Trading Ideas

Dive into daily market insights and trading opportunities in equity, forex, and commodity markets with our esteemed analyst Giles Coghlan. His cutting-edge analysis has been featured in Reuters, Business Insider, WSJ, Financial Times Adviser, NBC, LBC Radio, CoinTelegraph, Guardian Observer, National Express, and numerous other prestigious financial outlets.

Can the AUDUSD soar on dovish fed hopes?

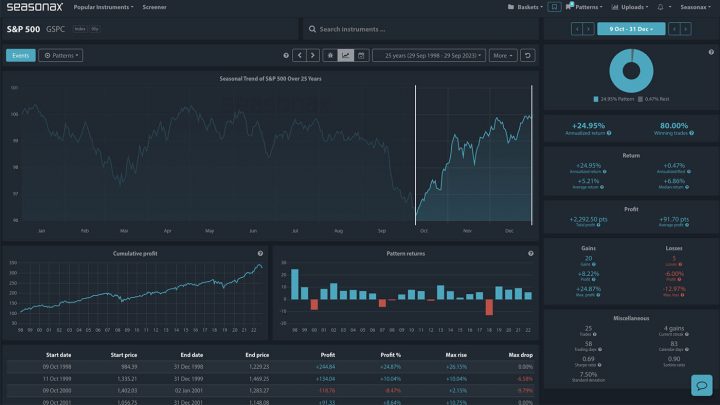

Q4 is super strong for the S&P500

Dollar Index Vulnerable To A Correction

Gold gains into the US CPI?

Is there room for some AUDCAD upside?

Can gold reverse on the US Jobs report?

Taking a look at the US Labour report there is a chance that gold can recover it’s recent losses if we see a big miss in the report. Remember that the Fed sees the labour market through an inflationary or…

Is this time for a US stock turnaround?

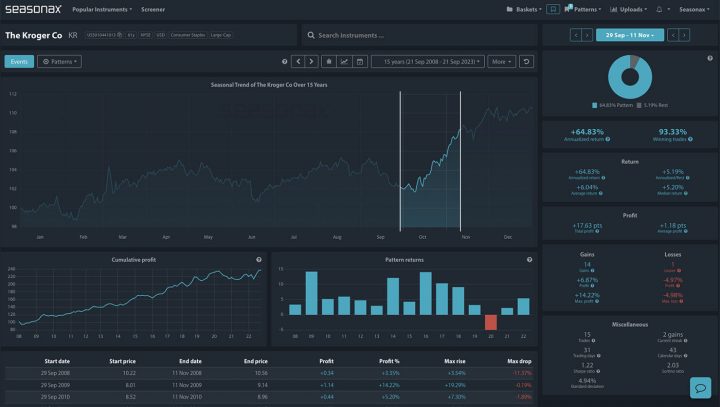

Time to go Kroger Co?

The Kroger Company, or simply Kroger, is an American retail company that operates supermarkets and multi-department stores throughout the US. It is a Consumer Staple sector and that sector can find buyers when traders are expecting a recession. The rationale…

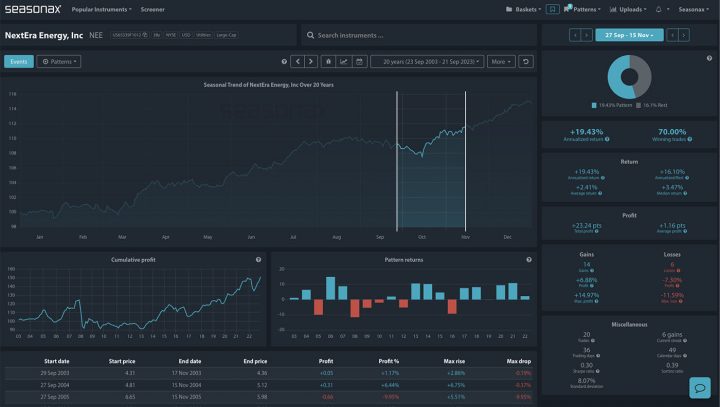

Utility stocks have appeal during recession

NextEra is a large American energy company with revenues exceeding $18 billion in 2020. If the US is heading towards a recession then typically utility companies, like NextEra energy should find buyers. This is because even when consumers spending power…