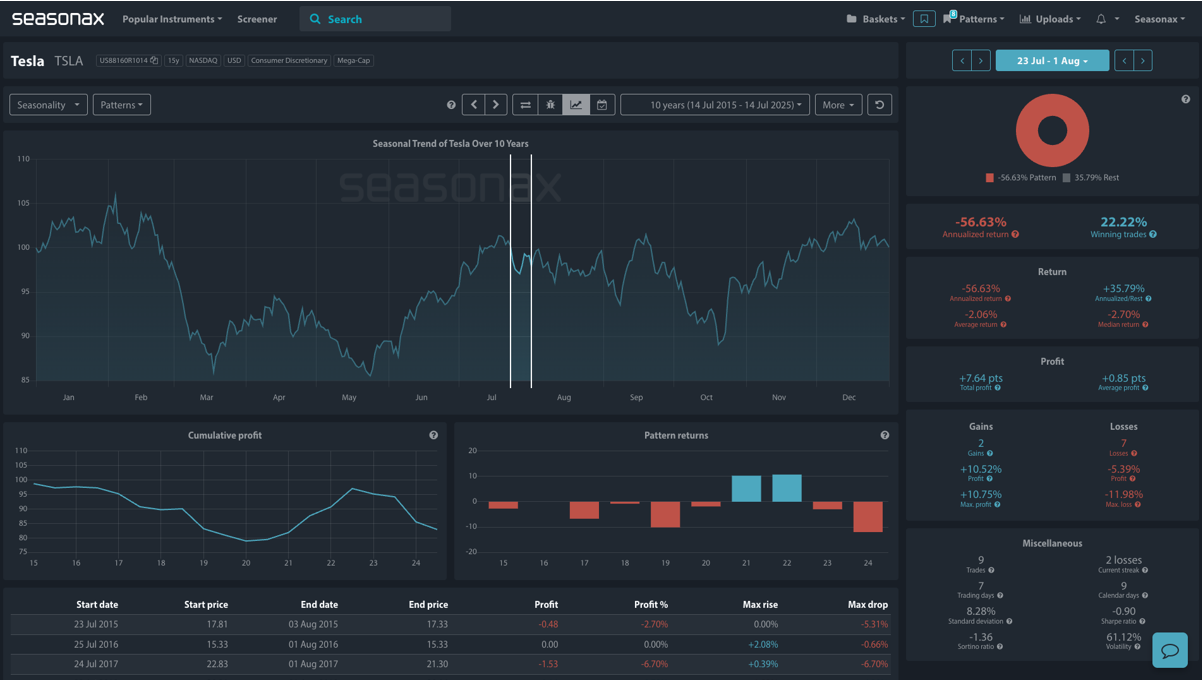

- Instrument: TSLA

- Timeframe: 23 July – 1 August (10 years)

- Average Pattern Move: –2.06%

- Winning Percentage: 22.22%

Dear Investor,

You may not realize it, but Tesla shares have a consistent habit of underperforming in the final days of July.

The chart below shows that over the last 10 years, TSLA has produced an average return of –2.06% between 23 July and 1 August, with only 22% of trades winning in this window. The annualized return for this period sits at –56.63%, with a median loss of –2.70%.

Even with Tesla’s market‑cap buoyed above $1 trillion and investor enthusiasm around autonomy and robotics, seasonals point to caution heading into earnings on Wednesday, 23 July, after the close.

Why It Matters Now: Weak Fundamentals + Historical Gravity

Despite Musk’s grand visions, Tesla’s core auto business is sliding:

- Deliveries fell 13% YoY in Q2, putting the company on course for a second straight annual decline.

- Registrations in Europe have plunged 37% YTD, even as EV sales in the region rose 28%.

- In the US, Tesla’s share of EV sales has dropped below 50% from over 75% in 2022.

- Chinese shipments have seen eight consecutive months of declines before a modest June uptick.

This seasonal pocket has historically aligned with weaker performance — and given Tesla’s current macro headwinds and competitive threats from BYD and Xiaomi, traders may be reluctant to bid ahead of earnings.

Technical Perspective

The weekly chart shows Tesla consolidating just above a long‑term trendline, with a key support zone marked around $275.

A break below this zone could open the way for a test of the $250 level.

On-balance volume (OBV) is softening, suggesting buyers are losing conviction.

Earnings Catalysts

Elon Musk is expected to highlight robotaxis and humanoid robots again, but these are still far from materially impacting cash flow. Analysts are concerned about the absence of a new affordable model and persistent sales erosion. If the earnings call fails to offer a credible roadmap, the seasonal selling bias could quickly take hold.

Trade Risks

- A surprise beat on margins or deliveries could ignite a sharp short-covering rally. Major product or cost announcements could override seasonal tendencies.

Use Seasonax for your professional handling of market-moving events!

Start your free 30-day trial today and Seasonax your strategy!

Don’t just trade it – Seasonax it.