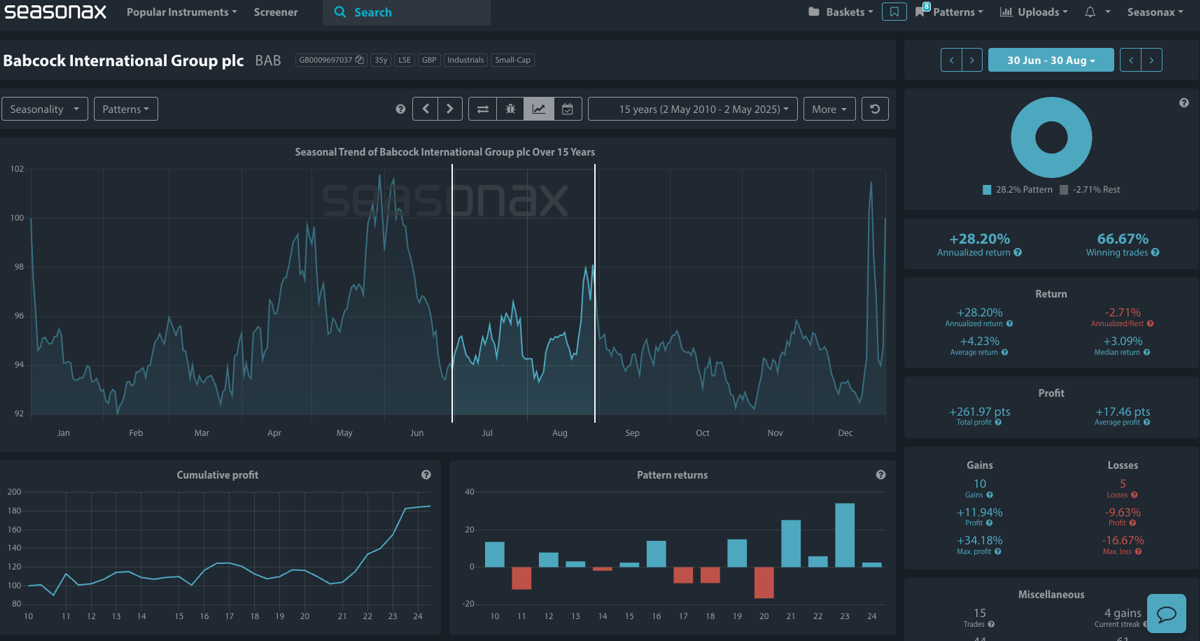

- Instrument: Babcock International Group plc (BAB)

- Timeframe: June 30 – August 30

- Average Pattern Move: +4.23%

- Winning Percentage: 66.67%

Dear Investor,

You may not realize it, but the best-performing stock in the FTSE 100 this year is no longer a gold miner — it’s Babcock, a British defense firm whose shares have surged 131% year-to-date. Now, with the stock trading at its highest level since 2014 and breaking out on strong fundamentals, Babcock enters a seasonally bullish stretch that deserves close attention.

Let’s analyse the data and setup.

From Defense to Dominance

Defense firms and gold miners have led UK equities in 2025, benefiting from sustained geopolitical tensions and demand for havens. But Babcock’s outperformance is more than just a macro trend — it’s company-specific:

- The firm raised its mid-term profit targets, triggering a 13% jump in one day.

- Shares have now reclaimed multi-year highs, breaking out above key daily term resistance.

This isn’t just recovery — it’s a regime shift.

Seasonal Sweet Spot: Summer Tailwind Ahead?

According to Seasonax data, Babcock shares have a 66.67% win rate between June 30 and August 30, with an annualized return of +28.20% and average return of +4.23% during this window.

Notably:

- The max seasonal gain was +34.18%

- 10 of the last 15 years saw positive returns in this period

- The cumulative profit curve shows a strong late-July to August spike

With the company riding strong sector momentum and institutional investors rotating into defense-heavy allocations, the seasonal and fundamental tailwinds could align meaningfully in the weeks ahead.

Technical Perspective

Price is trending higher, broken out of a flag pattern and has broken out of a key resistance area and is climbing rapidly, with no obvious overhead resistance until the 1,200p zone — a level not seen since pre-2015.

Momentum is strong, with On Balance Volume high on the weekly chart. If this current move holds above 1,000p, the 1,100–1,200p range could be the next magnet, especially if seasonality plays out.

Trade Risks

Any softening in global defense spending outlooks or UK budget constraints could temper sentiment. Technically, a failure to hold above 1,000p might invite mean reversion or profit-taking. Geopolitical de-escalation or negative press coverage on defense contracts could trigger short-term volatility.

Use Seasonax for your professional handling of market-moving events!

Don’t just trade it — Seasonax it.