Dear Investor,

Frank Sinatra once sang this song, and much later it became the theme song for the first “Wall Street” film starring Michael Douglas. You’re probably wondering what a historic hit song has to do with the stock market.

The Artemis space program is entering its next phase these days, and several publicly traded companies, which we will examine here, are also benefiting from it. With this new launch to the moon, astronauts will be propelled into an orbit farther from Earth than any human has ever been in space. The goal of this project is to establish a permanent station on the moon, from which a Mars mission will later be launched.

Much work and innovation will be required before that happens. However, the components for the current mission are already being produced and are also being manufactured in Germany.

Airbus with the service module for the upcoming moon mission

The so-called service module ensures the astronauts’ survival in the Orion capsule. Airbus is producing it in Bremen and will provide it to NASA free of charge. In return, the ESA, as the client, hopes to secure one or more launch slots for a German astronaut. If the mission is successful, further orders will follow. Currently, the module is being financed by the German government.

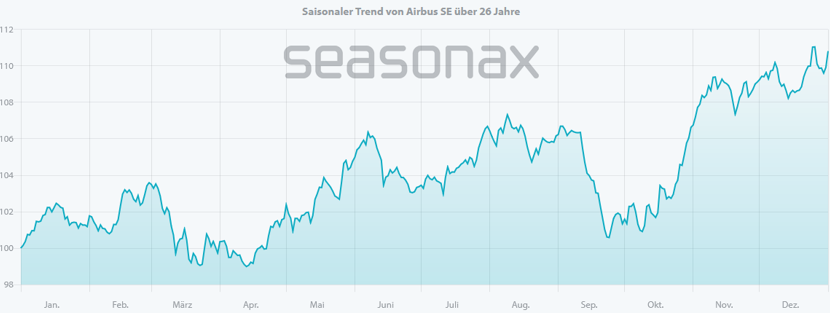

What does the current phase of seasonality look like at Airbus?

Despite seasonality, Airbus has been in a volatile upward trend since May 2003. Two particular phases stand out in the Seasonax chart. From mid-April to early June, an average gain of over 13% was achieved in 19 out of 26 years during this period. In the negative years, the average loss was just over 7%. This period would also coincide well with a hopefully successful mission to orbit the moon this year.

The second period covers the phase from the beginning of October to the beginning of November. Here, the ratio is significantly better at 24 to 2, even though on average “only” 10% could be gained during the positive phases.

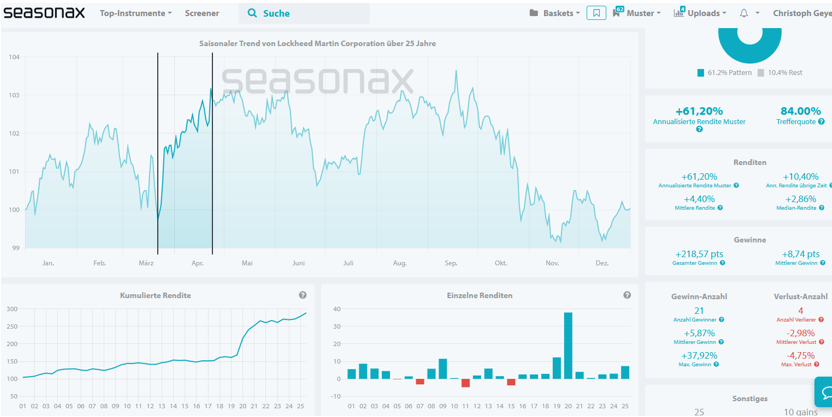

Lockheed Martin has been on an upward trend since 2000

Naturally, US companies are involved in a US project. Among many others, Lockheed Martin stands out, the company that manufactures the Orion capsule used to transport astronauts. Its stock has been in an upward trend since March 2000, characterized by brief but unsustainable dips.

Naturally, US companies are involved in a US project. Among many others, Lockheed Martin stands out, the company that manufactures the Orion capsule used to transport astronauts. Its stock has been in an upward trend since March 2000, characterized by brief but unsustainable dips.

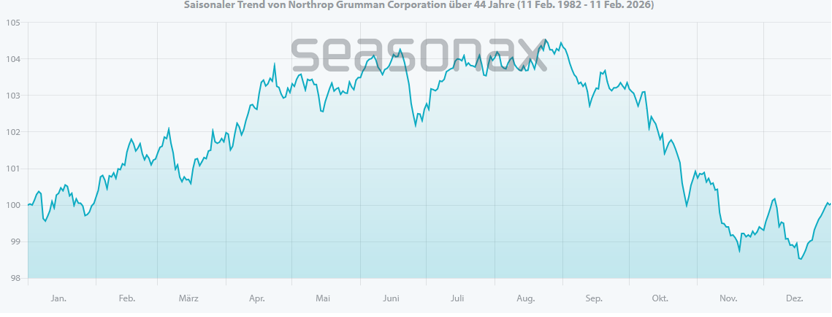

Northrop Grumman is indispensable for various components of the mission

Northrop Grumman manufactures, among other things, the solid rocket boosters that provide the main initial thrust. Northrop has enjoyed a boost in the chart in 33 of the last 44 years between mid-March and the end of April. In these positive years, the company averaged almost 8% of its boost.

During negative phases, the average loss is only 4.6%.

The second notable period spans from the beginning of September to the end of November. However, this phase appears worse than it actually is. Instead of a crash landing, a soft landing is more appropriate when looking at the figures. In fact, the ratio of 21 to 23 remains almost balanced, as do the average returns or losses, at 10% plus and just over 12% minus.

Therefore, despite its unusual nature, this period is only suitable for taking profits and less so for generating a short trade.

Conclusion: An exciting mission that promises excitement on the stock market.

Three of the many stocks involved in a project that will become increasingly important for the further development of space travel can be traded according to seasonal trends. Every successful mission is likely to increase the earnings of the participating companies. Therefore, not only space enthusiasts but also investors will be eagerly anticipating the upcoming events.

If you choose the right phases of the year, you can participate directly.

Regarding the launch of the second stage of the Artemis mission, NASA has now stated that the launch will not take place before March 2026. In the grand scheme of human history, it is irrelevant whether the launch occurs a month earlier or a month later.

The seasonal periods described above should be independent of this anyway.

Win with Seasonax and eagerly await success in the Artemis 2 mission .

Benefit from seasonality and a potential Buster through space exploration and the insights gained for the installation of a lunar base in the not too distant future.

True to the motto of Frank Sinatra’s evergreen: “Fly me to the moon”.

Take advantage of the benefits and use Seasonax for your professional handling of seasonal trends!

Best regards,

Christoph Geyer, CFTe

Winner of the AktienAnalystenAward for Technical Analysis