When you think of the markets, long investments are probably the first thing that come to mind.

However, in difficult times it can make sense to take short positions.

Indeed, you can spot good seasonal short opportunities with Seasonax, just as easily as those on the long side!

Today I would like to show you how you can do that by looking at Bitcoin’s seasonality as an example.

Source: Seasonax

As you can see, Bitcoin usually moves up or sideways.

But there is also a phase of weakness, as shown by the arrow: it begins on August 16 and lasts until October 7.

On average, Bitcoin lost 10.67% in this time span. This is an exceptionally sharp decline given the extremely high performance that Bitcoin has achieved over these 12 years. There were 7 years of falling prices and 5 of rising prices during this period.

So for Bitcoin, this is quite a weak phase. Nevertheless, the arrow hardly falls, and the phase is relatively difficult to recognize.

Source: Seasonax

As you can see, detrending significantly reinforces the visual representation of the seasonal trend. You can recognize the seasonal weak phase much more easily, and the arrow’s fall is much steeper.

Use Detrending!

Detrending allows you to quickly identify relatively weak phases for instruments that have risen sharply in recent years – and that may also correct downward particularly sharply during weak market phases.

Such phases may be interesting for short exposure.

Screen for short positions!

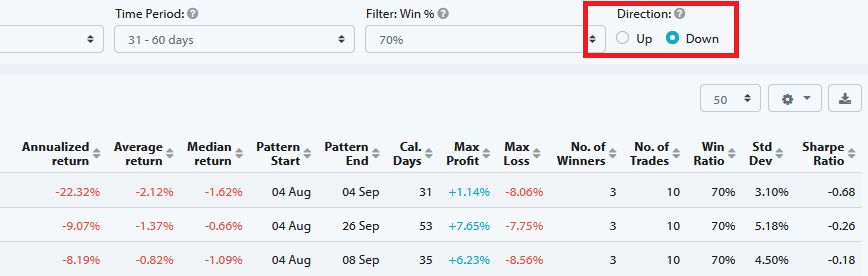

Source: Seasonax

Immediately you will be shown relevant patterns for falling prices.

Keep in mind: performance-related information is given in the same way as for long positions (and not converted for short exposures). On the one hand, this is for consistency. On the other hand, it has mathematical reasons: the return for short positions is not defined uniformly (for example, with regard to the adjustment of the leverage).

-20% is thus more than -10% for a short position; the indication is the same as what you are used to otherwise.

Earn even in difficult times!

While we at Seasonax have our own market opinions, Seasonax itself is a tool for estimating the probabilities of seasonal patterns.

It can therefore also be used for falling prices.

Use the “Detrending” and “Screening – Direction Down” functions for this purpose.

I recommend going to www.seasonax.com now to try it out right away!

Warm regards,

Dimitri Speck

Founder and Chief Analyst of Seasonax