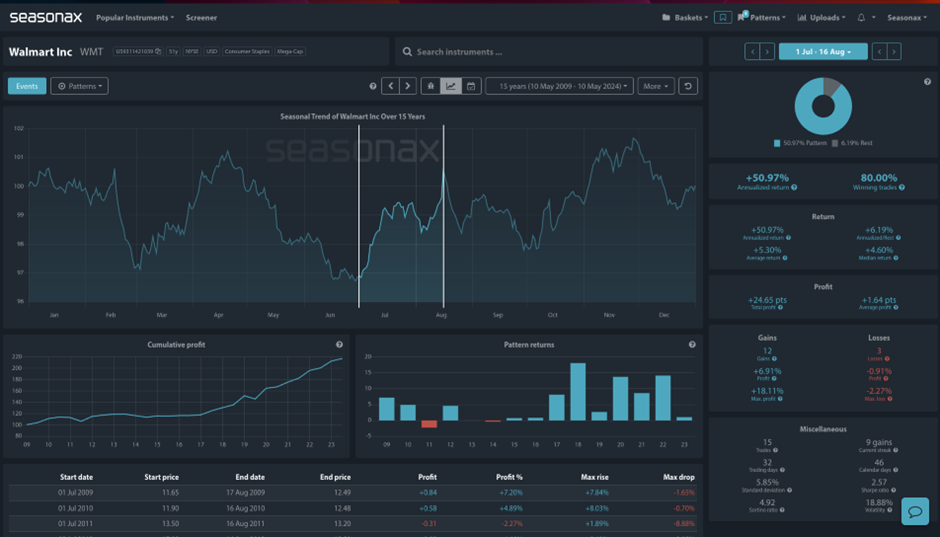

Walmart is announcing its earnings on Thursday before the open. Seasonally Walmart has had a weak period from May 16 through to June 30th over the last 15 years with a fall in the share price 60% of the time. The average return has been -1.59% and the largest fall has been nearly 18% in 2022.

That seasonal pattern then changes rom July 01 through to August 16 where there is an 80% winning trade percentage and an average return of 5.30%.

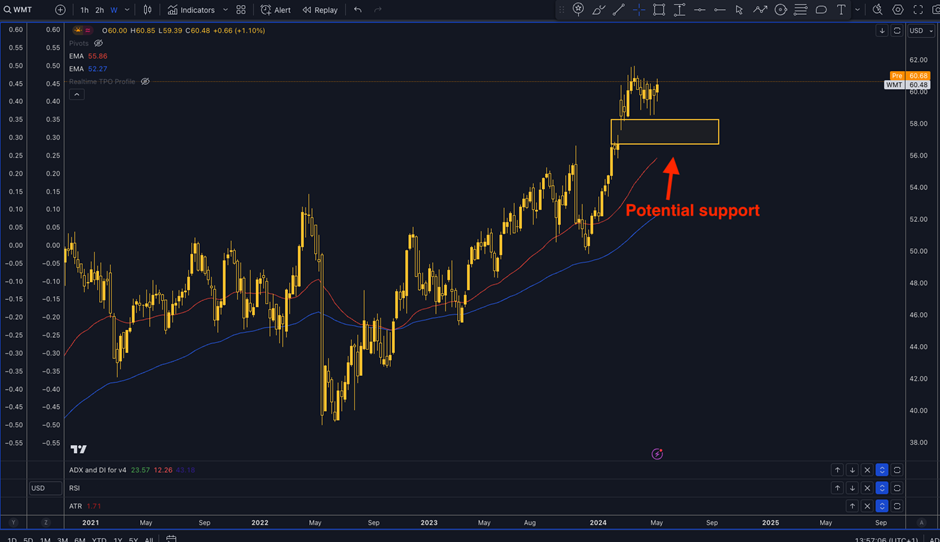

Technically, Walmart has some strong support around $58 with the rising window potentially positioned to provide support on any dips.

Giles Coghlan, CMT is a seasoned financial writer specialising in macro outlooks and key technical trading strategies

Sign up here for thousands of more seasonal insights just waiting to be revealed!

The major trade risk here is that prior seasonal patterns do not necessarily repeat themselves each year.

Remember, don’t just trade it Seasonax It!