In recent years it has been extremely challenging for companies to navigate the markets. Market crashes, economic recessions, wars, a global pandemic, technology revolutions and shifts in consumer tastes have all left their mark.

But what if I tell you that there is an elite group of companies that have overcome all the obstacles, and managed to increase their dividend payout for at least 50 consecutive years?

They are called Dividend Kings!

Strong companies, with great brand awareness, solid balance sheets, low volatility; I like to call them ultimate blue chips. So, what do we need to know about dividend kings, and how can they optimize your investment strategy?

Firstly, dividends are announced by a company’s board of directors and are usually disbursed quarterly to their shareholders. Not all profitable companies choose to pay a dividend though. Some companies reinvest profits into the business, or boost employee compensation.

How can you Benefit?

Dividend payments follow a strict series of events to determine who is eligible to receive compensation. After the company’s management announces the dividend payment, investors should be aware of the ex-dividend date – the so called day where the dividend eligibility expires. In other words, the investor must purchase the stock before this date in order to receive the compensation. e.g if the ex-dividend date is December 1st, anyone who owns shares before that date is eligible for the payment.

But not many companies have succeeded in becoming part of this elite group of Dividend Kings. One of the lucky ones is Canadian Utilities, a diversified global energy infrastructure corporation, delivering solutions in electricity, pipelines & liquid, and retail energy.

Despite multiple recessions and uncertain environments over the past 50 years, the company represents the only Canadian company which made it to the list.

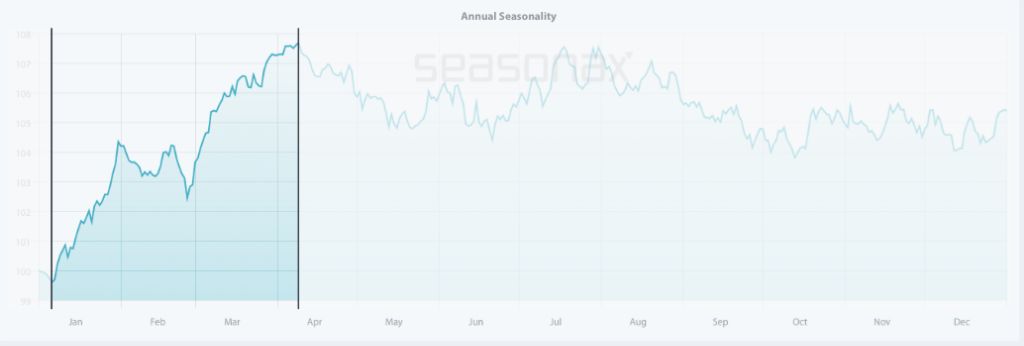

Seasonal Chart of Canadian Utilities Limited over the past 10 years

Source: http://tiny.cc/Seasonax-CanadianUt to open an interactive seasonal chart

Keep in mind that a seasonal chart depicts the average price pattern of a stock in the course of a calendar year, calculated over several years (unlike a standard price chart that simply shows stock prices over a specific time period). The horizontal axis depicts the time of the year, while the vertical axis shows the level of the seasonal pattern (indexed to 100). The prices reflect end of day prices, and do not include daily price fluctuations.

Looking at the seasonal chart above, it is clear that over the past 10 years the first quarter of the year has been favourable for this company. In this time span of 55 trading days (from January 6 until April 9), shares rose on average by almost 8%. Moreover, since 2013 the pattern returns had a winning strike of 80%. In effect, Canadian Utilities generated gains in 8 out of the 10 years during the selected time period.

Besides the strong seasonals ahead, I am wondering if it is possible to combine seasonal strategy with the upcoming ex-dividend date, and to receive an additional dividend payment as the cherry on top?

If this topic has awakened your interest, there are many other Dividend Kings that you might consider investing in.

For instance, American States Water has raised its dividend for 68 consecutive years, earning it the longest dividend growth streak in the stock market. It operates in the field of regulated water utility business. Moreover, it provides services for water distribution and wastewater collection on 11 military bases in the U.S.

Besides the dividend payments, AWR has a seasonal favourable period in the last quarter of the year. Looking at the seasonal chart, American States Water already had a successful October and November. Will this run continue during December?

Seasonal Chart of American States Water Company over the past 10 years

Sourdce: http://tiny.cc/Seasonax-AmericanStatesW to open an interactive seasonal chart

Dividend Kings aren’t necessarily a good fit for every investor. Many of these stocks frequently deliver relatively low growth.

However, Dividend Kings can be a great component of retirement portfolios, or for investors looking for a reliable income.

When choosing the right stocks, don’t forget to take into account fundamentals, and factors such as taxes on the dividend gains. Qualified dividends are taxed at the long-term capital gains tax rate, which is lower than the tax rate on regular income. To earn this status, an investor has to hold the stock for at least 60 days during the 121 days beginning 60 days before the ex-dividend date. For all other short-term investors, the regular tax rate will be applied.

However you decide to structure your investments, make use of Seasonality Screener to identify best entry and exit points based on recurring patterns. By signing up for free to https://app.seasonax.com/signup, you will be able to scan for more than 25.000 instruments, including Dividend Kings, stocks, (crypto)currencies, commodities, and indexes.

Remember, don’t just trade it, Seasonax it!

Yours sincerely,

Tea Muratovic

Co-Founder and Managing Partner of Seasonax