Understanding the Seasonal Rhythms of the DAX

The DAX (Deutscher Aktienindex), representing the 30 largest and most influential German companies, is one of the most prominent stock indices in Europe. Like many major indices, the DAX has its own seasonal patterns, influenced by various economic cycles, corporate performance, and investor sentiment. By recognizing these trends, investors can fine-tune their strategies to align with the historical behavior of the index.

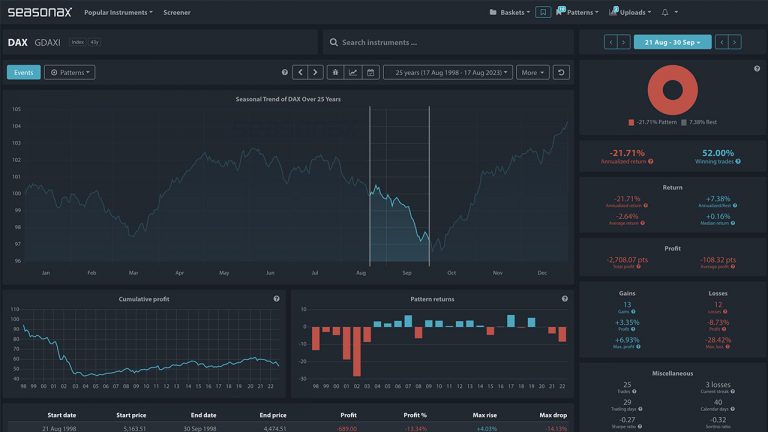

Key Seasonal Trends in the DAX

Over the years, certain months in the DAX’s annual cycle have exhibited stronger performance than others. Typically, the DAX shows positive momentum during the fall and winter months, from October to April. This period often benefits from end-of-year corporate results, investor optimism, and seasonal buying. The “Santa Claus Rally”, which boosts markets at the end of December, is also a factor contributing to this upward trend.

In contrast, the summer months, particularly May to August, are traditionally less favorable for the DAX. This is consistent with the “Sell in May and Go Away” strategy, as the market tends to experience lower volume, leading to less volatility and weaker returns. September is typically the weakest month for the DAX, often marked by market corrections or slower growth.

The Power of Seasonality

Seasonality in the DAX is not a guarantee, but over time, these patterns have proven useful in shaping investment decisions. By recognizing these trends, traders can adjust their portfolios, manage risks, and potentially capitalize on the market’s historical behavior. As always, it’s important to combine seasonality with other tools, like fundamental and technical analysis, to make well-rounded investment decisions.

Understanding and utilizing seasonality in the DAX helps investors navigate the stock market more strategically, taking advantage of recurring patterns to improve the timing and outcome of their trades.