Dear Investor,

Easter is a time of celebration for millions of people around the world. Some prepare for this time over a 40-day period of reflection in the run up to Easter known as Lent, a time of fasting or abstinence from certain foods or activities as a form of spiritual discipline and growth.

However, while Lent can have a significant impact on an individual’s spiritual life, can it also affect the price movements of the companies listed on the stock exchange?

The financial markets are influenced by a myriad of factors, including global events, investor sentiment, and consumer behavior. Easter abstinence is no exception, as it can lead to changes in consumer spending patterns, particularly in countries where the tradition is widely observed.

One of the primary industries that may be affected by Lent is the food and beverage industry. During this period, many people may abstain from consuming meat, dairy products, and alcohol. This can lead to a decline in sales for companies that produce these types of products. For example, fast-food chains may see a dip in sales during this time, as customers opt for vegetarian or seafood-based meals instead of meat-based ones.

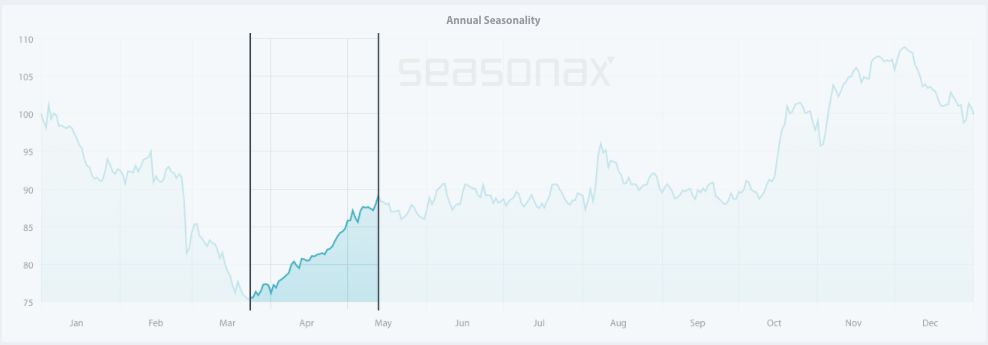

However, although many give up sweets and other sugary treats in the run up to Easter, at least one “tempting” stock has still made its way to investors’ portfolios around the world. Between March 23 and May 16 over the past 15 years, Nestlé has experienced a 90% winning streak, generating gains in 14 out of those 15 years. This no doubt reflects the extremely wide spread purchasing of chocolate confectionary and Easter eggs for the end of the Lent period.

Seasonal Chart of Nestlé over the past 15 years

Source: Seasonax, for further analysis click on the link http://tiny.cc/Seasonax-Nestle

Keep in mind that a seasonal chart depicts the average price pattern of a specific asset in the course of a calendar year, calculated over several years (unlike a standard price chart that simply shows prices over a specific time period). The horizontal axis depicts the time of the year, while the vertical axis shows the % change in the price (indexed to 100). The prices reflect end of day prices and do not include daily price fluctuations.

Don’t Put All Your Eggs In One Basket

A range of other sectors also often witness a surge in interest during the Easter festivities. With increased travel around Easter, stocks in the travel and hospitality sectors may see gains. Keep an eye on hotel, travel agencies and airline stocks during this time.

The fasting period also encourages people to focus on their health and well-being. As a result, stocks in the health and wellness sector, such as WW International (WW) may experience a boost in demand during this time.

Seasonal Chart of Weight Watchers International over the past 10 years

Source: Seasonax, for further analysis click on the link http://tiny.cc/Seasonax-WW

From a market entry perspective, investors who have invested their money from late March onwards over the past decade have gained a competitive edge compared to others. On average, WW yielded nearly a 14% return during the time frame spanning March 24 to May 13. For comprehensive statistics, please refer to the interactive chart provided above.

However, it’s worth noting that the impact of abstinence on the stock markets can vary depending on the specific industry and the duration of the fast. For instance, the end of the Lent period typically triggers a spike in consumer spending. This could create opportunities for investors in stocks like Walmart (WMT), Target Corporation (TGT), and Amazon (AMZN), as they stand to benefit from increased sales.

While some industries may suffer a decline in sales, others may witness a surge in demand for their products. As investors, it’s essential to be aware of these trends, and adjust portfolios accordingly to make the most of the opportunities that arise during this time.

To select the most suitable investments, leverage Seasonax to identify the optimal entry and exit points based on recurring patterns. By signing up for free at https://app.seasonax.com/signup, you can access over 25,000 instruments, encompassing various sectors, stocks, (crypto)currencies, commodities, and indices.

Remember, don’t just trade it, Seasonax it!

Yours sincerely,

Tea Muratovic

Co-Founder and Managing Partner of Seasonax