Dear Investor,

January 11th 2024 marked a game-changing day in crypto history.

The U.S.’s first-ever spot Bitcoin ETFs got the official green light. The U.S. Securities and Exchange Commission gave the go-ahead and with this eleven brand new Bitcoin ETFs hit the market. This included offerings from big names like Grayscale, BlackRock, Fidelity, Ark Invest, and WisdomTree.

The U.S. Bitcoin spot ETF can be a catalyst for positive public perception: Bitcoin won’t be seen as “shady” anymore. This means more everyday investors could start adding Bitcoin to their investment mix. Plus, big fund managers and retirement planners can now include it in their portfolios and 401(k) plans.

When thinking about the potential impact of this launch, the introduction of the first spot gold ETF is noteworthy. Launched in 2004, it significantly expanded the gold market. Prior to 2004, the total gold market capitalization was worth around $1 trillion to $2 trillion; after the spot gold ETF, this ballooned to $16 trillion within a few years.

Will this most recent launch have a similar impact on Bitcoin: enhancing its legitimacy and potentially leading to substantial market capital inflows? Time will tell.

Nevertheless, seasonality in this new kind of asset is super interesting.

Crypto Cycles

Unlike traditional assets, Bitcoin’s seasonality isn’t tied to agricultural cycles, corporate earnings, or holiday shopping trends. Instead, it is influenced by factors unique to the digital age – regulatory announcements, technological advancements, and global economic shifts.

Previous Seasonal Insights highlighted how Bitcoin tends to behave at different times of the year, especially pointing out its noticeable summer dip between June 10th and October 2nd.

This edition will now explore how Grayscale Bitcoin Trust and other Bitcoin-focused stocks behave throughout the year, to see if any seasonal trends in their performance are worth noting.

Grayscale Bitcoin Trust (GBTC) was not originally an ETF (Exchange-Traded Fund). Instead, it was established in September 2013 as a private, open-ended trust. This meant it was only available to accredited investors, typically high-net-worth individuals, and institutional investors.

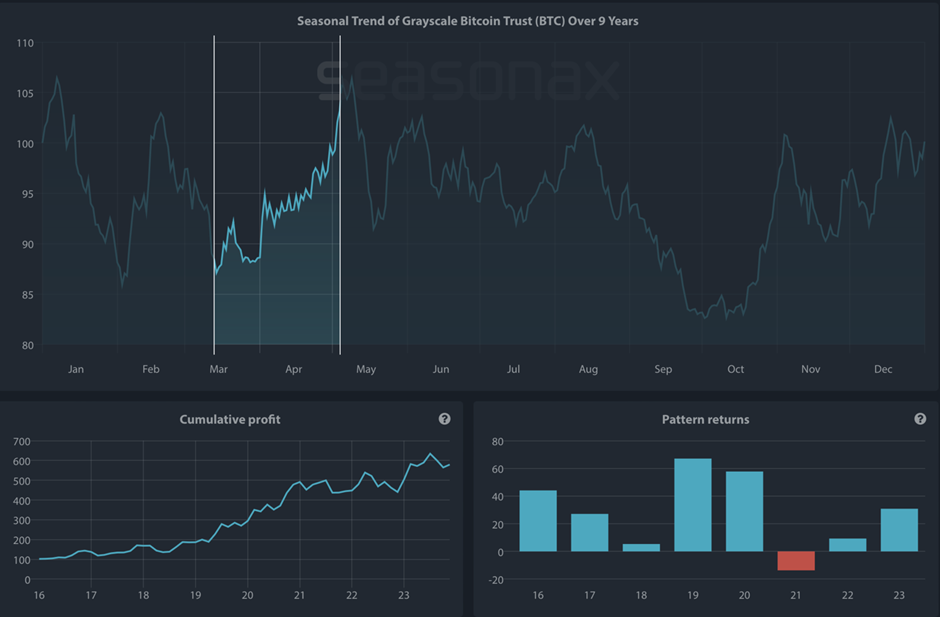

Similar to the Bitcoin seasonal summer weakness, Grayscale Bitcoin Trust had a negative annualized return, starting in May and stretching until October 8th, for the last eight years.

Significantly, however, there was also a positive seasonal period that started on March 14th and lasting until May 4th. Over the past 8 years, Grayscale has soared in this time frame, averaging a stunning 28.91% gain in just 36 days.

