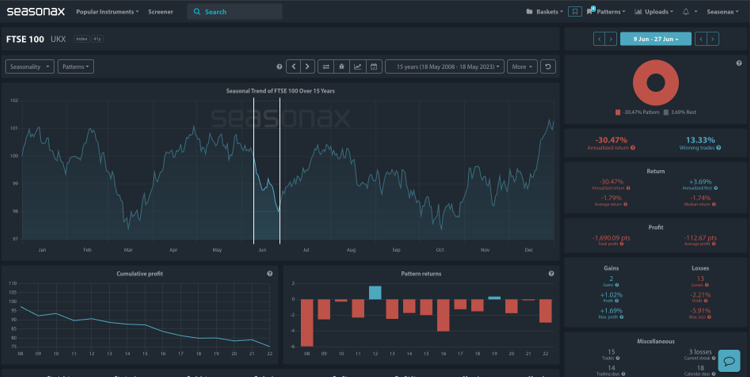

- Instrument: FTSE 100

- Average Pattern Move: -1.79%

- Timeframe: June 9 – June 27

- Winning Percentage: 13.33%

Dear Investor,

You may not realize how sharply the FTSE 100 tends to weaken into the final stretch of June. Historically, the period from June 9 to June 27 has produced a poor performance, with the index averaging a -1.79% drop over the past 15 years and showing just a 13.33% win rate. With UK markets facing macro and political uncertainty, we want to analyze the data in more detail.

Seasonal Pressure Into Month-End

The chart shows you the typical development of the FTSE 100 around this mid-to-late June window. The pattern is remarkably consistent: losses dominate, with only 2 gains and 13 losses in this 15-year sample. The -30.47% annualized fall tells the story well — this is historically a weak time of year for the UK benchmark index. That may surprise some investors, especially given the recent push toward 9,000.

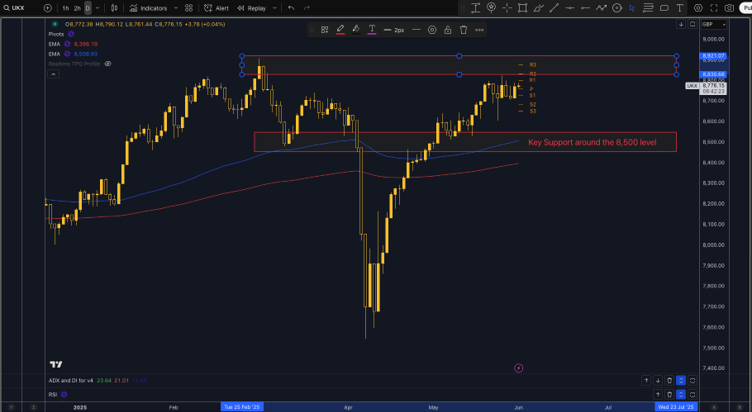

Technical Watch: 8,500 Support in Focus

From a technical standpoint, the FTSE 100 has risen into key resistance between 8,850 and 8,921, where it’s met prior supply and weekly pivots. The chart shows strong rising support converging near the 8,500 level — a level that could be tested if seasonal pressure materializes. With moving averages turning sideways and momentum waning, any disappointment could accelerate the turn. A deep dip here could offer a great dip buying opportunity for buyers.

Macro Cross: Submarine Surge vs. Market Seasonals

The UK’s renewed defense investment offers a compelling macro narrative. The government is committing £15 billion to expand its nuclear deterrent and submarine capabilities under the AUKUS pact. That’s supportive for defense-linked names like BAE Systems, Babcock, Rolls-Royce and QinetiQ — all of which traded higher on the news.

However, the broader index may still face drag. Political risk, stubborn inflation, and doubts around Bank of England easing all cast shadows. So while defense names may outperform, the index as a whole could continue to struggle — especially in light of this seasonal tendency.

Trade Risks

The FTSE 100’s direction will depend heavily on UK inflation, BoE guidance, and broader risk sentiment. Any positive surprise from UK growth or lower-than-expected CPI data could override the seasonal pattern. Additionally, the surge in defense spending may cushion the downside if the rally broadens.

Use Seasonax for your professional handling of market-moving events! Sign up and try out Seasonax for 30 days for free!