Dear Investor,

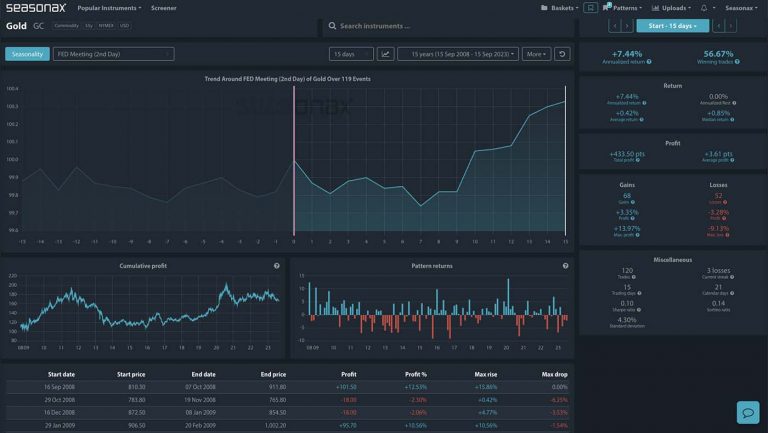

You may not realise it, but platinum has consistently delivered standout returns into the first quarter of the year. The chart below shows that over the last 25 years, platinum has produced an average return of +7.79% from December 6 to February 20, with a win rate of 84% and an impressive annualised return of +43.29%.

These aren’t just strong numbers, they are among the most statistically robust seasonal patterns in the entire precious metals complex. This year the seasonal surge coincides with a tight physical market, multi-year high prices, and a global scramble for supply security.

Why It Matters Now: Market Deficit + Structural Tightness

According to the World Platinum Investment Council (WPIC), platinum is expected to post a 692 koz deficit in 2025, equivalent to 9% of total annual demand and a third straight year in deficit. According to the WPIC, in their Q3 publication which was released on November 19: “Above-ground stocks have been depleted by years of market shortfalls, and lease rates remain elevated at over 15% — a clear sign of physical scarcity”.

In the same report WPIC goes on to state that :

- CME warehouse stocks rose sharply (+358 koz) suggests a defensive repositioning amid broader physical tightness and tariff uncertainty.

- ETF holdings dipped, not from fear, but from profit-taking in a surging price environment.

- Prices rose 16% in Q3 alone, up 73% YTD as of November 1st.

And while a minor surplus is forecast for 2026, that too is based on ETF outflows and recycling picking up rather than new mine production. WPIC notes that platinum remains ~$800/oz below its all-time inflation-adjusted high, suggesting plenty of upside remains.

Investment Case: Physical Tightness + Macro Tailwinds

The two key drivers behind platinum’s strong bid:

- Security of critical mineral supply: Western governments and industries are increasingly prioritising access to palladium, rhodium, and platinum which is driving both accumulation and defensive buying.

- Falling interest rates and a weaker USD: Portfolio allocation to hard assets is rising with platinum now gaining alongside gold and silver.

The demand for Platinum can also be strongly attributed to the wider story of critical-mineral security. Surging lease rates are incentivizing some investors to abandon leasing in favour of full ownership. On top of this there is growing strategic demand from the hydrogen economy, fuel-cell technologies, and stricter global emissions standards which is elevating platinum’s status as a critical mineral. As this long-term demand story strengthens, buyers increasingly prefer holding physical metal rather than relying on short-term leases.

