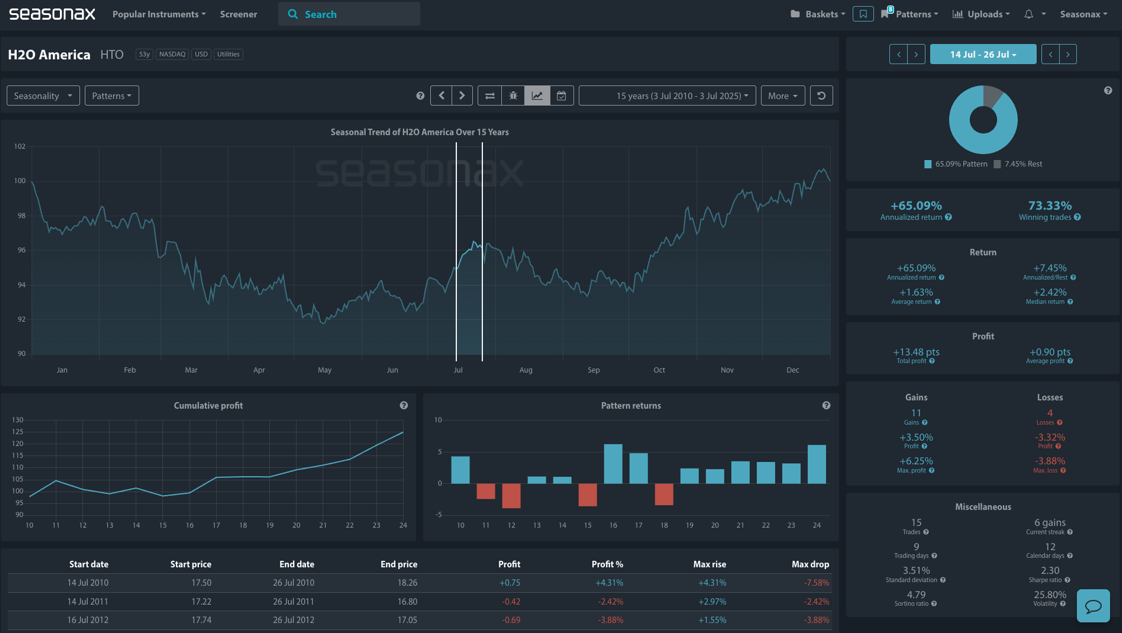

- Instrument: H2O America (HTO)

- Timeframe: July 14 – July 26

- Average Pattern Move: +1.63%

- Winning Percentage: 73.33%

Dear Investor,

You may not realize it, but H2O America is heading into one of its most statistically supportive short-term seasonal windows just as speculation intensifies over a major acquisition in Texas.

The chart below shows that from July 14 to July 26, shares have risen in 11 of the past 15 years, posting an average return of +1.63% and an annualized return of +65.09%. The Sharpe ratio sits at a healthy 2.30, with a maximum profit during this window of +6.25%, suggesting a tendency for sudden bursts higher, even within low-volatility environments like utilities.

The cumulative profit curve also points to steady gains, making this a reliable mid-July tailwind.

Acquisition Rumblings Could Catalyze Breakout

Bloomberg reports that H2O America is in advanced talks to acquire water utility Quadvest in a deal valued at approximately $540 million. This would significantly expand H2O’s footprint in Texas, particularly in the Houston area, and align with the broader M&A trend in the fragmented water infrastructure sector, which has seen over $6.5 billion in deals in 2025 alone.

The market’s muted reaction (-1.5% on the day) may reflect near-term uncertainty, but this could reverse quickly if the deal is officially confirmed. With Texas infrastructure demand and water usage expected to rise, the acquisition marks a logical strategic pivot.

Technical Perspective: Downtrend Still Intact… For Now

From a technical standpoint, H2O remains capped by a multi-year descending trendline, with the 100- and 200-week EMAs acting as dynamic resistance.

However, a clean breakout above ~$54.00 would violate the trendline and signal a potential regime shift. Should seasonal strength coincide with deal confirmation, this could finally be the catalyst to break the long-standing downtrend.

Trade Risks:

- If the Quadvest deal falls through or faces regulatory delays, bullish momentum could stall

- Failure to break above descending resistance could keep HTO locked in its existing bearish structure

Use Seasonax for your professional handling of market-moving events!

Don’t just trade it – Seasonax it.