Dear Investor,

Firstly, I would like to report that Tea Muratovic and I were invited to speak in New York at the end of April at the 50th Symposium of CMT. CMT is the international umbrella organization of professional technical analysts, and we attended as Seasonax speakers on the topic of “Seasonality”.

Speakers also included Larry Williams, John Bollinger, Ralf Acampora, Tom DeMark, Robert Prechter and Martin J. Pring – just to name a few. Their indicators, such as Williams %R, Bollinger bands or Pring’s KST, can be found in virtually every charting software today.

Speaking alongside these pioneers of technical analysis was a great honor for us. We take it as a challenge to continue making Seasonax beneficial and professional for you in the future!

In the picture you can see the Seasonax sign at the New York Stock Exchange as it appeared at the evening event, for which I would like to express my sincere thanks to CMT.

Seasonax, NYSE, 27.4.2023

Source: Privat

5 ways you can improve your yields with seasonality

The presentation reminded me of the importance of information about investment practices. When I talked about what basic methods there are for using seasonality, I looked into the curious eyes of many listeners.

Therefore, I would like to mention these methods to you as well. The following are five ways that you can use seasonality in investing and trading:

1. Direct Trading: Seasonal patterns can of course be traded directly. For example, you can go long during the year-end rally. With this method, make sure that the individual investment is not too large and that stop lots are used.

2. Timing: Seasonal patterns can be used for timing. For example, you can buy stocks in November at the beginning of the fall rally, rather than at its end in early January. With this method investors, whose investment horizon is longer than a seasonal pattern, can also take advantage of seasonality by optimizing entry and exit times.

3. Filter: Conversely, investors who are very short-term orientated can also use patterns of longer duration. This is done by using seasonal patterns as a filter. For example, day traders cannot enter a position if the seasonality is negative. The number of trades is reduced in this way, but the probability of winning is increased. Larry Williams uses this method regularly.

4. Additional Input: You can also use seasonality as an additional input factor to your existing trading approach – no matter if it belongs to fundamental or technical analysis. For example, if you trade your stocks with a trend following approach together with a fundamental filter, you can simply add the seasonal trend as an additional decision criterion. Since seasonality has its basis in the calendar, while other trading approaches do not, you can in this way link non-correlated signals. This increases the probability of a positive trade.

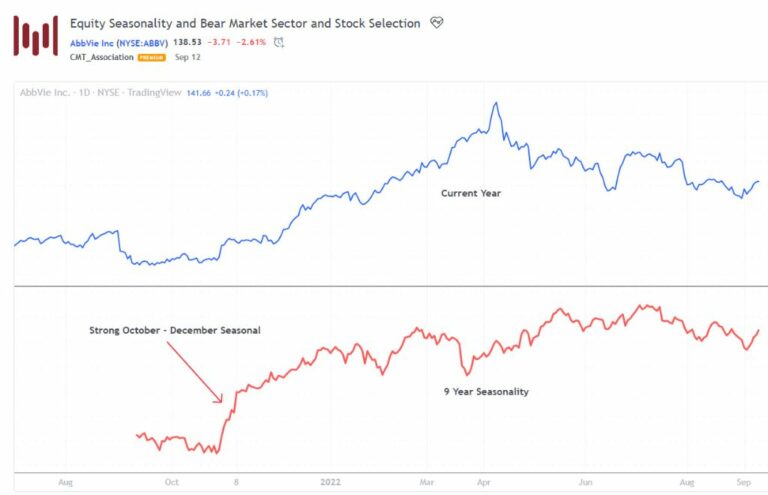

5. Selection: With this approach, you review your portfolio at regular intervals of, say, one month. You then invest in the stocks or commodities that have particularly good seasonality in the coming weeks. After a month, you repeat this process, selling the stocks that are no longer seasonally interesting and rolling into the more interesting ones. For this approach, the screener in Seasonax is particularly helpful.

Use seasonality in the way that suits you!

Just pick the one that works for you from these five methods! We designed Seasonax so you don’t have to spend a lot of time to make seasonality work for you.

No matter if you continue to use your existing trading approaches, or if you just hit with seasonality, www.seasonax.com offers you the necessary tools for that!

Warm regards,

Dimitri Speck

Founder and Chief Analyst of Seasonax

PS: Seasonality helps with many investment styles!