Dear Investor,

With Easter on the horizon, chocolate lovers across the U.S. are eagerly anticipating their annual dive into cocoa indulgence. But why stop at savoring sweets? This Easter, consider turning those chocolates into investment gold. After all, who says you can’t indulge in your candy and profit from it too?

The Sweet Spot: Confectionery Stocks

Confectionery giants like Nestlé (NESN) and Tootsie Roll (TR) often experience a seasonal uptick in sales as consumers stock up on Easter treats. This surge in demand can sweeten these companies’ financial performance, making their stocks particularly attractive in the lead-up to the holiday.

Nestlé, a global leader in confectionery, manufacturing popular sweets like KitKat and Smarties, skilfully mixes traditional flavors with innovative ideas to please chocolate lovers worldwide. But is there also an opportunity for investors to profit from these treats?

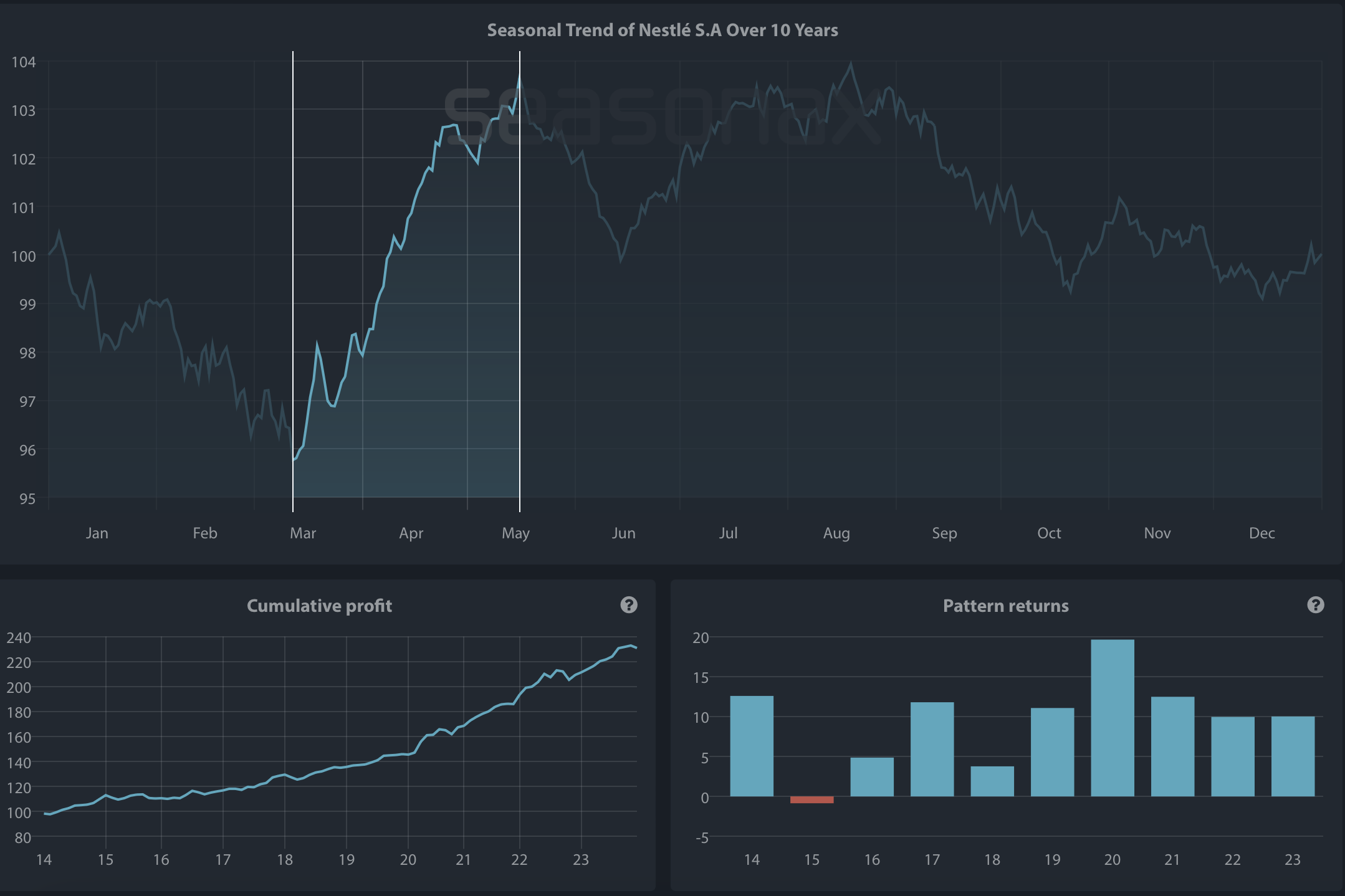

Looking at the seasonal chart below, there has been a clear upward trend that starts in March and presents a good entry point for this stock. During this highlighted time period, over the last 10 years, Nestlé made an average return of over 9.39% in only 44 trading days. This has reoccurred 9 out of 10 times since 2014 (see the pattern returns below).

