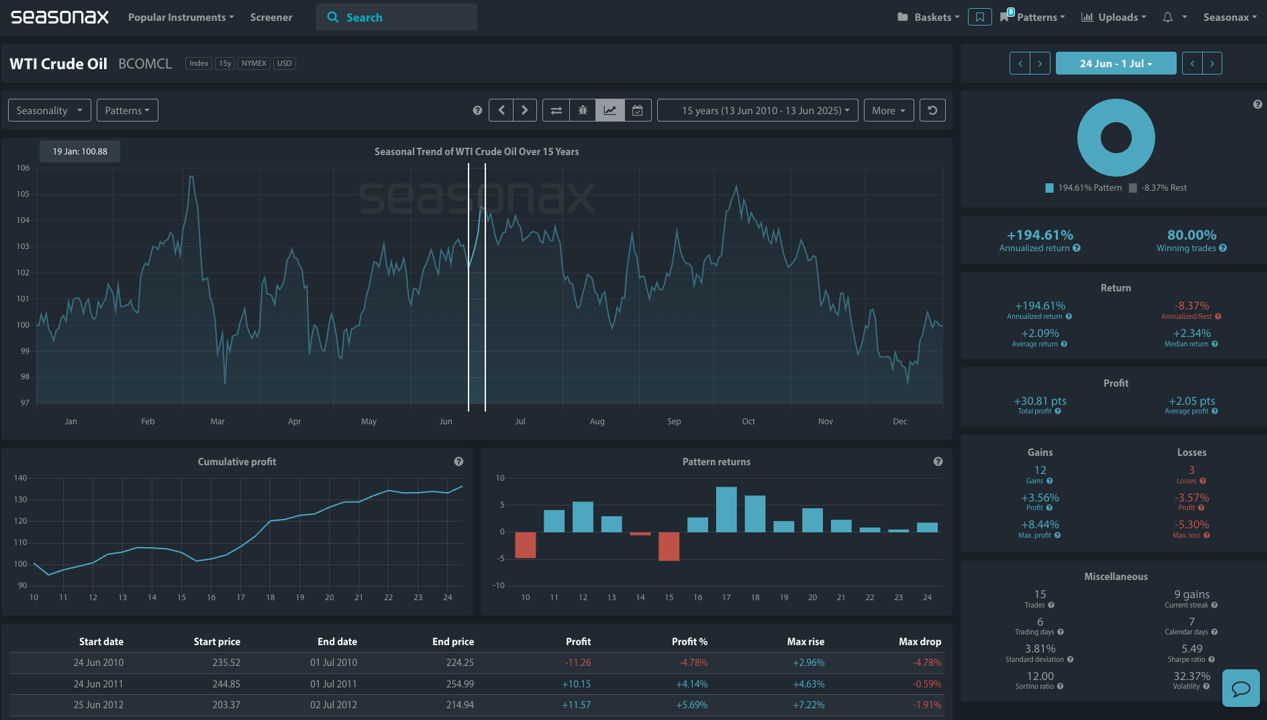

- Instrument: WTI Crude Oil

- Average Pattern Move: +2.09%

- Timeframe: 24 June – 1 July

- Winning Percentage: 80.00%

Dear Investor,

You may not realize just how vulnerable crude oil markets become in late June, right as seasonal tailwinds often align with intensifying geopolitical risk. With Israel escalating strikes on Iranian nuclear and military infrastructure, and Iran retaliating with coordinated drone attacks, the threat to Middle Eastern oil flows has surged, and traders are taking note. As tensions heighten, we want to analyze the data in more detail.

The chart below shows you the typical development of WTI crude oil prices from 24 June to 1 July over the last 15 years. It reveals a compelling seasonal window of strength, with average returns of +2.09% and an 80% win rate. This strong bias higher stands out as traders often price in higher risk premiums going into July on concerns tied to OPEC dynamics and Middle Eastern volatility.

But the macro backdrop right now gives this seasonal pattern additional fuel.

Israel’s coordinated strikes on Iran’s nuclear program mark a major escalation. Iran’s retaliation has prompted further warnings from Israel and surged the threat of disruption to oil and LNG flows through the Strait of Hormuz—a route which handles about one-third of the world’s seaborne crude. The risk of even partial blockade or infrastructure damage is now being priced into futures.

According to ING, a full shutdown of Iranian crude exports (~1.7m b/d) could see prices rise to $80 per barrel. However, any major disruption through the Strait could see oil spike as high as $120 as spare OPEC capacity in the Gulf becomes inaccessible. For now, WTI has rallied off the lows, but the market continues to hold a bid on any renewed escalation.

Technical Perspective

Technically, there are major technical resistance levels overhead on the weekly chart that could all act as near-term targets for any short-term, geo-politically motivated buyers. See the obvious zones market below, and also be aware that they can also act as support if/when these levels are broken.

Trade Risks

If diplomatic channels reopen or military action de-escalates sharply, oil’s risk premium may compress rapidly. Similarly, if OPEC signals increased supply or the Strait of Hormuz remains unaffected, the seasonal edge could diminish. Bear in mind that any Fed pivot toward cutting would also change the risk calculus across commodities

Use Seasonax for your professional handling of market-moving events! Sign up here and try Seasonax for 30 days for free!