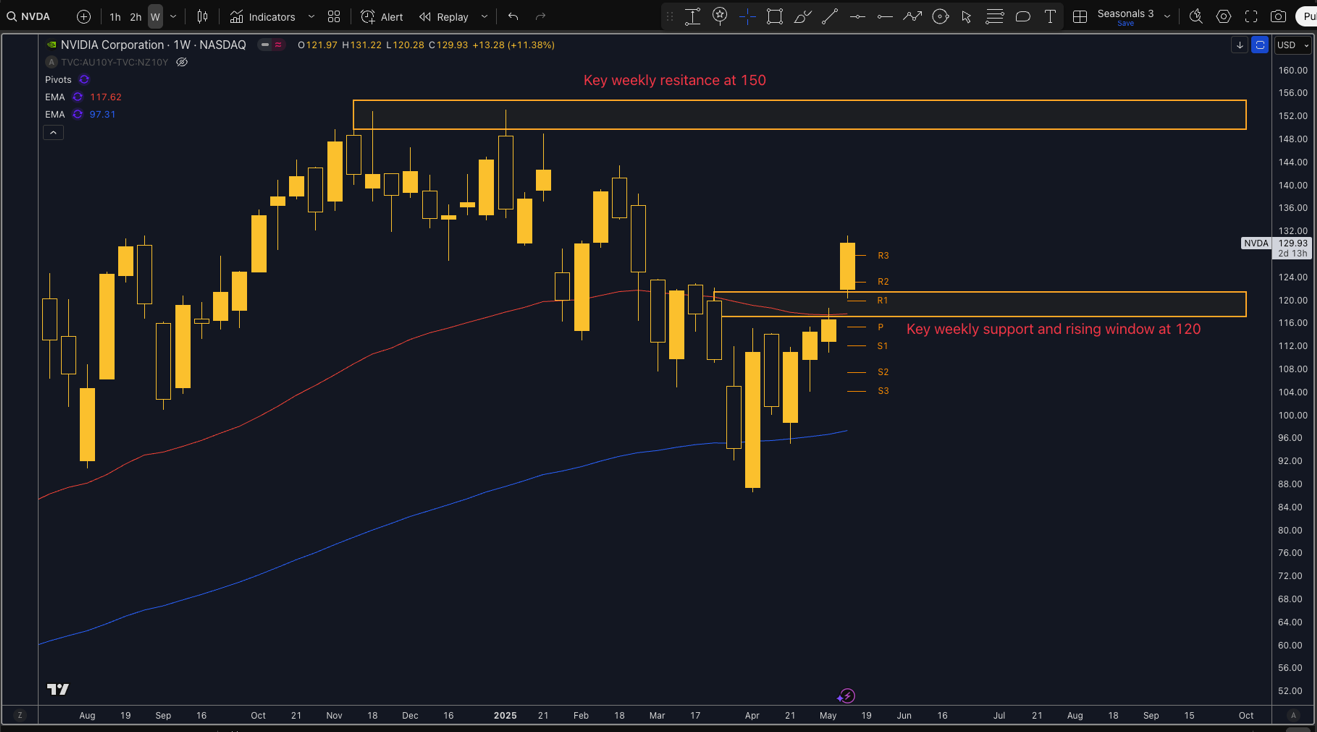

- Instrument: Nvidia (NVDA)

- Average Pattern Move: +7.55%

- Timeframe: May 25 – June 17

- Winning Percentage: 90.00%

Dear Investor,

You may not realize how powerfully Nvidia has performed in the weeks following its Q1 earnings announcement. With results due after the close on Wednesday, May 28, many investors will be watching closely. This period has historically seen Nvidia shares advance with impressive consistency, and we want to analyze the data in more detail.

The chart above shows you the typical development of Nvidia’s share price over the past 10 years between May 25 and June 17. The seasonal trend is remarkably strong: the stock has posted gains in 9 of the last 10 years, with an average return of +7.55% and a maximum rise of +19.26%. Even during the post-pandemic reset in 2022, the seasonal tendency reasserted itself in 2023 and again in early 2024, supporting a strong pattern bias.

This strength is not without fundamental basis. Nvidia is the undisputed leader in AI-related hardware, and its quarterly earnings have often catalyzed major upward moves when results beat consensus and guidance surprises to the upside. With AI spending still a broad tailwind, investors are likely to focus on data center revenue growth and margin expansion in this week’s release.

Technical Perspective

From a technical standpoint, the picture supports the bullish seasonal window. Nvidia recently cleared a key pivot resistance at $120 and has opened up room to test the $150 zone, which aligns with its weekly resistance area. The $120 level — which also contains a rising window and the 100-week EMA — is a crucial support to watch. If the earnings report is strong, these technical levels could act as a springboard for a breakout continuation.

Trade Risks:

Nvidia is a volatile stock, and post-earnings reactions can be sharp in either direction. While the seasonal pattern is strong, forward guidance and macro sentiment (including yields and China data) may drive unexpected volatility. Investors should also consider that much of Nvidia’s AI strength may already be priced in, raising the bar for upside surprises.

You can also screen for other AI-related equities such as AMD or Broadcom to look for similar bullish post-earnings setups. Sign up for free!

Don’t just trade it, Seasonax it!