Dear Investor,

Given current global events, space might seem the safest place to be! But is this safety also reflected in our future space investments?

Citigroup analysts expect the space industry to reach $1 trillion in annual revenue by 2040.

Elon Musk’s SpaceX continues to reach new milestones within the industry, and has been one of the most desired pre-IPO companies. The new technology and Starlink satellite internet network have been of assistance during the current geopolitical situation.

However, as it is Musk ’s Twitter acquisition that is presently getting all the media attention, space lovers will have to satisfy their needs with other companies until Musk decides to go public.

Meanwhile, in the legacy space industry, Boeing (BA) is building its own space taxis and the most powerful rocket ever for taking astronauts into deep space. It is considered to be one of the pioneering companies in the space industry, dating back to 1969, when Boeing helped to build the Apollo 11 rocket.

But which companies nowadays have the most potential to fly our investments to the moon?

Fly me to the moon

This year some of the Space Stocks that I have analyzed have achieved strong results year-to-date, compared to the decline of S&P500 which remains down by 14%.

What we also see is the gradual shift in the industry, from government-driven space programs towards privately run programs. Moreover, new markets are opening up, ranging from satellite-based internet to space tourism, that could drive revenue growth in the long run.

In that context, Lockheed Martin is experiencing significant momentum, driven party by the tensions between Ukraine and Russia.

Apart from their strong defence sector, they are considered to drive innovation by building satellites and spacecrafts for government and commercial customers. Their latest NASA’s Orion spaceship, due to take the first woman and the next man to the Moon by 2024, is also giving them additional wind.

The stock is up 27% from the beginning of the year. However, is now the right time for new investors to come on board? Looking from the seasonal perspective, Lockheed Martin does seem to be one of the companies whose stock price starts rising at the end of June.

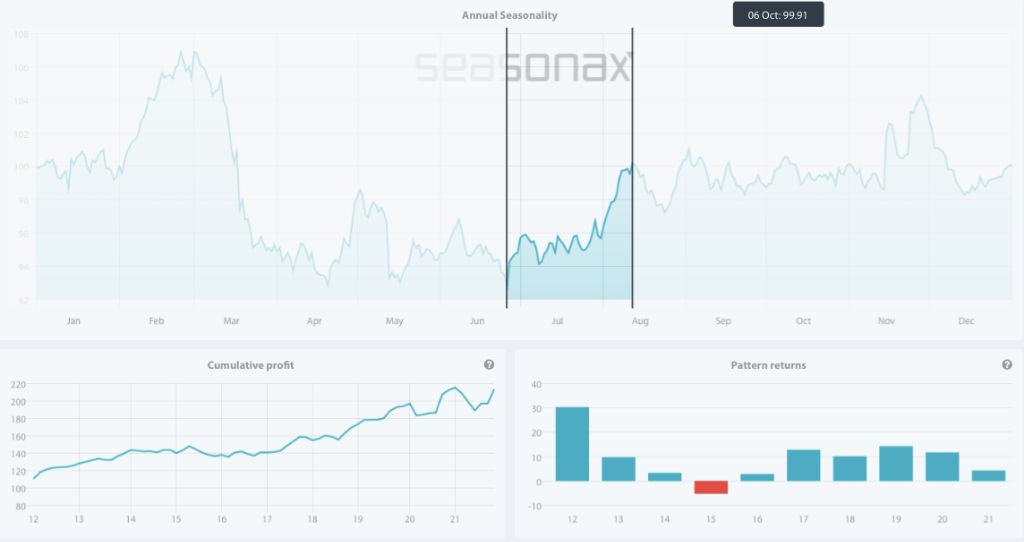

Seasonal Chart of Lockheed Martin over the past 10 years

Source: Seasonax, click on the interactive link http://tiny.cc/LockheedMartinCorporation to receive more information

Keep in mind that a seasonal chart depicts the average price pattern of a stock in the course of a calendar year, calculated over several years (unlike a standard price chart that simply shows stock prices over a specific time period). The horizontal axis depicts the time of the year, while the vertical axis shows the level of the seasonal pattern (indexed to 100).

From the chart above, it is clearly visible that the end of June until mid of August, over the past 10 years, have been reasonably favourable months for this space stock. In this time span of 35 trading days (from June 26 until August 14), shares rose on average by 7.68%. Moreover, the pattern returns since 2012 have been positive for every single year, except 2021.

It is also interesting to see a very weak seasonal phase that starts prior to the pattern on June 8, and lasts until June 26. During this period in the last 10 years, Lockheed Martin has made significant losses.

Weak seasonal period over last 10 years

Mayday, mayday we have a problem

Loral Space & Communications is another interesting stock that I came across.

As the name already reveals, it provides satellite-based communications services around the world.

The historical data of this stock speaks for itself. The stock shows an exceptional seasonal trend from June 26 until August 12 over the last 10 years, with high annualized* returns over 95%.

* An annualized rate of return is calculated as the equivalent annual return an investor receives over a given period.

Seasonal Chart of Loral Space & Communications over the past 10 years

There is no doubt that the space market is growing rapidly. But there are still many risks that must be considered, and that are hard to predict. The number of potential customers for these businesses is still relatively small, and the government still has a major role in funding.

Apart from the stock already mentioned, there are many more that are gaining interest. E.g Aerojet Rocketdyne (one of the nation’s primary rocket engine suppliers) or even Maxar Technologies (satellite imagery expert).

So, if you decide to engage in the space sector from a long-term perspective, or to benefit from short term gains, be aware of the risks. Look to seasonax the stocks before you decide to invest your money.

Enter the space of seasonal opportunities

To identify stock opportunities even more easily, we have launched a Seasonality Screener. The award-winning algorithms behind the screener are based on predictable seasonal patterns and are designed to find trading opportunities with above-average profit potential starting from a specific date.

By signing up for free to https://app.seasonax.com/signup you will be able to analyze more than 25.000+ instruments, including stocks, (crypto)currencies, commodities and indexes.

Remember, don’t just trade it, Seasonax it!

Yours sincerely,

Tea Muratovic

Co-Founder and Managing Partner of Seasonax