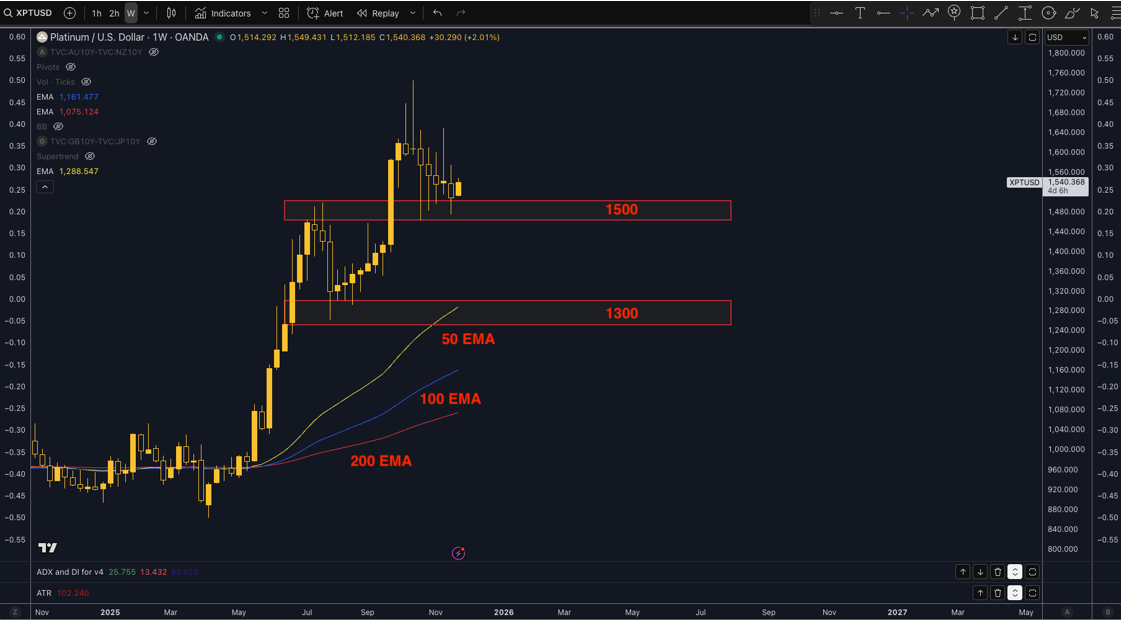

Technical Setup: Momentum and Structure

On the seasonality chart, the cumulative profit curve shows a steady gain, reflecting the strong and consistent upside over this winter window leading into the start of next year. Car manufacturers typically begin ramping up production planning in Q1, driving forward orders for platinum-rich autocatalysts — particularly in diesel and hybrid segments where platinum loadings remain high

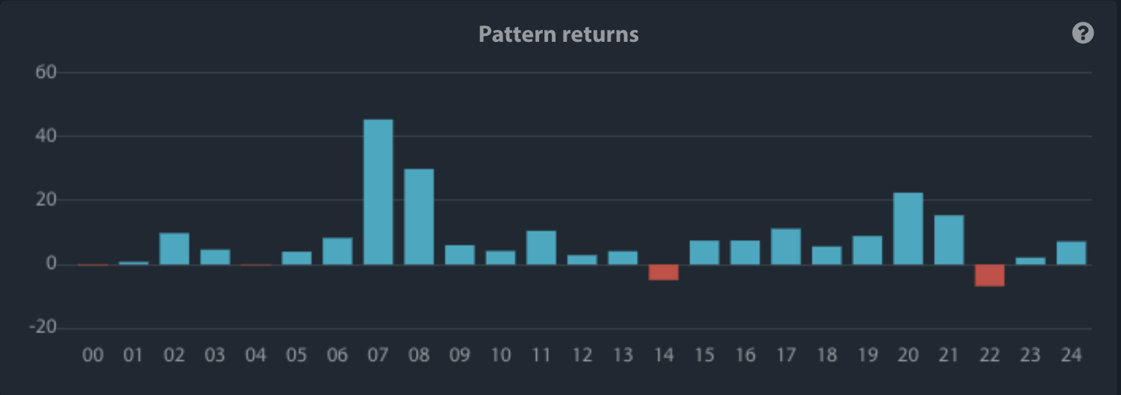

Furthermore, pattern returns are heavily skewed to the upside — and key historical surges (+45.48% max return) suggest aggressive spikes, not just grinding gains.

Any short-term dip into December may be treated as a buy-the-dip opportunity, especially if macro tailwinds (e.g. a dovish Fed and a soft USD) remain in place. The next Fed meeting is on December 10 and current short term interest rate pricing assigns a 63% probability of a Fed cut with a further three 25bps cuts expected next year.

Finally, technically XPTUSD is in a clear and obvious uptrend. Any clear daily or weekly price action signals will potentially offer great opportunities to find discount longs ahead of this strong seasonal pattern. On the weekly chart below, you can see platinum trending sharply higher above its 50, 100, and 200 moving averages (EMAs) as well as price making a sequence of higher highs and higher lows. Major support sits at both $1500 and at $1300 below that. These are ideal areas for potential dip buyers to step in.

Trade Risks and Opportunities: Navigating a Powerful Seasonal Window

Platinum’s seasonal strength from early December through February is one of the most statistically compelling across all commodities boasting an 84% win rate and an average return near +8% over 25 years.

Still, some near-term headwinds could slow the pace of gains, namely:

- ETF profit-taking or exchange outflows which may temporarily cap upside, especially after the recent rally.

- A sharp decline in lease rates could reduce urgency for physical delivery.

- A stronger than expected dollar rebound remains a key risk — particularly around the Fed meeting on December 10.

Yet, with tight physical supply, bullish sentiment, and macro tailwinds from expectations of falling US rates, dips could be short-lived and present attractive tactical opportunities. Make sure you keep platinum on your radar this December!

Use Seasonax for your professional handling of market-moving events!

Don’t just trade it — Seasonax it.

Giles Coghlan, CMT

Macro Strategist Seasonax