Tesco Plc expects a slight increase in retail profit this year, projecting a minimum of £2.8 billion ($3.5 billion) in retail adjusted operating profit for the fiscal year. This uptick comes as the supermarket chain anticipates reduced cost pressures, enabling it to lower prices and attract budget-conscious shoppers. Tesco aims to remain competitive in Britain’s crowded grocery market by strategically cutting prices and matching competitors like Aldi. CEO Ken Murphy highlighted the importance of consistency in navigating the market’s dynamics and various competitive threats.

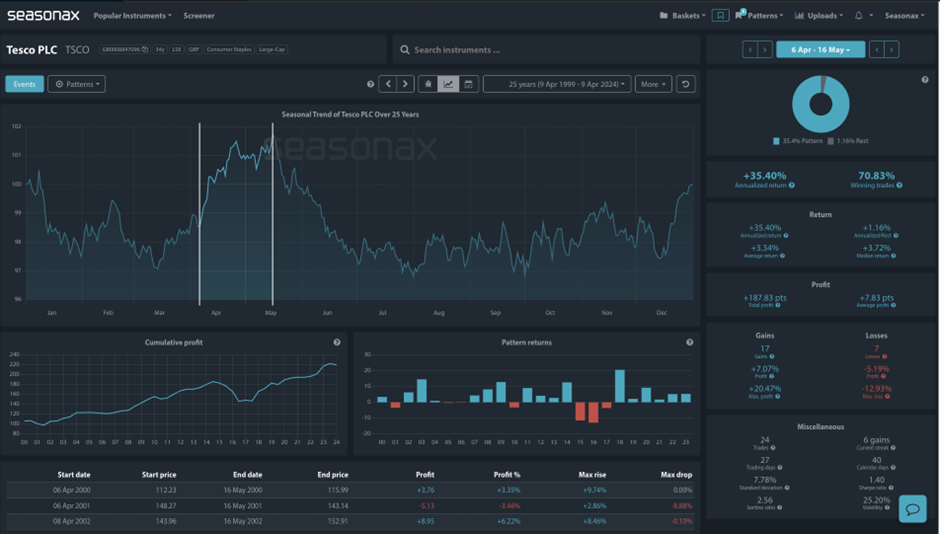

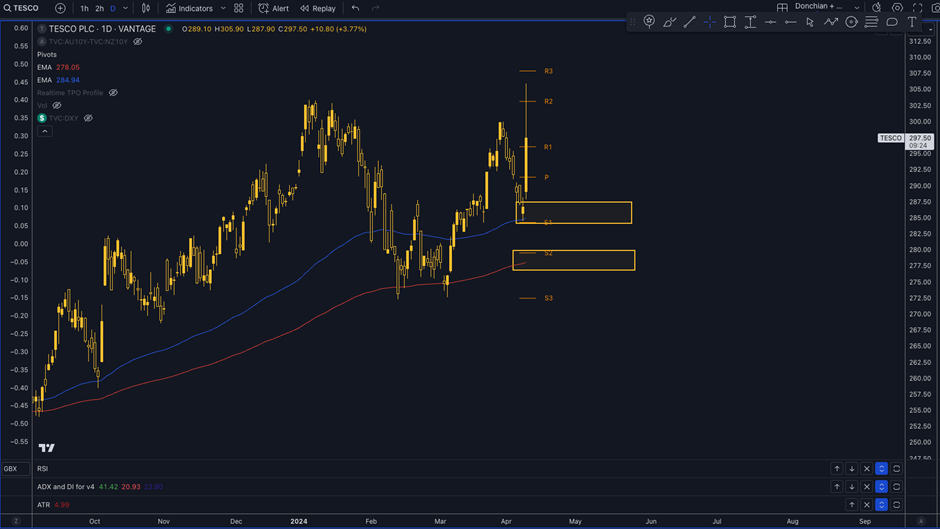

Tesco has some great seasonals ahead with an average return of over 3% over the last 25 years between April 06 and May 16. There have been outsized gains in 2003, 2009, 2014, 2018, and 2020. With a 70% winning trade percentage, will Tesco repeat it’s strong seasonal pattern again this year? Will the key support levels marked find buyers?

Sign up here for thousands of more seasonal insights just waiting to be revealed!

The major trade risk here is that previous seasonal patterns do not play out again this year.

Remember, don’t just trade it Seasonax It!