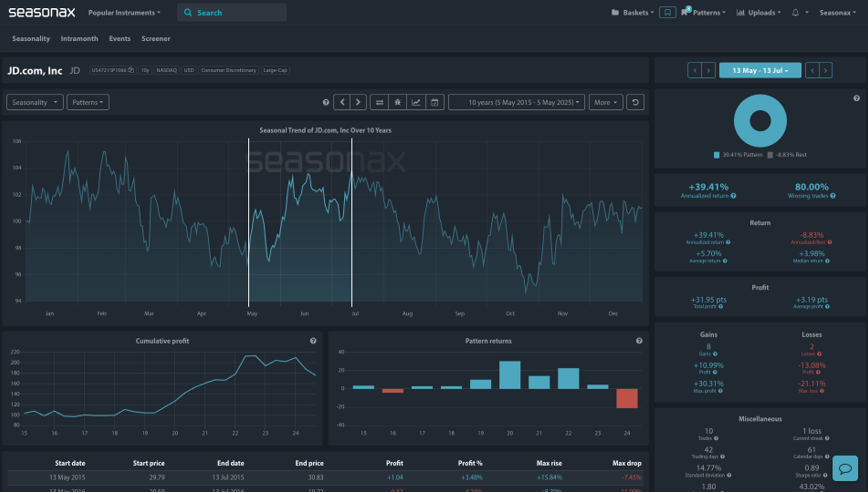

- Instrument: JD.com (JD)

- Average Pattern Move: +5.70%

- Timeframe: May 13 – July 13

- Win Rate: 80.00%

- Next Event: Earnings – May 13, 2025

Dear Investor,

With JD.com set to report earnings on May 13, you may not realize that the stock is also heading into one of its most statistically supportive seasonal windows. We want to analyze the data in more detail.

The chart above shows you the typical development of JD.com’s share price from May 13 to July 13 over the past 10 years. Historically, this window has delivered a 39.41% annualized return with a compelling 80% win rate. The average gain of +5.70% over this period speaks to consistent post-earnings momentum, even in challenging macro backdrops.

This year, JD.com reports earnings against a mixed sentiment backdrop. While Chinese consumer discretionary names have remained under pressure due to macro headwinds and regulatory overhangs, the recent stimulus tone from Beijing and signs of stabilization in e-commerce could create upside surprise potential.

What makes this setup even more interesting is how clean the seasonal edge is: the cumulative profit curve steadily climbs from mid-May to early July, suggesting that this is not just a one-off data distortion but a pattern of repeatable behavior.

Key seasonal insights:

- Positive returns in 8 out of 10 years

- Average return of +5.70%

- Notable max gains in prior years of +30.31% and +22.66%

- Only two losing instances, albeit with sharp drawdowns into double digits (-11.09% and -23.65%)

This backdrop makes JD.com a compelling seasonal setup going into its Q1 earnings. The company will need to deliver clarity on margins and revenue trajectory, but history suggests that if the print is clean, follow-through buying often persists into summer.

Technical Perspective

From a technical standpoint JD.com has a strong support confluence area marked on the chart below. This is both a major horizontal weekly support zone and a weekly trend line, so this could be a key area for stop placement and any potential buyers.

Use Seasonax for your professional handling of market-moving events!

Trade Risks

JD.com remains sensitive to China macro policy signals, tech regulation headlines, and U.S.-China tensions. A weak earnings print or softer guidance could override historical seasonal patterns. Also, volatility around earnings can be significant — with historical drawdowns during this window exceeding -20%, traders should manage risk accordingly.