Dear Investor,

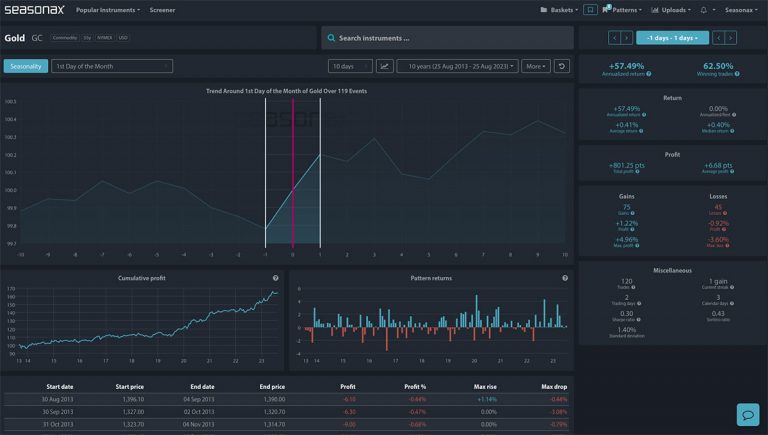

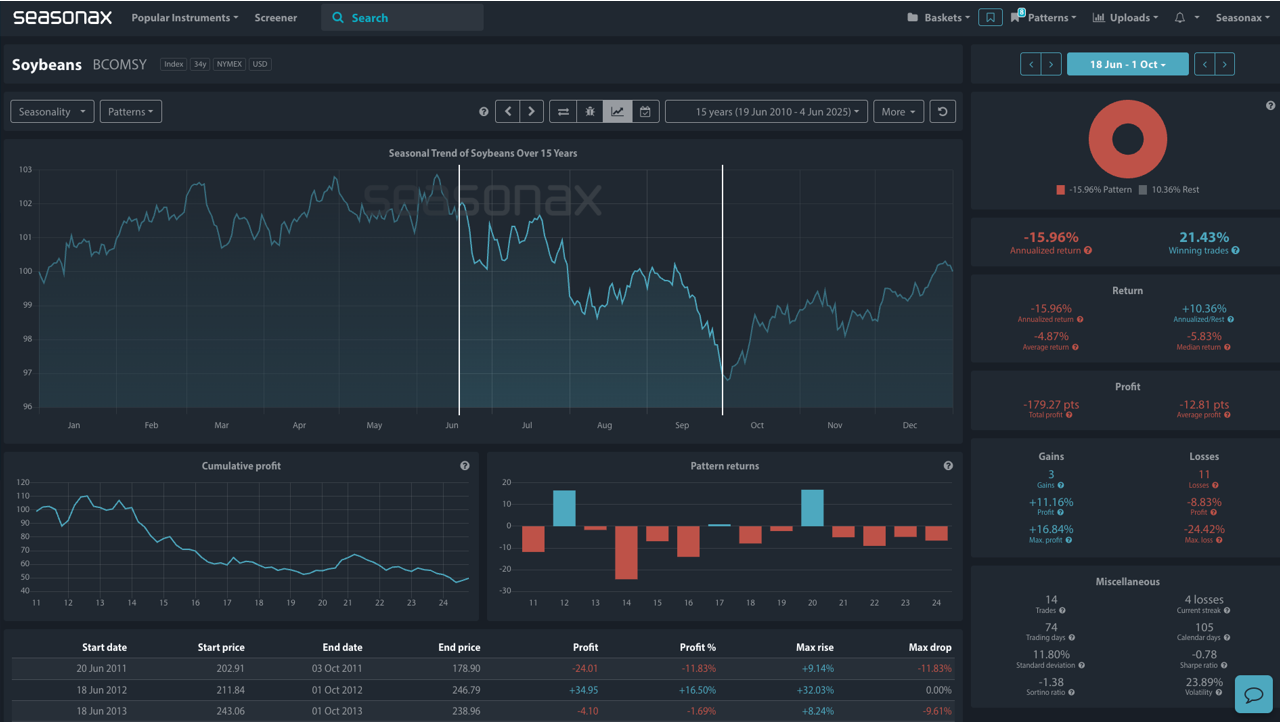

You may not realize it, but the period from late June through early October has been a dangerous stretch for soybean bulls. Over the last 15 years, this timeframe has delivered losses in 11 out of 14 years, with an average return of -4.87%. It’s one of the weakest seasonal windows in the entire commodity complexes as the chart below shows with only a 21.43% winning percentage.

Let’s analyse the data in more detail.

Historical Lessons: How Bad Can It Get?

