- Instrument: USD/JPY

- Timeframe: June 16 – September 1

- Average Pattern Move: –6.32%

- Winning Percentage: 28.00%

Dear Investor,

You may not realize that USD/JPY has historically struggled in the summer stretch from mid-June to early September. Over the past 25 years, the pair has produced negative returns in 18 out of 25 seasons — that’s a mere 28% win rate during this time, with an annualized average decline of –6.32%. Given the evolving macro backdrop and a compelling technical setup, this pattern deserves renewed attention. Let’s analyze the data in more detail.

Macro Pressure Is Mounting

Nomura has recently flagged a tactical opportunity to short USD/JPY, projecting a move toward ¥136 by the end of September. Their case hinges on two forces converging:

- Japanese Investor Repatriation: Rising domestic yields are encouraging capital to shift from overseas bonds back into JGBs — reducing demand for USD-denominated assets.

2. Geopolitical FX Tensions* With bilateral trade talks ongoing, the US Treasury has now openly called for the Bank of Japan to persist with rate hikes, adding weight to a normalization in JPY levels.

This forms part of a broader structural shift: the era of ultra-dovish BOJ policy appears to be winding down, while the Fed is under increasing scrutiny over potential rate cuts later this year.

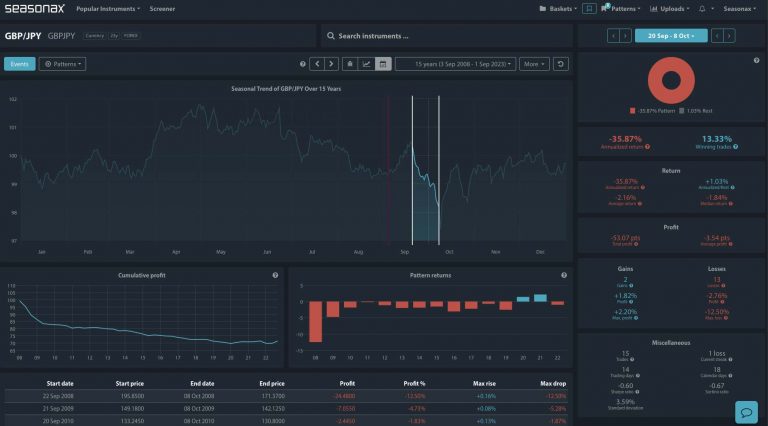

Seasonals Signal Trouble for the USDJPY

The Seasonax chart shows a persistent and prolonged seasonal drawdown for USD/JPY beginning around June 16. Average losses of –1.37% during this period are coupled with extreme downside examples, including 2010’s –7.94% and 2024’s sharp –7.16% fall. These seasonal drawdowns coincide with historical periods of global yield realignment and risk aversion — themes now back on the radar.

Technicals Align with the Fundamental Narrative

From a technical perspective, the pair is hugging a rising multi-year trend line, and a clean break below this support could open the door to deeper losses toward the ¥137–¥136 zone. The weekly chart highlights this support zone clearly, with price recently failing and momentum indicators turning lower.

Trade Risks:

While macro and seasonal forces are lining up, traders must remain mindful of key risk events. Intervention chatter from the Japanese Ministry of Finance, shifting Fed rhetoric, or a sharp bounce in US data could stall yen strength.

Use Seasonax for your professional handling of market-moving events! Try it for 30 days for free!