Dear Investor,

On February 4, the Olympic torch made its way to the Bird’s Nest stadium in Beijing, kicking off the 2022 Winter Olympics. Although at the moment China is facing many issues concerning geopolitical tensions, the pandemic and diplomatic boycotts, there are numerous other positive effects that arise from hosting such an event.

For instance, the Olympic Games usually involve substantial infrastructure investment and boost tourism to the host nation. There are several reasons for strong rallies ahead of such events: for one thing, major sporting events spur a flurry of public spending. Moreover, they attract a great deal of media coverage. This in turn attracts investors.

We can see whether investors have so far brought the gold medal (with the motto “Faster, Higher, Stronger – Together”) by analyzing historical data from the stock markets of host countries. The evidence suggests that typically rallies start many months prior to the event, and tend to enter into a strong downtrend the month before the event starts.

These findings are also reflected in the shares of companies related to arena construction and heating-and-cooling systems, such as: Bingshan Refrigeration & Heat Transfer Technologies Co.; Beijing North Star Co; or Lander Sports Development Co – sectors that are spurred by the Beijing Olympics infrastructure investments.

But I am even more interested as to whether there are any other reasonably good entry points that present themselves after the Olympics start.

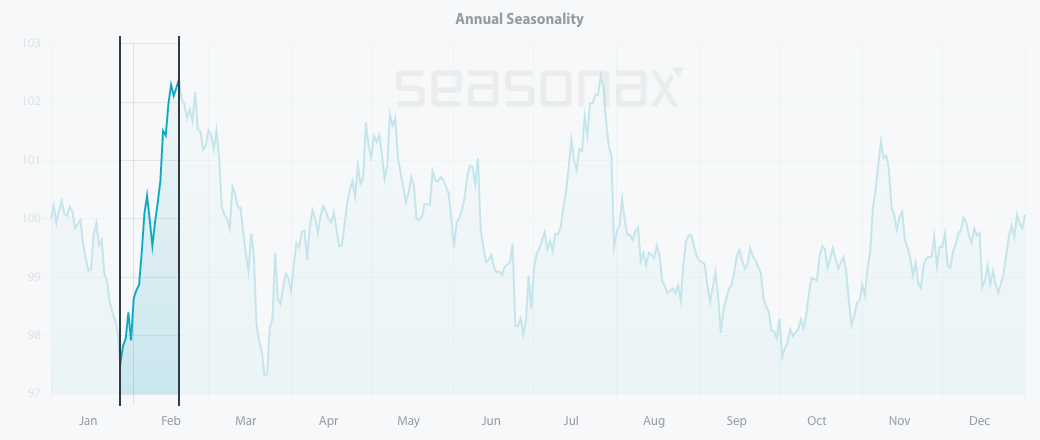

Looking at the seasonal chart of Shanghai Composite Index, I can conclude that over the past 15 years, it has entered into a strong seasonal period from February 1 to February 20. In that time span of only 11 trading days, its index rose on average by 4.7%. Moreover, the pattern returns in this time frame have been consistent and positive since 2007 – the blue bars in the chart below.

Seasonal chart of Shanghai Composite Index calculated over the past 15 years

Source: Seasonax – by clicking on the link you will be able to conduct further analysis

Please also keep in mind that past results and seasonal patterns are no indication of future performance, in particular future market trends.

Another interesting discovery that I came across is related to China’s new state-backed digital currency. China made enormous efforts to introduce digital yuan right on time as a part of the Olympic Games payment system. But what nobody seems to notice is that this digital version of the currency is one of only three payment choices at sporting venues, aside from cash.

Are there any more trophies to be collected?

In search of the third payment provider I have looked at the main sponsors of this year’s Winter Olympics, and have immediately identified Visa.

Could Visa’s earnings be once again spurred on during February, and are there other technical and fundamental reasons that could contribute to future gains?

By analyzing a seasonal chart of Visa, it can easily be seen that over the past 13 years there is a strong seasonal tendency from January 27 to February 18. In this time span of only 16 trading days, shares rose on average by 6.87%.

Seasonal chart of Visa over the past 13 years

Source: Seasonax – by clicking on the link you will be able to conduct further analysis

Keep in mind that the seasonal chart shows the average price pattern of stock calculated over the past few years. The horizontal axis shows the time of the year, and the vertical axis shows percentage change in the value of the stock (indexed to 100).

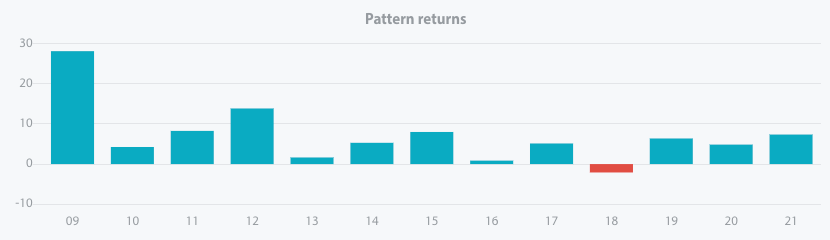

Moreover, the pattern returns in that period have been consistent and positive since 2009, with just one outlier year in 2018, as can be seen on the chart below.

Pattern return for every year since 2009

Source: Seasonax – by clicking on the link you will be able to conduct further analysis

Will this seasonal market anomaly reoccur in 2022? We will have to wait and see.

Nevertheless, to make finding seasonal opportunities even easier, we have launched Stock Screener. The screener is an analytical tool designed to identify trading opportunities with above-average profit potential, starting from a specific date. Use this opportunity and sign up to a Free Trial to analyze more than 25.000+ instruments including stocks, (crypto)currencies, commodities, and indexes.

Yours sincerely,

Tea Muratovic

Co-Founder and Managing Partner of Seasonax