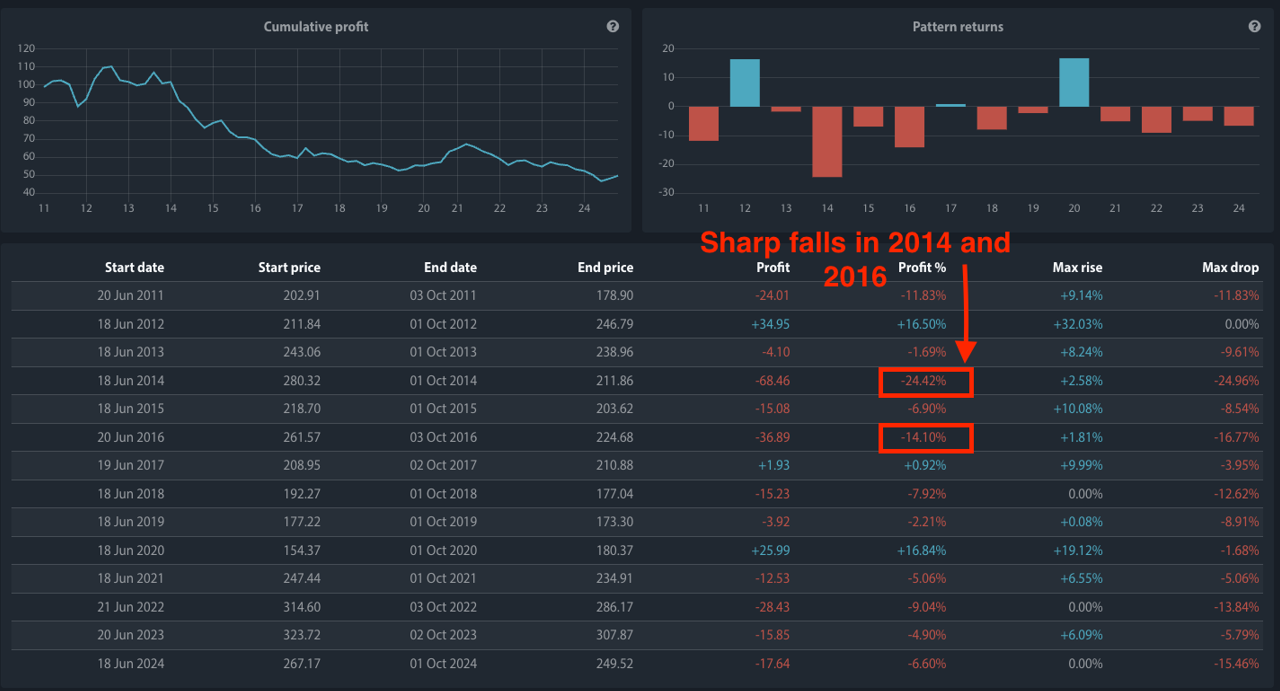

Looking more into the Seasonax data below tells us a cautionary tale. In 2014, soybean futures fell a staggering -24.42%, driven by a bumper US crop and cooling Chinese demand. Similarly, in 2016, the market dropped -14.10%, again due to strong crop yields and a broad-based commodity pullback.

These aren’t isolated cases. Across the years, soybeans have shown vulnerability to favorable US weather, South American harvest competition, and shifts in global trade sentiment.

Macro Cross: All Eyes on China

In 2025, the seasonal pattern runs head-on into a tricky macro environment:

- China’s economy is still unsteady, and recent PMI prints have raised fresh doubts about industrial demand and consumer confidence.

- The yuan’s weakness against the dollar could limit the country’s appetite for US agricultural imports. A depreciated yuan makes imports priced in U.S. dollars more expensive for Chinese buyers. This price increase can reduce China’s demand for U.S. agricultural products, such as soybeans and corn. Additionally, ongoing trade tensions and China’s efforts to diversify its import sources further influence this dynamic.

- And with the US election cycle heating up, trade rhetoric could quickly reignite volatility. China’s share of U.S. soybean imports has declined from 40% in 2016 to 18% in 2024, as the country increases imports from alternative suppliers like Brazil.

That means while the seasonal trend is clearly down, this year’s catalyst for a break in the pattern—if any—will likely come from Beijing. U.S. soybean markets are facing significant headwinds due to escalating trade tensions with China, the nation’s largest soybean importer. Despite a temporary reduction in Chinese tariffs from 145% to 10%, U.S. soybeans remain uncompetitive in the Chinese market. AgResource projects a potential 20% decline in U.S. soybean exports, dropping from an estimated 1.865 billion bushels to 1.5 billion bushels, if a substantive trade agreement isn’t reached by late summer.

Given the current trade dynamics and competitive global landscape, the outlook for U.S. soybeans remains bearish. Without a significant improvement in trade relations with China, U.S. soybean exports and prices are likely to continue facing downward pressure.

Technical Picture Heavy

Seasonax’s cumulative return curve shows how consistently bearish this stretch has been. Even brief rallies tend to fade quickly, as traders sell into strength and hedge against harvest outcomes.

Conclusion: Stick With the Data, But Be Alert

The historical odds don’t favor soybeans in this window, and the sharp drop risk is real, as 2014 and 2016 starkly illustrate. But should China step in with surprise demand or US weather shift late in the cycle, the script could change quickly. Chinese import volumes, US Midwest drought threats, or unexpected geopolitical shifts (like tariff adjustments or USDA stockpile revisions) could temporarily reverse seasonal pressure, but a strong seasonal window like this could pay dividends to the savvy seasonal investor.

Use Seasonax for your professional handling of market-moving events!

Yours sincerely,

Giles Coghlan, CMT

Macro Strategist Seasonax