A hawkish Federal Reserve and expectations of increasing interest rates have kept major stocks pressured over the month of September. The higher rates for longer narrative from the latest Fed meeting has helped push up yields and US interest rate expectations which is naturally more challenging conditions for US companies.

Higher levels of debt repayment, lower levels of consumer disposable income and concerns about how high rates will actually go are all a natural headwind for US stocks.

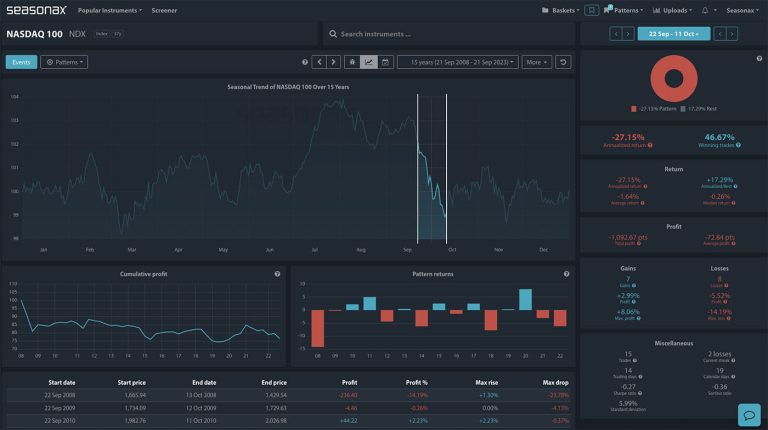

However, do you know that there is a strong seasonal pattern for the 4th quarter for US stocks and if you take a look at the Dow, NASDAQ, and the S&P 500 you can see that from October through to December. There is a tendency for stocks to gain. Will that play out again this year? Key answer to that question will come from the Fed but this season or pattern is worth noting.

Major Trade Risks:

The major trade risks here is that previous seasonal patterns do not necessarily repeat themselves each year and perhaps some incoming US data will alter the expectations for the path of US rates

Remember don’t just trade it, Seasonax it!