Dear Investor,

Scoring on the stock exchange – soccer and seasonality

That soccer is the most popular sport on earth is a well-known fact, but that it was invented in China around 476 B.C. presumably isn’t. Today it may be hard to imagine that soccer has originated in China, considering that the Chinese national team is currently ranked merely in 76th place in the FIFA World Rankings.

An interesting fact is also that most World Cup finals were reached by European teams, with the exception of the finals of 1930 and 1950.

What does soccer have to do with seasonality and stock markets?

As many readers probably know, seasonal effects are predictable patterns that recur almost every year. The best-known seasonal drivers include investor sentiment at certain times of the year, tax or balance sheet deadlines, earning reports, the weather and big sports events, all of which are affecting the stock prices of various companies.

A number of explanations suggest themselves regarding strong rallies ahead of big sporting events: for one thing major sporting events tend to spur a flurry of public spending. For another thing, they attract a great deal of media coverage. This in turn attracts investors as well.

In this issue of Seasonal Insights I would like to focus on two listed European clubs, the stock prices of which exhibit seasonal patterns – Borussia Dortmund and Juventus Turin.

Will seasonality prevail?

Germany’s Bundesliga has prepared to attract new “armchair fans” from around the world when it becomes the first major European soccer league to resume playing after a two-month shutdown due to the coronavirus.

Bayern CEO Karl-Heinz Rummenigge issued a bold statement: “With the Bundesliga as the only league to be broadcast on TV, I expect we will have an audience of a billion people”.

The new normal will be applied and games will be played in empty stadiums with only about 300 essential staff and officials attending. Players have also been given special instructions not to celebrate in groups and to avoid touching hands with team mates.

“The Black and Yellows”

Borussia Dortmund is best known for its men’s professional soccer team, which plays in the Bundesliga, the top tier of the German soccer league. The club has won eight league championships, four DFB cups, one UEFA Champions League Cup, one Intercontinental Cup, and one UEFA Cup Winners’ Cup.

The results are impeccable but what is the future seasonal outlook?

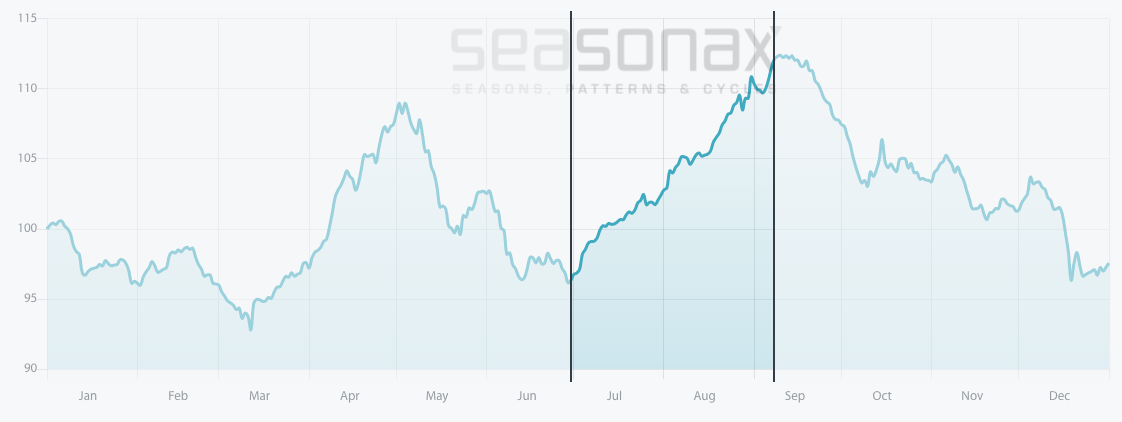

The stock typically delivers strong gains in the third quarter of the year. A detailed analysis and the period of seasonal strength can be seen in our seasonal chart below.

Unlike a standard price chart that simply shows stock prices over a specific time period, a seasonal chart depicts the average price pattern of a stock in the course of a calendar year, calculated over several years. The horizontal axis depicts the time of the year, while the vertical axis shows the level of the seasonal pattern (indexed to 100). With that in mind, let us examine the seasonal chart of Borussia Dortmund, which shows the seasonal pattern of the stock over the past 15 years.

