There are a few reasons cited for oil markets to gain over the medium term.

Russia’s oil ban from the EU comes into place on February 05 and China’s recent PMI prints showed a surprise expansionary print indicating strength in China’s service sector as China opens up post Covid.

Furthermore, OPEC+ is not expected to change production levels today and the Fed meeting later tonight which will help set expectations for oil prices as the Fed meeting impacts the USD.

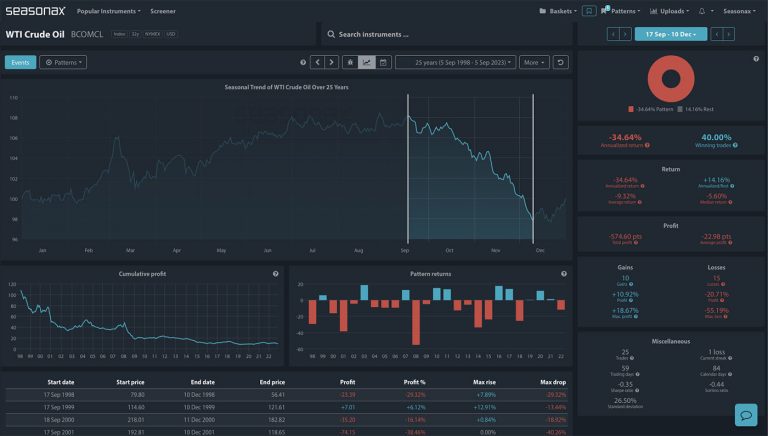

So, with all these moving parts it is worth being aware of the seasonal pattern that is coming up for US oil.

Over the last 25 years US oil has gained 72% of the time between February 07 and March 05. The average return has been 6.30% for an annualised return of +134.22%.

Major Trade Risks:

– The major trade risk here is that these factors do not lift oil prices. Two key risks would be from the Fed and the Russian oil ban. The Fed meeting today could send the USD sharply higher on a hawkish decision (pressuring oil). The Russian oil ban may prove to be ineffective in preventing Russia oil finding its way to the EU.

– The USD sharply higher on a hawkish decision (pressuring oil). The Russian oil ban may prove to be ineffective in preventing Russia oil finding it way to the EU.

Remember, don’t just trade it, but Seasonax it!