UBS Group AG is planning significant job cuts across its investment bank, expected to affect over a hundred positions globally. This move follows the rescue of Credit Suisse, which increased UBS’s workforce substantially. Job losses are also anticipated in wealth management and markets units. The CEO aims to save $6 billion in staff costs. UBS’s shares fell due to proposed regulatory reforms, potentially resulting in a $20 billion capital hit. The restructuring process, coupled with the merger of parent banks and subsidiaries, makes 2024 a challenging year for the bank.

So, the seasonal patterns are particularly interesting right now as investors consider whether these jobs cuts are enough to boost sentiment surrounding UBS.

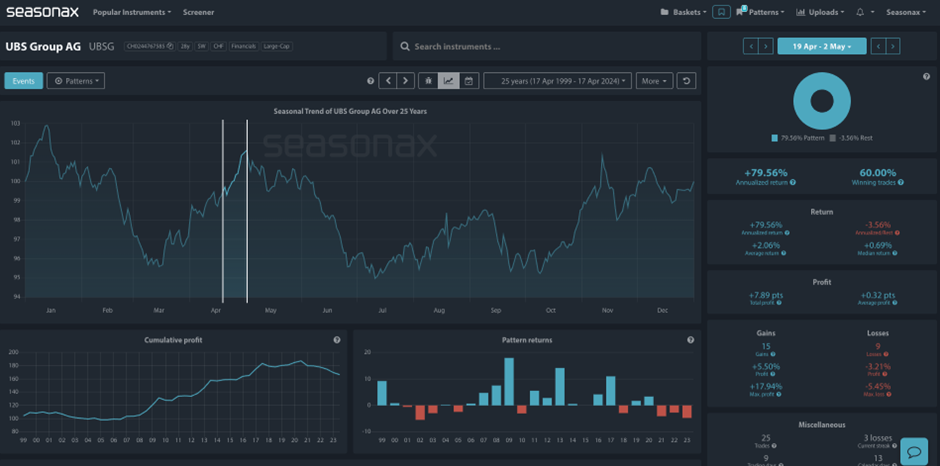

Over the last 25 years the share price has had a strong end to April with a 2.06% average return between April 19 and May 02. The largest gain was over 17% in 2009, but the last three years have seen falls of 4.07%, 2.71%, and 4.74%.

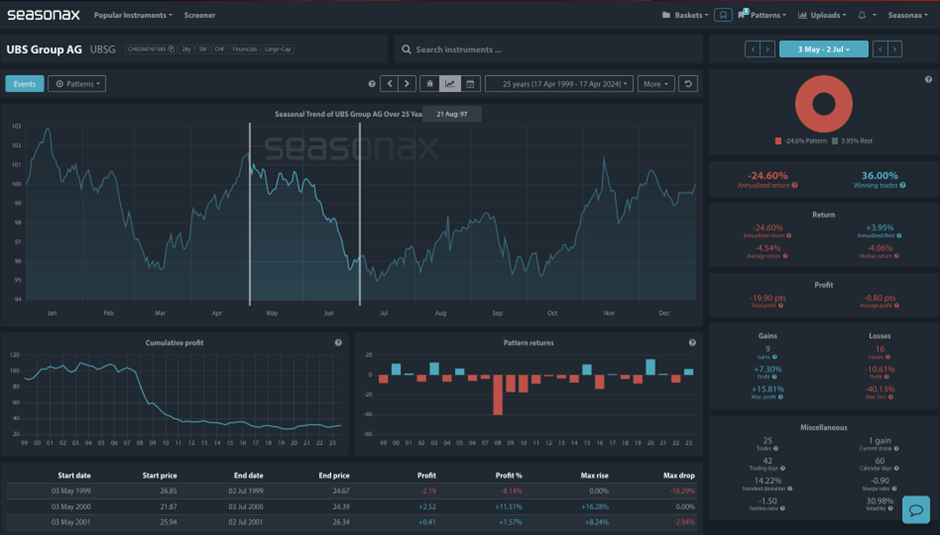

However, the period following this tends to be very weak. From May 03 through to July 02 the share price has fallen over 60% of the time over the last 25 years for an average fall of just over 4.5%.

So, will this weekly trend line hold as support for UBS around the 25.50 area? Will buyers take comfort from the cost saving job cuts?

Sign up here for thousands of more seasonal insights just waiting to be revealed!

The major trade risk here is that previous seasonal patterns don’t necessarily repeat themselves each year.

Remember, don’t just trade it Seasonax It!