On Thursday at 13:30 we have the US GDP print which is expected to come in at 2.4%, down from 3.4% in Q4 2023. At the latest Fed meeting the Fed projected GDP to be 2.1% for 2024, so a firm US GDP print underpins the ‘soft landing’ narrative. This should be supportive for stocks should we see a strong print.

However, a weak GDP print should also be supportive for stocks as that may mean the Fed has to move more quickly to cutting interest rates. Now the Fed’s preferred measure of inflation, the PCE print, is released on Friday, so that is likely to be a key driver too.

The key aspect to be aware of is that there may be asymmetric risk for the US GDP print on Thursday with both a weak and a strong print likely to find S&P500 buyers.

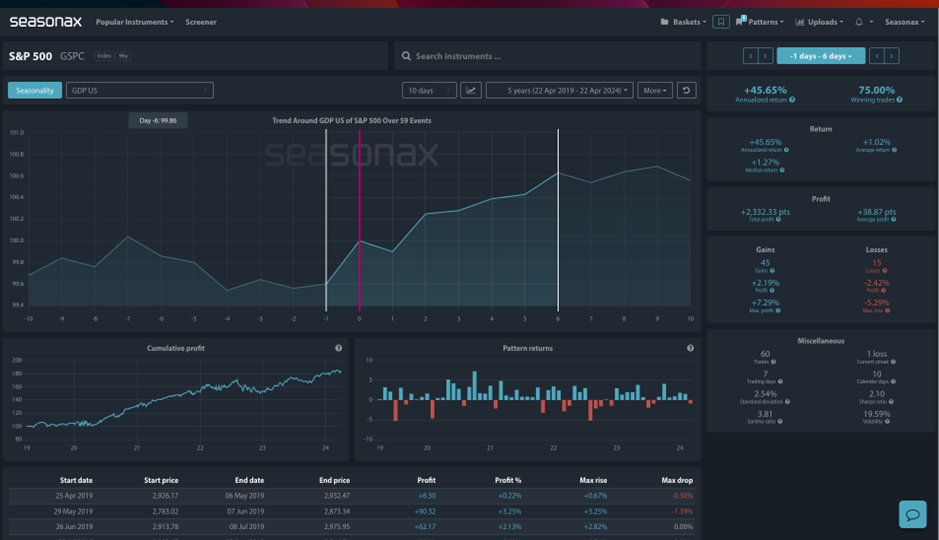

On top of this the seasonal risk event analysis shows that the S&P500 has a bias for gains into and out of the US GDP print. From the day before the GDP release to 6 days after the release the S&P500 has gained an average of 75% of the time with a median return of 1.27%.

So, will the S&P500 find buyers again this time out of the GDP print?

Sign up here for thousands of more seasonal insights just waiting to be revealed!

The major trade risk here is the US PCE print on Friday, A big beat on Friday will mean the higher for longer narrative will be reinforced and that can be negative for stocks. Also, if geo-political risk flares in the Middle East again, that can be negative for stocks.

Remember, don’t just trade it Seasonax It!