Seasonal Chart of Nestle over the past 10 years

Source: Seasonax, sign up to access https://app.seasonax.com/signup all features and markets 30 days for free

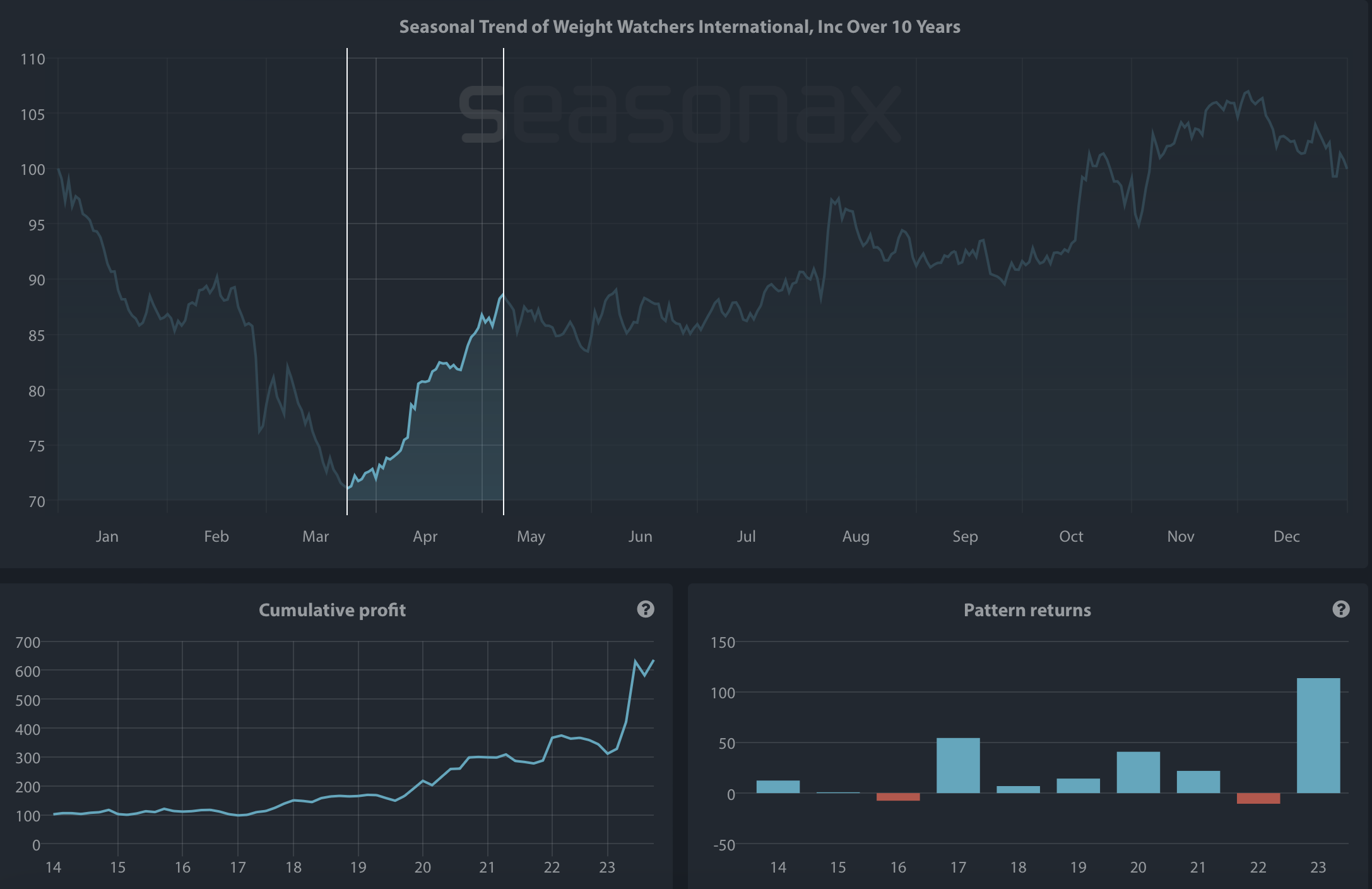

Unlike regular charts, a seasonal chart doesn’t display price over a set time, but shows the average trend over several years. The horizontal axis represents the time of the year, and the vertical axis shows the % change in price (indexed to 100). The prices reflect end of day prices and do not include daily price fluctuations.

But Don’t Put All Your Eggs In One Basket

Beyond chocolate, other sectors also benefit from Easter’s festive spirit.

Retailers like Walmart (WMT) and Conagra Brands (CAG), known for their extensive Easter decorations, baskets and attire, typically see a surge in consumer spending.

As families prepare for Easter gatherings, the uptick in purchases can positively impact the stock performance of these retail giants. A noticeable seasonal trend can be seen during March and the beginning of April.

Similarly, the travel and leisure sector flourishes, as families seize the long weekend for getaways, boosting airlines, hotels, and booking platforms.

With the pandemic’s shadow receding, the appetite for travel is robust, presenting potential gains for investors tuned into the travel sector’s seasonal dynamics.

Nonetheless, the fasting period also encourages people to focus on their health and well-being. As a result, stocks in the health and wellness sector, such as WW International (WW) may experience a boost in demand during this time.

From a market entry perspective, investors who have invested their money from late March onwards, over the past decade, have gained a competitive edge compared to others. On average, WW yielded nearly a 21% return during the time frame spanning March 24 to May 7.

Seasonal Chart of Weight Watchers International over the past 10 years

Source: Seasonax, sign up to access https://app.seasonax.com/signup all features and markets 30 days for free

The period of Lent, leading up to Easter, can also have economic implications. For example, stocks related to luxury goods and certain types of food and beverages might see a temporary dip in demand, as some consumers give up indulgences during Lent.

While some sectors may thrive, others face a downturn, highlighting the importance of portfolio adjustment to capitalize on these seasonal shifts.

The key to successful trading lies in timing. While past performance isn’t a guaranteed future predictor, recurring patterns are hard to overlook.

For those looking to refine their investment strategies, Seasonax offers a platform to identify optimal entry and exit points based on historical trends. Register for free at www.seasonax.com, and you can explore patterns across various markets, including cryptocurrencies, stocks, and commodities.

Remember, don’t just trade it, Seasonax it!

Yours sincerely,

Tea Muratovic

Co-Founder and Managing Partner of Seasonax