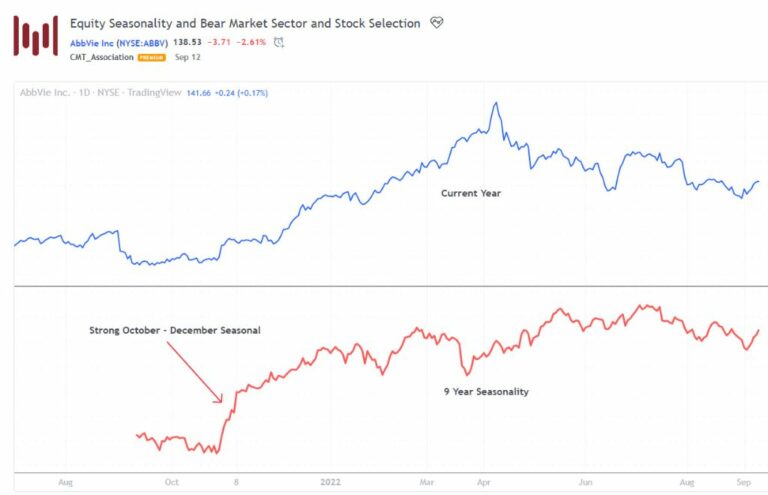

How I analyze and use seasonal patterns in my trading approach

There are many myths surrounding the topic of seasonality among traders and scientists alike. Seasonal patterns in the stock market are a topic of their own. Are regularly recurring patterns a purely random phenomenon, or can they be explained by certain market behavior? The fact is that there are regular recurring patterns in the markets that can provide a significant advantage when taken into consideration in decision-making.