Seasonal pattern of Borussia Dortmund over the past 15 years

Borussia Dortmund typically delivers strong gains in the third quarter of the year.

Source: Seasonax (click here to view the interactive seasonal chart)

I have highlighted a strong seasonal phase from June 26 to August 31. On average Borussia Dortmund has delivered solid returns of 12.96% during this period, which corresponds to a very respectable annualized gain of 96.15%.

What is even more important is that the positive returns during this phase are also very consistent, which suggests that this pattern is very reliable.

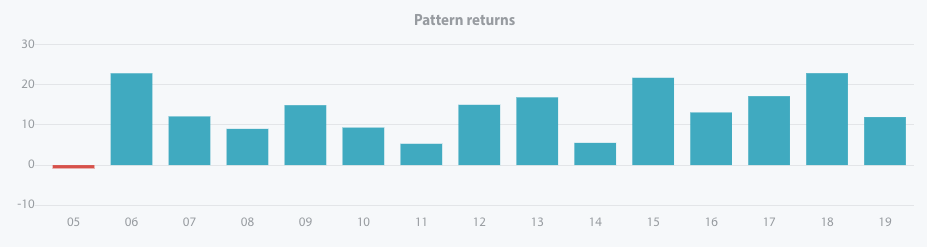

The bar chart below depicts the return delivered by Borussia Dortmund in the relevant time period from June 26 to August 31 in every year since 2005. Blue bars indicate years with positive returns.

Pattern return for every year since 2005

Borussia Dortmund rallied in 14 out of 15 cases

Source: Seasonax (click here to view the interactive seasonal chart)

“The Old Lady”

Nicknamed Vecchia Signora (“the Old Lady”), Juventus Football Club has won 35 official league titles, 13 Coppa Italia titles and eight Supercoppa Italiana titles, making it the record title-holder in Italian soccer competitions. It has also won two Intercontinental Cups, two European Cups / UEFA Champions Leagues, one European Cup Winners’ Cup, two UEFA Super Cups and was the first club to win all three major UEFA competitions.

The club was strongly affected by the corona crisis and even had to cut the pay-checks of its players. The club’s fan base is the largest at the national level and one of the largest worldwide, but will that be enough two secure a strong performance of the stock in the difficult times of 2020?

Seasonal pattern of Juventus Turin over the past 15 years

Historically Juventus Torino also exhibits a strong seasonal phase during the third quarter of the year.

Source: Seasonax (click here to view the interactive seasonal chart)

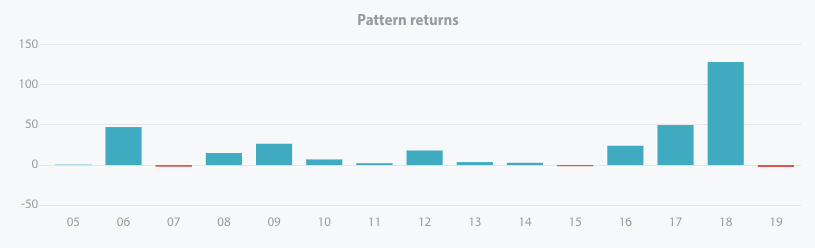

The following bar chart shows the pattern return for the time period June 30 to September 8 in every single year since 2005 – the stock has also generated gains in the vast majority of cases, namely in twelve of the fifteen years under review.

Pattern return for every year since 2005

Source: Seasonax (click here to view the interactive seasonal chart)

Enter the world of seasonal opportunities

Apart from the football clubs we have presented in this issue of Seasonal Insights there are also many other stocks that are benefiting from seasonal effects related to big sporting events, such as Nike, Anheuser Busch InBev or PepsiCo.

To make finding these opportunities even easier, we proudly present the launch of our new Seasonality Screener. The Seasonality Screener is a tool designed to identify trading opportunities with above-average profit potential based on predictable seasonal patterns that recur almost every calendar year. You can filter hundreds of global instruments in all sectors using more than 10 customizable screening criteria in order to discover such investment opportunities.

Yours sincerely,

Tea Muratovic

Co-Founder and Managing Partner of Seasonax