Dear Investor,

Anyone who owns property is always looking to protect it. However, property these days, is not only bricks and mortar, but also immaterial in the form of data or access. You may have probably already thought about what a firewall or cloud solution could look like.

One of the leading providers of such cyber security systems is Palo Alto Networks, INC (PANW) which is a company based in California and founded in 2005. In times of increasing international cyber attacks on all kinds of public and private institutions, this topic is becoming more and more important.

Palo Alto not only provides solutions to these problems, but it is also active in the field of artificial intelligence. You might be wondering how you can benefit from this future trend.

Finding the best phases in a turbulent upward trend

At Palo Alto, two behaviors stand out in particular. In the course of the trading years to date, so-called “gap-downs” have sometimes occurred. The share price has repeatedly plummeted from one day to the next with a gap between prices. However, these slumps were recovered within a few weeks or months. This has resulted in a long-term upward trend.

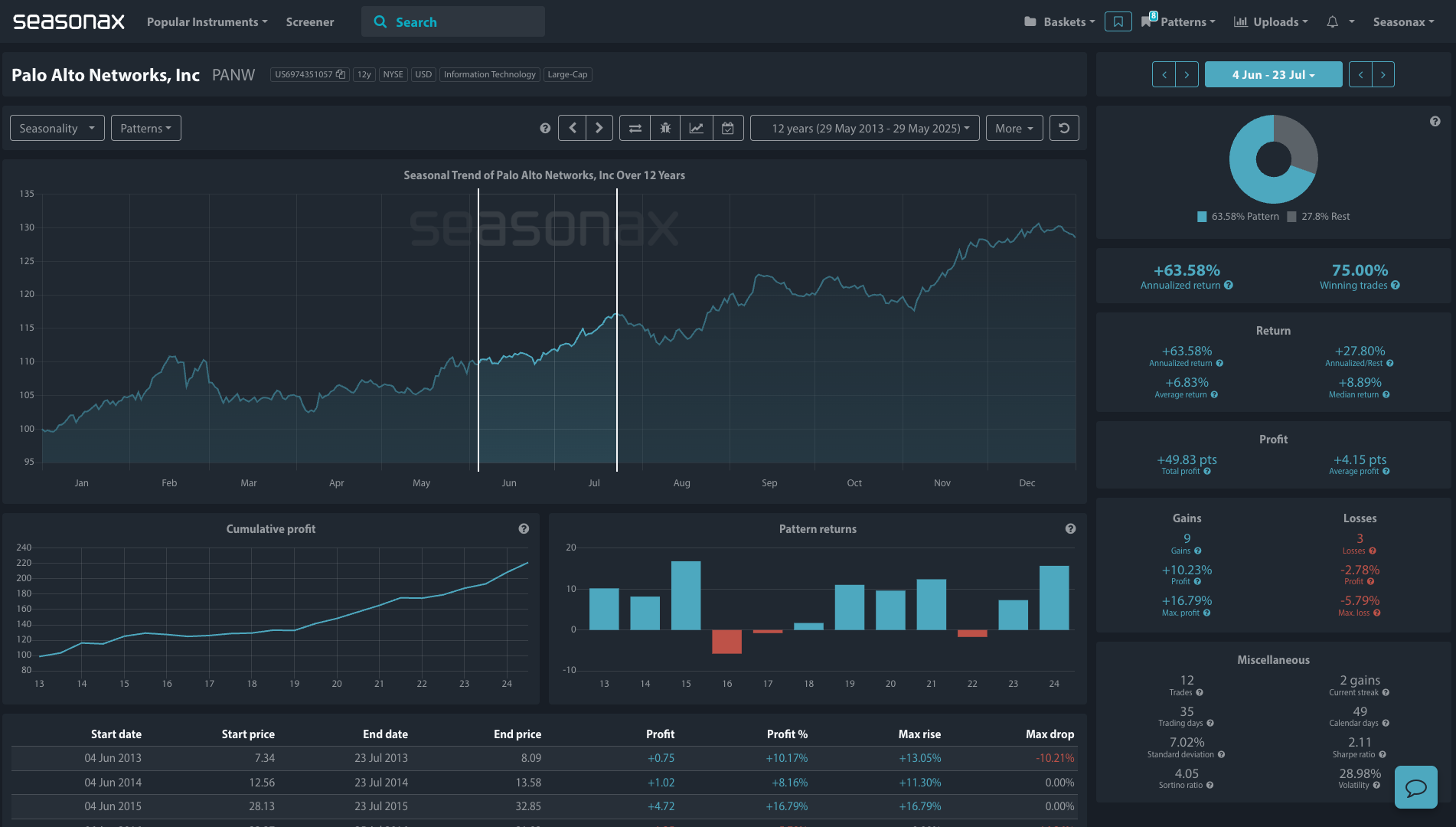

The second conspicuous feature is seasonality, which you can use for your investments in the short term. There is currently a very good seasonal phase from June 4 to July 23. The win rate is 75% over the last twelve years, but even if the ratio of 9 to 3 positive to negative years does not look overly good at first glance, the percentage ratios of a good 10% in the positive years compared to just under 3% in the negative years are convincing. In addition, two of the three negative years only posted a red zero, thus enhancing the overall picture once again. For such a short period of time, these figures are quite respectable.

A cross-country skier with special phases

Even though Palo Alto plays a leading role in security systems, there is of course no guarantee that the share can also be considered safe in the current phase. However, the upward trend and the probability of the statistics as they currently stand speak for a worthwhile investment.

Cyber attacks are modern warfare

It’s a sad reality that the web has long been waging its own war with cyber attacks a regular feature on our headlines. This war can only be won with innovative solutions. Palo Alto’s growth should therefore continue and the chances of share price gains increase further.

Finding the right entry point is your opportunity to participate in this trend.

Search for other entry opportunities at Palo Alto

The short-term slumps described above are often observed in spring and late fall. Particularly good statistical values can also be observed at these times, as can be seen in the chart. So if the next slump is seen with a gap and the seasonality matches, you may not want to hesitate to build up a position here. With the Seasonax charts, you can also define clear stop prices to protect yourself from unusual events.

Win with Seasonax in terms of security, the time is ripe!

The selected Palo Alto share not only shows a long-term upward trend, but also repeatedly offers good entry opportunities. The best way to find these is to use the Seasonax charts. You can also define both a price and a time stop if you do not want to make a long-term investment.

We wish you every success in securing your property and thus also success with your investment on the market.

Use Seasonax for your professional handling of seasonal trends!

Yours sincerely,

Christoph Geyer, CFTe

Winner of the AktienAnalystenAward Technical Analysis