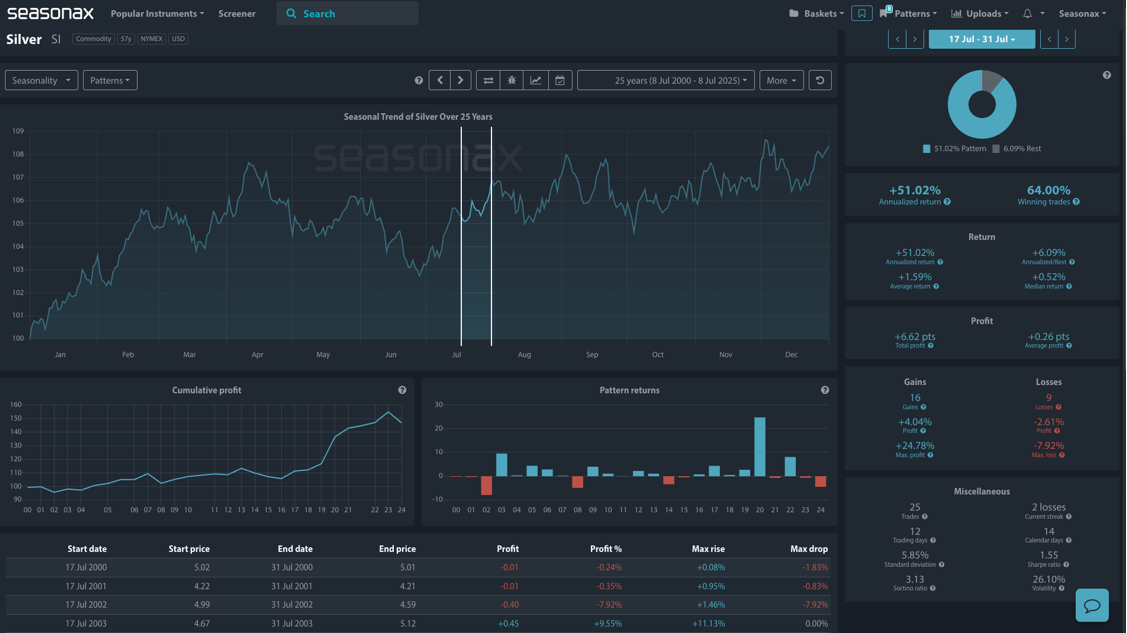

- Instrument: Silver (SI – NYMEX)

- Timeframe: July 17 – July 31

- Average Pattern Move: +1.59%

- Winning Percentage: 64.00%

Dear Investor,

You may not realize it, but silver typically strengthens into late July as the chart below shows, with the precious metal posting a +1.59% average return and a 64% win rate between July 17 and July 31 over the last 25 years. The pattern has delivered a +51.02% annualized return during this period, with a compelling Sharpe ratio of 1.55 and Sortino ratio of 3.13.

This seasonal edge is especially relevant now as hedge fund positioning and open interest in silver hit critical thresholds, hinting that we may be entering a volatility pocket where a breakout becomes more likely.

Positioning Tensions Are Building

CFTC Commitment of Traders data paints a compelling backdrop. Hedge funds are heavily long silver relative to short positions, with the long/short ratio hovering above 80%. Open interest percentile has reached 90%, historically a level where silver tends to see directional extensions, often bullish if price has already stabilized Commercials (typically more informed hedgers) remain moderately net short, while retail flows have stayed flat, suggesting institutional speculators are pressing for follow-through upside. If silver can clear key technical resistance in the coming sessions, this concentrated positioning could force late shorts to capitulate.

Why Now? Seasonals + Sentiment = Setup

Silver has outperformed in 16 of the past 25 July cycles during this window, and gains tend to cluster when macro volatility rises or when the dollar stalls.

Add in:

- Ongoing central bank gold/silver diversification

- Real yields stalling as markets look past the Fed

- Fragile equity sentiment driving haven demand

…and silver could be gearing up for another round of inflows.

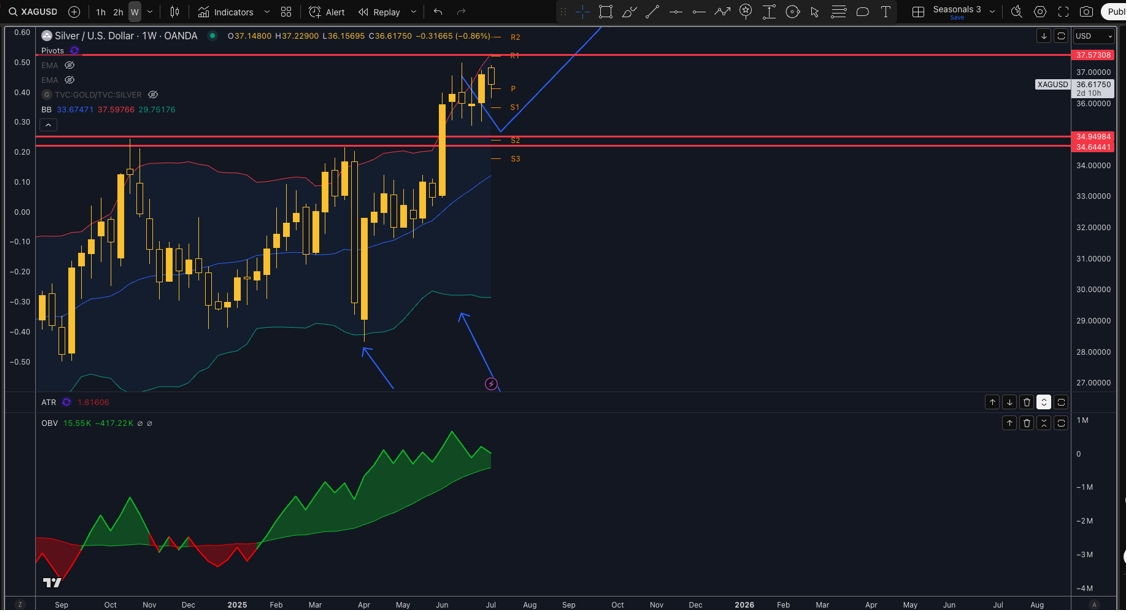

Technical Take

Watch for a sustained breakout above recent consolidation levels around $36.00, with a potential push toward $39-40 if sentiment accelerates.

Trade Risks

- A surprise rally in USD or real rates could suppress silver’s upside and overcrowded hedge fund longs may lead to a shakeout before continuation.

Use Seasonax for your professional handling of market-moving events!

Don’t just trade it — Seasonax it.