Dear Investor,

Four times a year – on the third Friday of March, June, September and December – contracts for stock index futures, stock index options, single stock futures and stock options all expire on the same day. Many non-US contracts such as the DAX futures expire on this day as well.

At certain times – namely the quadruple witching hours of quadruple witching Friday, many investors are closing out contracts they hold, which leads to heavy trading activity.

Quadruple witching day is sometimes abbreviated to “quad witch day”, or in line with tradition, “triple witch(ing) day”.

Quadruple Witching Dates from 2021 to 2023

Below follows a list of all quadruple/ triple witching dates for 2021, 2022 and 2023, for your records:

Triple/Quadruple Witching Dates 2021:

- March 19, 2021

- June 18, 2021

- September 17, 2021

- December 17, 2021

Triple/Quadruple Witching Dates 2022:

- March 18, 2022

- June 17, 2022

- September 16, 2022

- December 16, 2022

Triple/Quadruple Witching Dates 2023:

- March 17, 2023

- June 16, 2023

- September 15, 2023

- December 15, 2023

On 18 June 2021, it will be happening again: a great many contracts will expire on the upcoming quad witch day. How does this affect prices?

What Impact Do Quadruple Witching Days Have On Equities?

Let us now examine the impact of quadruple witching days on stock prices.

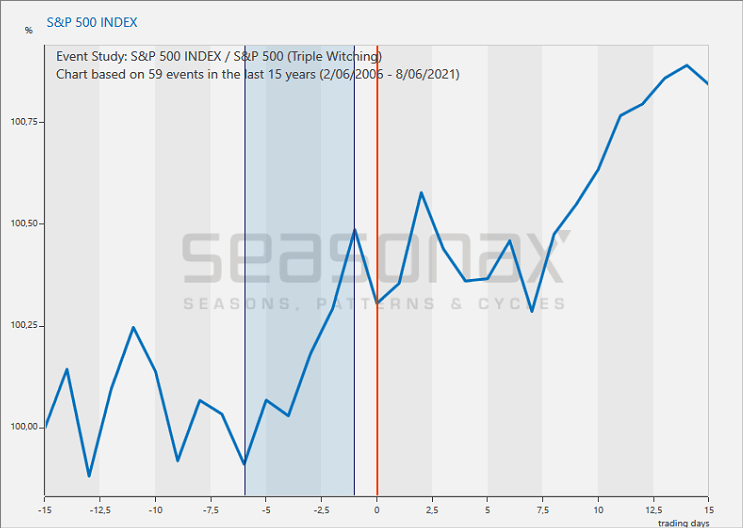

The chart on the next page shows the average performance of the S&P 500 in the 15 trading days before and after quadruple witching day. It was calculated over the past 15 years, which featured 59 quad witch days in total.

The horizontal scale shows the number of days before and after the quadruple witching days, the vertical scale shows the average move of the index in percentage points. The quadruple witching day is highlighted in orange.

Average pattern of the S&P 500 Index in the 15 days before and after quadruple witching day, 59 events from 2006 to 2021

The S&P 500 Index typically rallies before quadruple witching days! Source: Seasonax

As the chart shows, the S&P 500 typically rallies from the 6th day before to the day before quad witch day (area highlighted in blue). The average price increase over this period of 5 trading days was 0.58 percent. The market posted gains in 42 of the 59 cases under review.

However, it is also evident that the market typically declines on quadruple witching day itself. This is particularly important for the numerous investors who are not rolling their position over on quad witch day but are closing it out. If they hold a long position, they should consider doing so one day before the expiration date.

Overall, the week containing quadruple or triple witching days is typically friendly – with the exception of the final trading day, the quadruple witching day itself.

Yours sincerely,

Dimitri Speck

Founder and Head Analyst of Seasonax

PS: Stay calm on quad witch day – focus on the opportunity in the preceding days!