Dear Investor,

A new business worth billions of dollars

As traditional industries are caught up in the global pandemic storm, there are areas that are poised to benefit from the changes in the way we work and behave. As economies open up and coronavirus infection rates fall, demand for new innovative technology is higher than ever.

A behavioral change is taking place, and the pandemic has significantly accelerated digital adoption across all industries. Areas one should keep in focus include productivity tools, health care, entertainment, education, cyber-security and anything having to do with touch-less, autonomous technology. People will have to adjust to a so called “new normal”.

The beginning of the telemedicine era

Today I would like to focus on one area in particular – telemedicine.

First let me explain what exactly telemedicine refers to. In the global pandemic hospitals have been seen as potentially dangerous places, where infection rates have drastically increased. Telemedicine is a mediator and “safe place” that provides the opportunity of caring for patients remotely when health care providers and patients are unable to meet in person. Modern technology has enabled doctors to consult patients by using video conferencing tools.

Thus demand for telemedicine services such as Teladoc, Everlywell and Nurx is soaring. Current conditions force clinics and hospitals to implement telemedicine at a faster rate.

Is there a catch?

The field of telemedicine has changed dramatically since its inception. A mere fifty years ago a few hospitals started experimenting with telemedicine to reach patients in remote locations. But with the rapid changes in technology over the past few decades, telemedicine has been transformed into a complex integrated service used in hospitals, homes, private physician offices, and other healthcare facilities.

Telemedicine or tele-health companies allow people to see doctors and other medical professionals remotely via smart phone, video call, and computer. Telemedicine helps cut healthcare spending by reducing unnecessary ER visits.

While a number of large, publicly-traded health services companies such as UnitedHealth Group Inc. and Humana Inc. are branching into telemedicine, most companies that are focusing on telemedicine exclusively are privately held.

Outlook

United Health Group is a leading health care services company based in Minnesota. Its core business comprises insurance and health care.

The company typically delivers strong gains in the first half of the year. A detailed analysis and the period of seasonal strength can been seen in our seasonal chart below.

Unlike a standard price chart, that simply shows stock prices over a specific time period, a seasonal chart depicts the average price pattern of a stock in the course of a calendar year, calculated over several years. The horizontal axis depicts the time of the year, while the vertical axis shows the level of the seasonal pattern (indexed to 100). With that in mind, let us examine the seasonal chart of United Health Group Inc., which shows its seasonal patterns over the past 10 years.

United Health Group Inc. typically delivers strong gains in the first half of the year.

Source: Seasonax (click here to analyze the pattern)

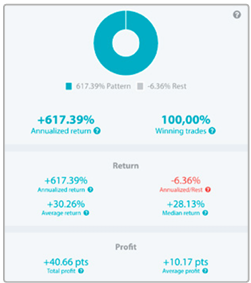

I have highlighted a strong seasonal phase from June 1 to June 19. On average United Health Group Inc. has delivered solid returns of 4.60% during this period, which corresponds to a very respectable annualized gain of 150.43%.

What is even more important is that the positive returns during this phase are also very consistent, which makes the pattern more reliable.

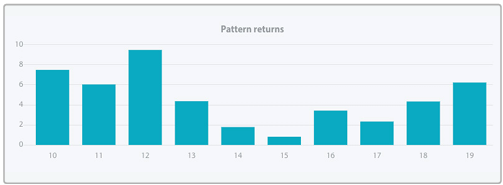

The bar chart below depicts the return delivered by UnitedHealth Group Inc. in the relevant time period from June 1 to June 19 in every year since 2010. Blue bars indicate years with positive returns.

United Health Group Inc. rose in 10 out of 10 cases

Source: Seasonax (click here to analyze the pattern)

There is one exception among telemedicine companies that is not privately held, namely Teladoc Health (TDOC) which is listed on the New York Stock Exchange.

Teladoc Health is a multinational telemedicine and virtual health company based in the United States. In particular, Teladoc Health uses telephone and videoconferencing software as well as mobile apps to provide on-demand remote medical care.

Teladoc Health has also strong seasonal phase during first half of the year.

Source: Seasonax (Click here to open the interactive chart to choose the best investment period.)

Telemedicine is just one of a number of new areas that are going to flourish in coming years.

Find unique opportunities with seasonal patterns

There are still many great opportunities to be found even during these challenging times. Feel free to find and examine them using our award winning algorithms and to enter the world of seasonal opportunities!

Yours sincerely,

Tea Muratovic

Co-Founder and Managing Partner of Seasonax