The ECB are due to meet this week on Thursday and the pressure is on the ECB to hike rates. Inflation data last week showed a headline print of 8.1% y/y over the 7.6% y/y expected which was at the top end of analysts estimates. Short Term Interest Rates markets are not looking for a June rate hike at the time of writing, but watch for EUR strength post Thursday.

In contrast, the BoE is still expected to hike rates, but crucially the BoE has revised growth negative for 2023. This means that the BoE could well pause hiking rates around the summer time. They may even look to cut rates in 2023.

So, there is a medium term EURGBP upside bias. Also note the strong seasonals that are in place for the EURGBP pair from the second part of this month.

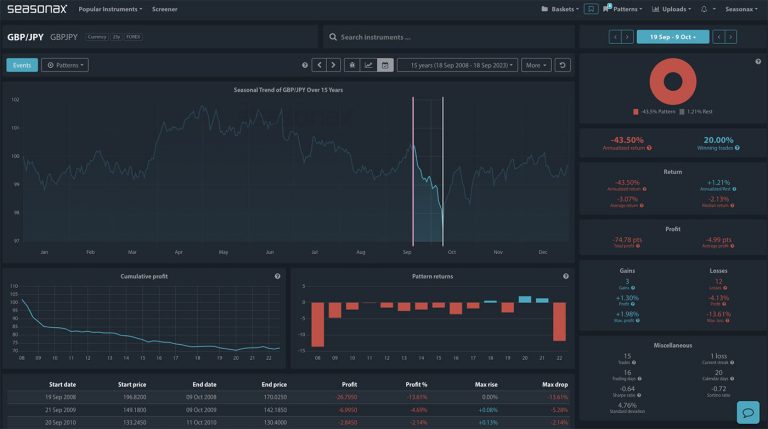

Over the last 15 years the EURGBP has gained 11 times between June 16 and August 25. The average gain has been 1.56% and the average loss has been -1.03%.

Does this make EURGBP a buy ahead of this strong seasonal pattern and the ECB meeting on Thursday?

Major Trade Risks:

The major near term risks are from a more dovish ECB that stresses growth worries over inflationary fears.

Analyse these charts yourself by going to seasonax.com and get a free trial! Which currency pair would you most like to investigate for a seasonal pattern?

Remember, don’t just trade it, Seasonax it !