Dear Investor,

In last year’s edition of Seasonal Insights, I presented the four-year cycle for the US stock market. This cycle spans four years and is also known as the election cycle.

The current year, 2026, is a so-called midterm election year. For stocks, it is the weakest year in the four-year cycle. But how does gold fare in a midterm election year? Gold, considered a “safe haven,” is seen as the counterpart to the stock market in terms of risk-on/risk-off. The future prospects of this currently very popular precious metal are of great importance to many investors.

The 4-year cycle influences the markets

The phenomenon known as the 4-year cycle affects not only the stock markets, but also other markets such as the gold market.

In the 57 years since 1969, the price of gold has risen by an average of only 3.47% in presidential election years. In contrast, it performed quite well in the primary election years, rising by 9.68%. In the post-election years, the increase was 5.11%, and in the midterm election years, it reached a high of 12.59%. The midterm election year is thus the best year for gold in the four-year cycle. This is a promising outlook for the precious metal in the current year, 2026, which is a midterm election year.

The midterm election year at Gold

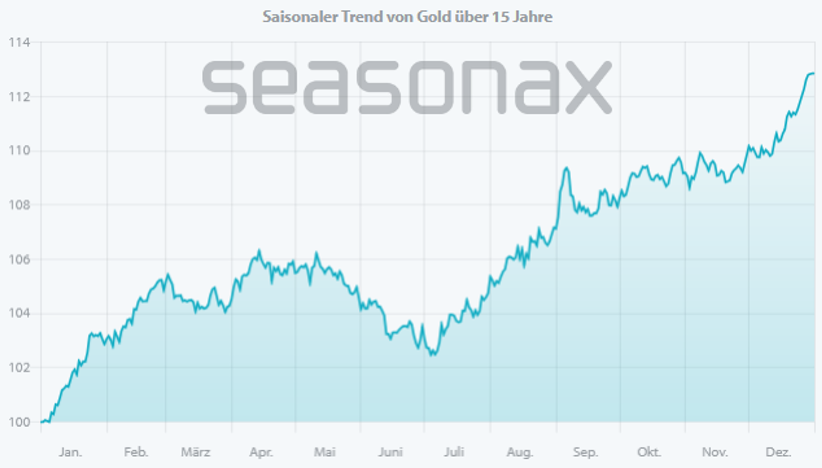

What does the development look like in detail? To understand this, consider the average performance of gold only during midterm election years. The scale on the right shows the percentage gain. The scale below shows the time period over the course of those midterm election years.

Average gold price trend in midterm election years, 1969 to 2025

You can see a cyclical increase until April, then a sharper decline in May and June, and then a strong second half of the year.

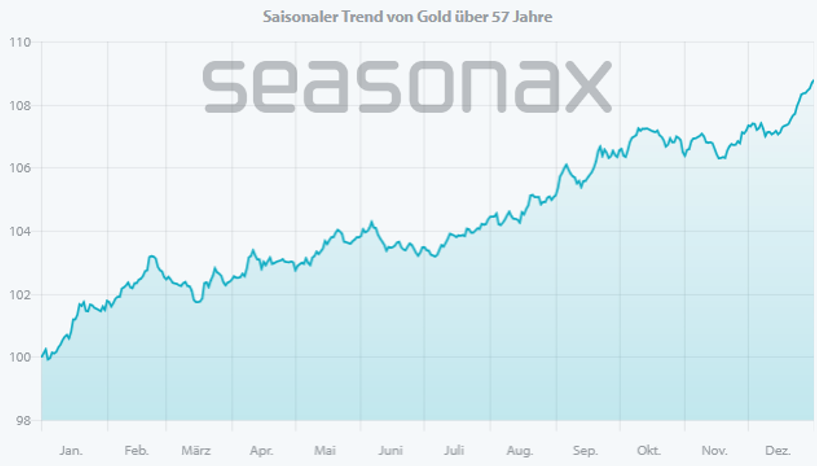

For comparison, I will also show you the normal seasonal pattern over the same period:

Gold in US dollars, seasonal trend, 1969 to 2025

In a typical gold year, with its usual annual seasonality, a more consistent trend can be observed than in midterm election years. Only minor seasonal declines occur. Furthermore, the average annual seasonality shows an increase of 8.74%, significantly less than the 12.59% seen in midterm election years.

Compared to a typical gold year, a midterm election year is therefore stronger. It also exhibits a more pronounced cyclical correction.

Gold could also be an exciting investment in the current midterm election year!

In these exciting times, more factors than just seasonality are certainly influencing the price of gold. But seasonality and cycles do play a role.

This is clearly illustrated by the recent rise in platinum. My colleague Giles Coghlan drew attention to this precious metal at the beginning of December 2025. In his Seasonal Insights article , he wrote, “Platinum: A Seasonal Upswing Extending into February!” In the two months leading up to the end of January, platinum rose by a peak of 77.7 percent!

For gold, the 4-year cycle suggests a decent performance in the current midterm election year, but also a stronger correction over the course of the year.

Gold typically rises in midterm election years, while stock markets are problematic. In this sense, gold acts as a counterweight to standard stocks.

Gold isn’t the only alternative to standard stocks. There are also other precious metals, commodities, commodity stocks, as well as small-cap and non-US stocks. Seasonax offers a wide selection of promising investment opportunities!

Warm regards,

Dimitri Speck

Founder and Chief Analyst of Seasonax

PS: Take advantage of the full range of investment opportunities!