The recent falls in gold have occurred after constant Fed messaging that two rate hikes seems the likely option this year.

Higher rates and a stronger USD is a natural headwind for gold. However, the Fed is also data dependent and some crucial data is set to be released on Friday; the Fed’s preferred measure of inflation the PCE print. The PCE print refers to the measurement of personal consumption expenditures, which tracks the expenditure on goods and services by US citizens. Since around 2012, the PCE index has become the primary inflation index used by the Federal Reserve to guide its policy decisions.

If this reading comes in very high on Friday then gold is likely to fall out of the meeting.

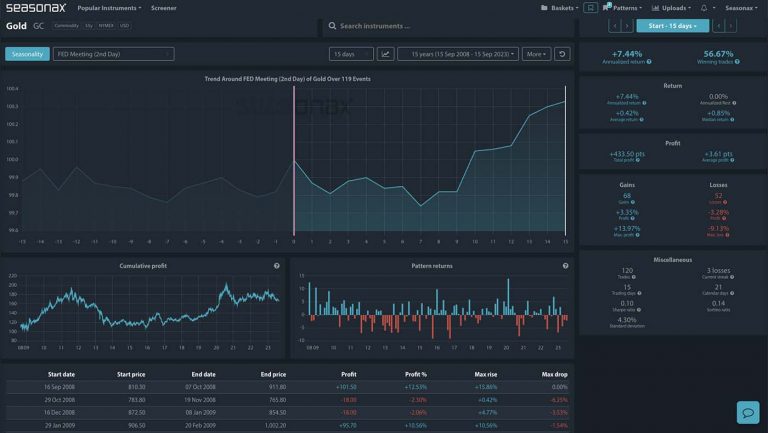

Note the seasonals for gold also favour selling. Over the last 25 years between June 30 and July 08, gold has fallen 64% of the time for an average fall of -0.41%. The maximum fall has been 4.00% in 2010, but falls of greater than 2% have also occurred in 2022, 2017,2010 2005, 2000, and 1999. So, will gold move lower if Friday’s US core PCE print comes in above 4.7% for the core and above 4.4% for the headline?

Major Trade Risks:

The main risk here would be if the US Core PCE print comes in below 3.9% for the headline and below 4.5% for the core as this would likely lift gold on lower rate expectations.

Remember, don’t just trade it, Seasonax it!