Seasonal Chart of Grayscale Bitcoin Trust over the past 8 years

Source: Seasonax, sign up to access https://app.seasonax.com/signup all features and markets 30 days for free

The question is: will this trend persist or will major shifts emerge under SEC influence?

For The More Cautious

For those who prefer a more cautious approach, there are still ways to dip into Bitcoin. Consider investing in companies that are either actively investing in Bitcoin, incorporating it into their business models, or are heavily involved in providing crypto services.

An interesting example is MicroStrategy Incorporated. MicroStrategy Incorporated (NASDAQ: MSTR) is like the big player in the Bitcoin game. They’ve caught everyone’s attention in the finance circles because they’re using Bitcoin as a primary treasury reserve asset, making it a unique case of corporate investment in cryptocurrency.

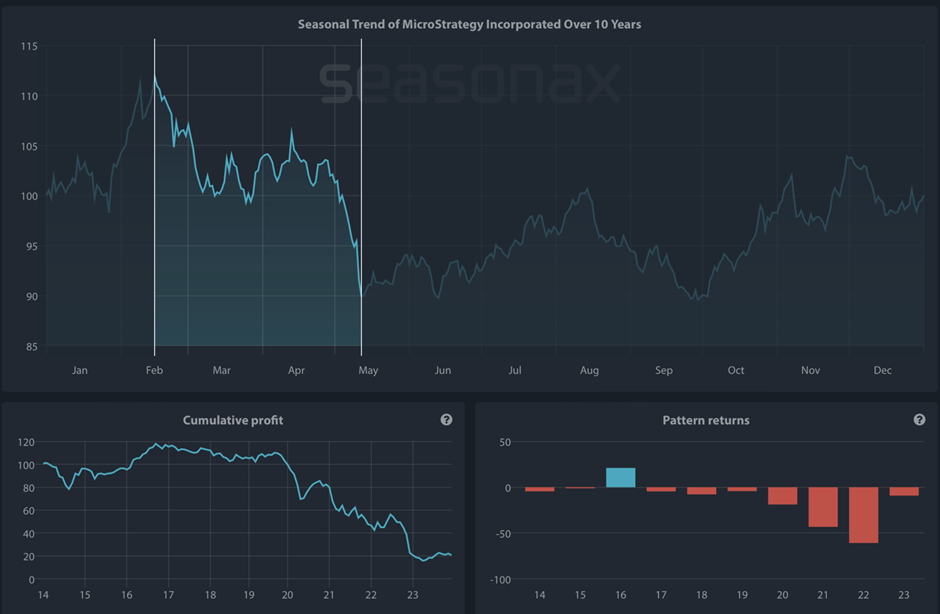

Looking at the seasonal chart below of MicroStrategy, there has been a clear downward trend that started on February 15th and lasted until May 12th. During this highlighted time period, over the last 10 years, MicroStrategy Incorporated made a loss 9 out of 10 times (red bars below).

Seasonal Chart of MicroStrategy Incorporated over the past 10 years

Source: Seasonax, sign up to access https://app.seasonax.com/signup all features and markets 30 days for free

Unlike regular charts, a seasonal chart doesn’t display price over a set time, but shows the average trend over several years. The horizontal axis represents the time of the year, and the vertical axis shows the % change in price (indexed to 100). The prices reflect end of day prices and do not include daily price fluctuations.

Marathon Digital Holdings, Inc. (NASDAQ: MARA) is another Bitcoin mining company that has invested in Bitcoin and operates several mining facilities. It has a pronounced strong summer period during the month of July.

Keep an eye on unexpected Bitcoin players like NVIDIA Corporation (NASDAQ: NVDA). Famous for their graphics cards, they’re also big in the Bitcoin mining game.

Don’t forget PayPal Holdings, Inc. (NASDAQ: PYPL) either. This digital payment powerhouse lets you easily buy, hold, and sell Bitcoin and other cryptos. It’s not just about direct Bitcoin companies; these indirect connections are just as exciting!

Timing is everything in trading. Remember, past success doesn’t always guarantee the future, but it’s hard to ignore the patterns.

Smart investing means looking at the big picture. These stocks are influenced by many factors and need a thoughtful strategy. Want a head start? Check out Seasonax. It’s free to sign up at www.seasonax.com, and you’ll discover the best times to buy and sell by analyzing patterns and trends across a range of markets, including crypto, stocks, and commodities.

Remember, don’t just trade it, Seasonax it!

Yours sincerely,

Tea Muratovic

Co-Founder and Managing Partner of Seasonax