On Wednesday we have the US CPI print being released and it is a major focus for the Fed. In the last Fed meting, on May 01, the Fed confirmed that recent US inflation data had been disappointing. In the Press Conference Powell said, when asked about the prospect of 3 cuts this year, that the Fed needs more confidence on inflation and that the Fed did not see progress in Q1.

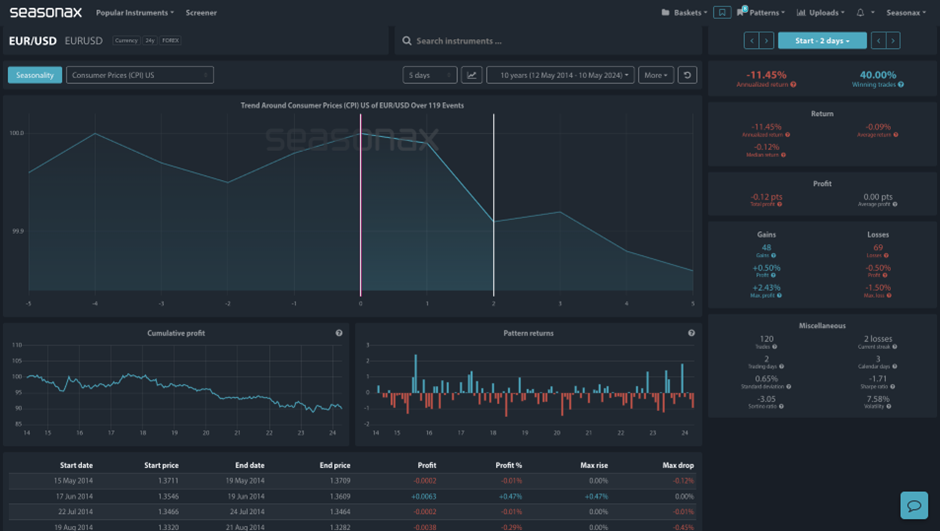

So, if we see a surprise CPI print on Wednesday, to the upside or the downside, what sort of range could we expect? Well, looking at the seasonals, over the US CPI print for the last 10 years we see what the ranges can be. The largest gain in the EURUSD has been over 2.40% and the largest fall in the EURUSD has been 1.50%.

So, that helps set some expectations in terms of what to look for in the event of a surprise print.

Technically, key daily support at 1.0650 sits around 1.30% lower than current prices, so this area could prove a significant support area to keep an eye on over the release.

Giles Coghlan, CMT is a seasoned financial writer specialising in macro outlooks and key technical trading strategies

Sign up here for thousands of more seasonal insights just waiting to be revealed!

The major trade risk here is previous maximum deviations don’t repeat themselves each year.

Remember, don’t just trade it Seasonax It!