The recent narrative has been a tough headwind for gold as bonds continued their sell off on the first two weeks of August. Expectations of higher rates needed for longer needed to deal with stickier inflation has been the driver.

With US core inflation still twice the Fed’s target investors are pondering the prospects of rates remaining restrictive for some time. This narrative is the main cause of what’s been driving gold lower. However, gold has now found some major support. Furthermore, if the US economy starts to show acerbating signs of slowing down the bid could come back into bonds and that could once again assist gold higher, especially if the market starts to sense the prospect of a Fed cut next year.

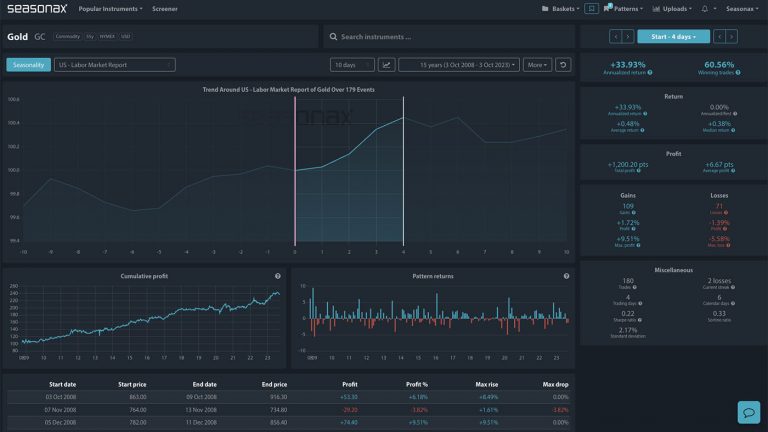

Seasonally, gold has a strong period in the second half of August attributed to physical demand. Over the last 15 years gold has risen 73% of the time between August 16 and September 02. Will gold find buyers now from key technical support and its strong seasonal pattern?

Major Trade Risks:

The main risk here to be aware of is a continuation of the ‘higher rates for longer’ narrative from the US. A further rise in yields and the USD will be a headwind for gold that can send gold prices still lower.

Remember don’t just trade it, Seasonax it!