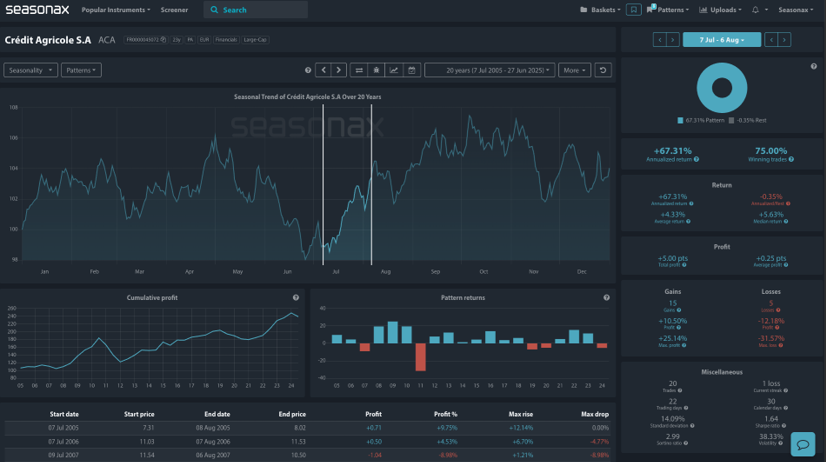

- Instrument: Crédit Agricole S.A. (ACA)

- Timeframe: July 7 – August 6

- Average Pattern Move: +4.33%

- Winning Percentage: 75.00%

Dear Investor,

You may not realize it, but Crédit Agricole — one of France’s largest banking groups — is heading into one of its most statistically favorable windows of the year, right as sentiment toward European equities undergoes a historic shift.

Between July 7 and August 6, shares in Crédit Agricole have historically produced an average return of +4.33%, with a 75% win rate and an impressive +67.31% annualized return over the past 20 years.

The timing is compelling. Let’s dive deeper.

Europe Is Back in Focus

According to Bloomberg, European stocks have outperformed US peers by the widest margin on record in dollar terms during the first half of 2025. The euro has surged 13% YTD, while investors reallocate away from US assets amid tariff tensions, fiscal concerns, and valuation fatigue.

What’s supporting the bid for Europe?

- Fiscal expansion: Germany has ditched its debt brake, unleashing a wave of infrastructure and defense spending.

- Monetary support: The ECB has aggressively cut rates, creating a wide differential to the US Fed and driving demand for EUR assets.

- Valuation edge: European equities trade at a 35% discount to US peers and boast higher dividend yields.

Crédit Agricole stands to benefit from all of this — deeply embedded in the European credit system, leveraged to EUR strength, and supported by domestic tailwinds in banking and lending demand.

Seasonal Setup: 15 Wins in 20 Years

The Seasonax data reveals a robust July–August performance profile for Crédit Agricole:

- 15 out of 20 trades ended positively

- Max return: +25.14%

- Median return: +5.63%

- Sortino ratio: 2.99 | Sharpe ratio: 1.64

The cumulative profit curve confirms the trend: strong, steady gains with surprisingly modest volatility relative to other financial names. The technical setup tends to gain traction mid-July, often extending into August.

With European equities in favor, this summer may prove no exception.

Technicals

Technically there is strong support from the 2 candle bullish piercing line pattern holding support around the 15.50 region. See the chart below.

Trade Risks

A reversal in the EUR/USD uptrend could reduce foreign buying interest. Also, ECB policy missteps or signs of fragmentation in Eurozone bond markets may dent banking sentiment. Finally, Crédit Agricole remains sensitive to broader financials weakness — monitor Euro STOXX Banks Index closely.

Don’t just trade it – Seasonax it.